- United States

- /

- Tech Hardware

- /

- NasdaqGS:AAPL

Payments, Credit, and EVs - The Key WWDC 2022 Takeaways for Apple (NASDAQ:AAPL) Investors

Summary:

- Apple rolled out multiple hardware and software improvements in WWDC 2022.

- The company seems to be taking a soft approach to the Apple Car project by allowing Tesla's competitors access to Apple's operating system for EVs.

- Apple finance may increase the value of the current device ecosystem, and may become a strong competitor in consumer credit and payment processing.

Apple Inc. (NASDAQ:AAPL) unveiled a bundle of software and hardware updates at WWDC 2022, which may have implications for the further growth of the business. In this article, we will break down these announcements and analyze what they may mean from the perspective of investors.

These are the key WWDC updates important to investors:

- New M2 chips

- New MacOS - Ventura

- Apple Car Play

- Apple Finance

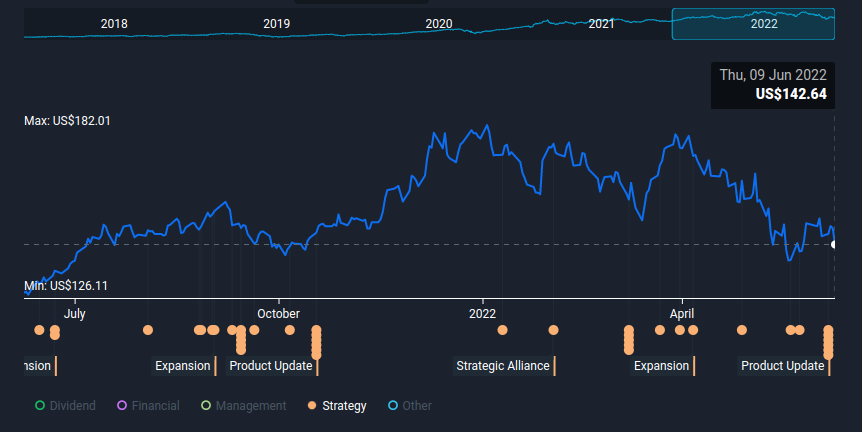

Strategic events are important to keep track of, and in the chart below, you can also see how the history of product and strategic updates has influenced Apple's stock price:

While most of these new services have been advertised to investors well in-advance, the company is only now starting to implement them.

Rolling out M2 Chips Into Devices

The new redesigned MackBook Air/Pro will be available as early as July and will contain their new M2 chip. Apple consumers are going to get an increase in performance as the company claims that the chips deliver roughly 18% more raw CPU performance vs M1 chips, as well as a 35% increased GPU performance.

For investors, this means that Apple is moving even more ahead of Intel (NASDAQ:INTC) and AMD (NASDAQ:AMD). If customers are satisfied with the product and experience, and see a noticeable increase in the performance of their devices, then Apple may further increase its market share in the devices segment. While this may mean little regarding the already priced-in expectation of growth for Apple, it may result in future market share declines for Intel and AMD.

An inadvertent participant in this process may be Microsoft (NASDAQ:MSFT) Windows. As Apple hardware and iOS become more convenient, people will have more incentive to switch to Apple for their daily use, while having a console or separate PC for gaming or other use.

Introduced Ventura - The New iOperating System

Ventura includes general operating system improvements and features that sync well across devices. Many features in the new version now have an available API (connection) for 3rd party developers, which can interact with the apps to create better software.

While Apple is hardly considered a viable option for gamers, they seem to be aggressively taking on the market, and developed their own Metal3 API that is aimed to increase gaming quality.

For investors, this means that Apple is offsetting the supply chain and chip pressures by pushing for quality on the software side.

View our latest analysis for Apple

Apple CarPlay vs Tesla (NASDAQ:TSLA)

Apple Car Play allows users to integrate their iPhone with their car, and is claimed to be compatible with 98% of US cars. The goal is to give users an improved system via their iPhone that will enable some "smart" functionalities.

While Car Play initially only worked with the dashboard, Apple is moving to integrate the next gen with all the driver's screens.

For investors, it is key to note that Apple has been working with EV car manufacturers in a bid to create an operating system which will be available for their EVs. Traditional auto manufacturers have historically had difficulties building a good EV operating system, and Apple will be able to provide this as software leverage against Tesla, which has a full proprietary OS for their EVs. In return, Apple may get a substantial amount of data from leasing their OS to manufacturers, in order to improve their self-driving algorithms. Keep in mind, that this process may take a long time before investors see a material impact.

Apple Finance

Apple has been moving into the finance world for quite a while, and is now increasing the palette of financial services.

Starting this month, the company will also release "tap to pay", for contactless payments on the iPhone, where no additional hardware or payment terminal is needed. The first thing that investors think of in this situation, is that this move will likely affect payment processors such as Block (NYSE:SQ), as they require a physical terminal for processing, while Apple does not.

Notably, Apple released the Pay Later service, which allows people to spread their payment in 4 equal installments for 6 weeks, with zero interest and no fees. The last bit here is important in ensuring a better service for customers and increasing the value of Apple devices.

The service works out of the box with Apple Pay, and the company is currently collaborating with Mastercard (NYSE:MA) in order to issue payment credentials, while Apple is handling the underwriting and lending by the new subsidiary called Apple Financing.

When we have a company that has over $50b in cash on the balance sheet, engaging in financial services like car insurance, payment processing, and short term revolving consumer credit become a good use of that capital.

Additionally, as we mentioned before, moving into the EV space and gathering driver data, may allow the company to create a tailored car insurance service that distinguishes good from bad drivers - based on performance history.

For investors, this means that new Apple services may affect partners and competitors in the beginning, but the company has a tendency to move these services in-house, creating an additional revenue stream for the company and increasing the general value of their product ecosystem.

Conclusion

Apple is a large, if not mature company that is expected to deliver on growth. While all these updates are exciting for investors, it is more likely that they serve as a way to deliver what was already priced in the stock, rather than to create new value.

The possible exception to this is the financial branch, which, if allowed to take off, may transform the company into a major conglomerate.

We should also be mindful of the risks, and also found 2 warning signs for Apple that you need to be mindful of.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:AAPL

Apple

Designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion