- United States

- /

- Communications

- /

- NasdaqGM:AAOI

Should Applied Optoelectronics’ (AAOI) 800G Transceiver Unveiling Change Investor Perspectives on Hyperscale Strategy?

Reviewed by Sasha Jovanovic

- At ECOC 2025 in Copenhagen, Applied Optoelectronics showcased its new 800G OSFP 2xSR4 multimode optical transceiver built on 100G VCSEL technology, highlighting advancements in cost-efficient, low-power optical solutions for hyperscale data centers and AI/ML clusters.

- This unveiling underscores the company's vertically integrated manufacturing approach and its pursuit of short-reach, high-speed connections favored by major cloud clients.

- We'll explore how this product innovation for hyperscaler data centers could reshape Applied Optoelectronics' outlook and risk profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Applied Optoelectronics Investment Narrative Recap

To be a shareholder in Applied Optoelectronics, you have to believe in a long-term transformation powered by rapid adoption of high-speed optical modules by large data center and cloud customers. The recent 800G OSFP 2xSR4 announcement puts the company at the heart of this momentum, but customer concentration remains the biggest short-term risk, any sign of lost orders from top partners could outweigh positive product news.

Of the recent company announcements, the debut of the 100G VCSEL multimode optical transceiver at ECOC 2025 stands out for its relevance. The success of this product piggybacks on surging data center demand, but further customer diversification may be required before it materially changes the company's risk profile. Yet, contrasting with this optimism, investors should be aware of the risk if customer concentration leads to revenue swings and...

Read the full narrative on Applied Optoelectronics (it's free!)

Applied Optoelectronics' outlook anticipates $1.3 billion in revenue and $111.0 million in earnings by 2028. This implies a 51.5% yearly revenue growth and a $266.7 million increase in earnings from the current $-155.7 million.

Uncover how Applied Optoelectronics' forecasts yield a $27.20 fair value, in line with its current price.

Exploring Other Perspectives

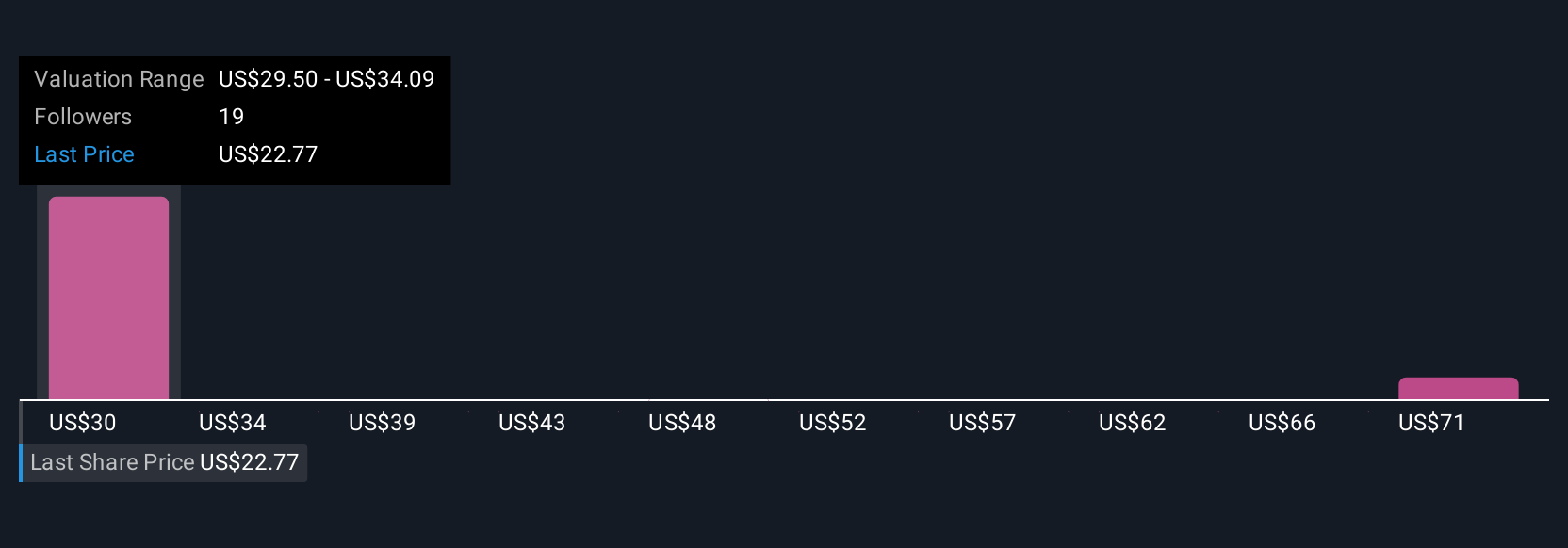

Seven fair value estimates from the Simply Wall St Community range from US$27.20 to US$75.38, underlining broad divergence in expectations. While high-speed product adoption drives enthusiasm, ongoing reliance on a few key customers could still shape outcomes, considering a wide range of viewpoints is essential.

Explore 7 other fair value estimates on Applied Optoelectronics - why the stock might be worth just $27.20!

Build Your Own Applied Optoelectronics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Applied Optoelectronics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Applied Optoelectronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Applied Optoelectronics' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AAOI

Applied Optoelectronics

Designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives