- United States

- /

- Tech Hardware

- /

- NasdaqGS:AAPL

Down 11.8% in a Week, Why Apple Inc. (NASDAQ:AAPL) may be Approaching Value Territory

The US market lost about 12% last month , and Apple Inc. ( NASDAQ:AAPL ) has been affected by dropping 11.8% in the last 7 days. In our analysis, we will review the effect of markets on Apple, as well as explore if the stock is now attractive for investors.

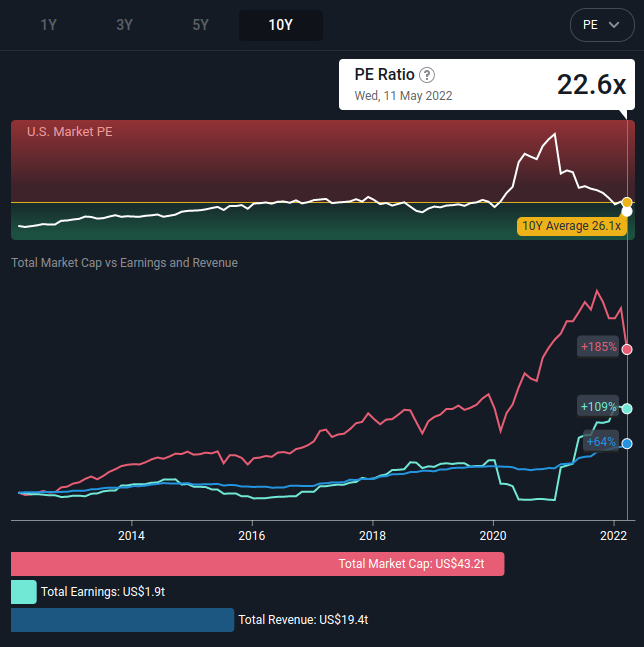

In the chart below , we can see the relationship between the change in earnings, market cap (stock prices), and revenue for the last 10 years in the US market.

We notice a few key things:

- Revenues seem to reveal a small cyclical pattern which may slowly be approaching a top.

- Earnings and market cap seem to have a relationship where the market is slightly ahead of earnings - this is also why forward earnings are more important than current performance on earnings calls.

- The market is currently experiencing a decline, however earnings are up - and more importantly, they are forecasted to grow 12.3% next year.

So if we pushed this chart a bit forward, we could envision earnings slightly increasing, but the price not reflecting the increase.

Investors want to know why this is happening, and on the surface there are 3 possibilities:

- Analysts are mistaken on their growth estimates and earnings will come-in weaker than projections. The alternative interpretation, is that sell-side analysts are not mistaken, but reluctant to post what they really think in fear of scaring off investors.

- Second, is that the market is increasing the price for risk. Meaning that marginal (large, institutional) investors now demand a larger return from stocks in order to invest. This has the effect of depressing stock prices while earnings are constant.

- Third, is that the market is overreacting by fears of the unknown. Specifically, inflation (and rates) is hard to predict, and investors are choosing to be safe.

The chart above reveals that markets are now approaching "appropriate" PE valuation levels, meaning that if investors become more risk averse, there is likely still more downside for stocks.

Additionally, the market may be using blunt force (general selloffs, lack of liquidity) to depress stocks across the board, which means that strong stocks have a chance of regaining first, while riskier assets will stay down longer.

In the next section, we will explore if Apple has the future earning capacity to regain traction, and what can investors expect.

Apple Inc.'s DCF Valuation

We can value a stock by projecting its future cash flows and then discounting them to today's value, this shows investors the value of a company in terms of its cash generating capacity.

We use free cash flow forecasts from analysts covering Apple in order to estimate the value of future cash flows. For the next 10 years, we arrive at a value of the (after debt) free cash flows at US$998b

We now need to calculate the Terminal Value, which accounts for all the future cash flows after this ten-year period. In the same way as with the 10-year 'growth' period, we discount future cash flows to today's value, using a cost of equity of 6.7%.

Terminal Value (TV) = FCF 2031 × (1 + g) ÷ (r – g) = US$179b× (1 + 1.9%) ÷ (6.7%– 1.9%) = US$3.8t

Present Value of Terminal Value (PVTV) = TV / (1 + r) 10 = US$3.8t÷ ( 1 + 6.7%) 10 = US$2.0t

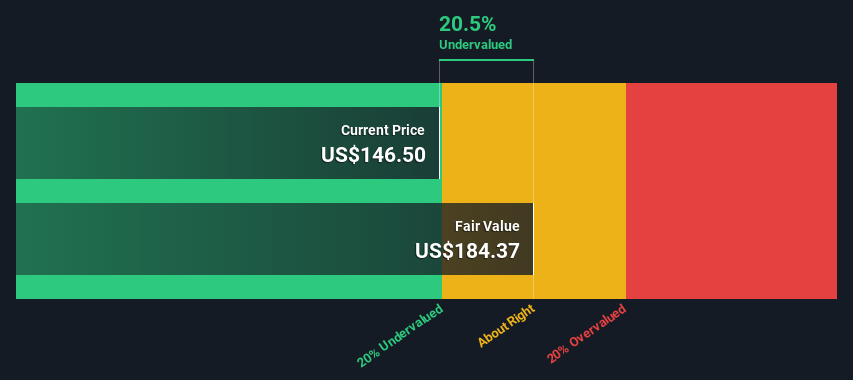

The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is US$3 trillion or US$184 per share.

Compared to the current share price of US$147, the company appears a touch undervalued at a 21% discount to where the stock price trades currently.

The assumptions in any calculation have a big impact on the valuation, so it is better to view this as a rough estimate .

By including a 20% margin of safety for our model, we can see that Apple is approaching value territory, and investors may want to set an alert for revisiting the stock once markets settle down .

Conclusion & Looking Ahead:

The market is still highly volatile, and it is not clear if that will change soon. This has pushed down the prices of productive companies like Apple as well. While economic tightening may impact near-term performance, the stock has the capacity to increase the bottom line once the situation stabilizes.

Our DCF model indicates that the stock may be approaching attractive levels for investors, but market risk makes it harder to make a good estimate.

For Apple, we've put together three important elements you should explore:

- Risks : You should be aware of the 1 warning sign for Apple we've uncovered before considering an investment in the company.

- Future Earnings : How does AAPL's growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart .

- Other Solid Businesses : Low debt, high returns on equity and good past performance are fundamental to a strong business. Why not explore our interactive list of stocks with solid business fundamentals to see if there are other companies you may not have considered!

PS. The Simply Wall St app conducts a discounted cash flow valuation for every stock on the NASDAQGS every day. If you want to find the calculation for other stocks just search here .

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:AAPL

Apple

Designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion