- United States

- /

- Software

- /

- OTCPK:INVU

Undervalued Opportunities Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.5%, contributing to an impressive 18% increase over the past year, with earnings expected to grow annually by 15% in the coming years. For those interested in smaller or newer companies, penny stocks—despite being a somewhat outdated term—offer intriguing opportunities for growth at lower price points. By focusing on stocks with strong financial foundations and solid fundamentals, investors can uncover hidden gems that may offer potential long-term value.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| ATRenew (RERE) | $3.28 | $759.26M | ✅ 3 ⚠️ 1 View Analysis > |

| Waterdrop (WDH) | $1.89 | $737.79M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.67 | $275.27M | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (MAPS) | $0.9664 | $163.33M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.45 | $256.66M | ✅ 3 ⚠️ 0 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $99.33M | ✅ 3 ⚠️ 2 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.8601 | $6.32M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.73 | $108.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.575 | $29.45M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 412 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Freightos (CRGO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Freightos Limited operates a vendor-neutral booking and payment platform for international freight, with a market cap of $150.13 million.

Operations: Freightos Limited has not reported any specific revenue segments.

Market Cap: $150.13M

Freightos Limited, with a market cap of US$150.13 million, is navigating the penny stock landscape by expanding partnerships and digital capabilities. Recent collaborations with SEKO Logistics and Forward Air Corporation enhance its platform's reach in freight booking and management. Despite being unprofitable with a negative return on equity of -43.41%, Freightos has no debt and sufficient cash runway for over three years based on current free cash flow. Revenue is projected to grow by 21.12% annually, although earnings have declined by 1.5% per year over the past five years, reflecting ongoing volatility in share price performance.

- Get an in-depth perspective on Freightos' performance by reading our balance sheet health report here.

- Understand Freightos' earnings outlook by examining our growth report.

FDCTech (FDCT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: FDCTech, Inc. is a technology provider and software developer focused on digital assets, with a market cap of $37.40 million.

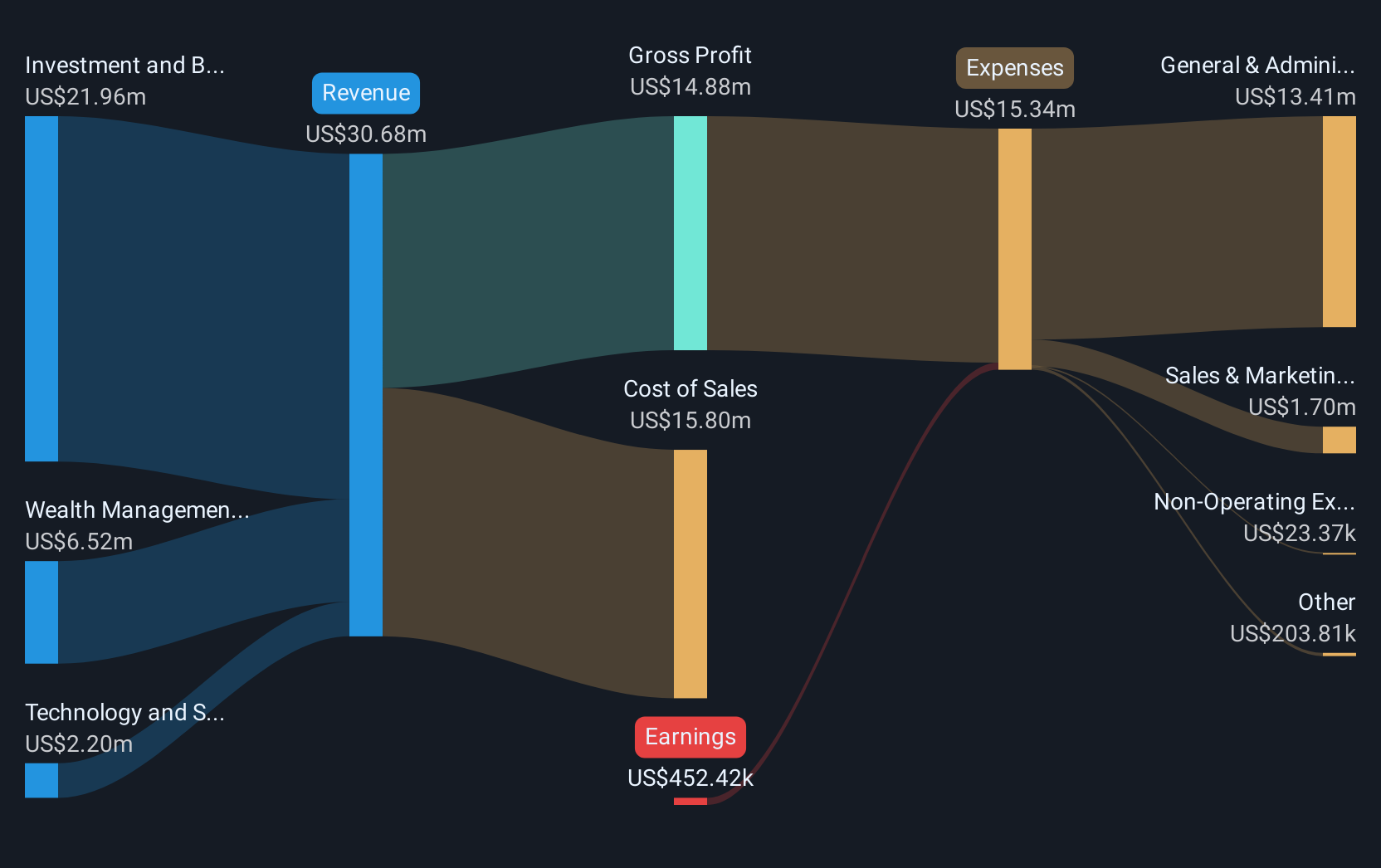

Operations: The company's revenue is derived from three main segments: Wealth Management ($6.52 million), Investment and Brokerage ($21.96 million), and Technology and Software Development ($2.20 million).

Market Cap: $37.4M

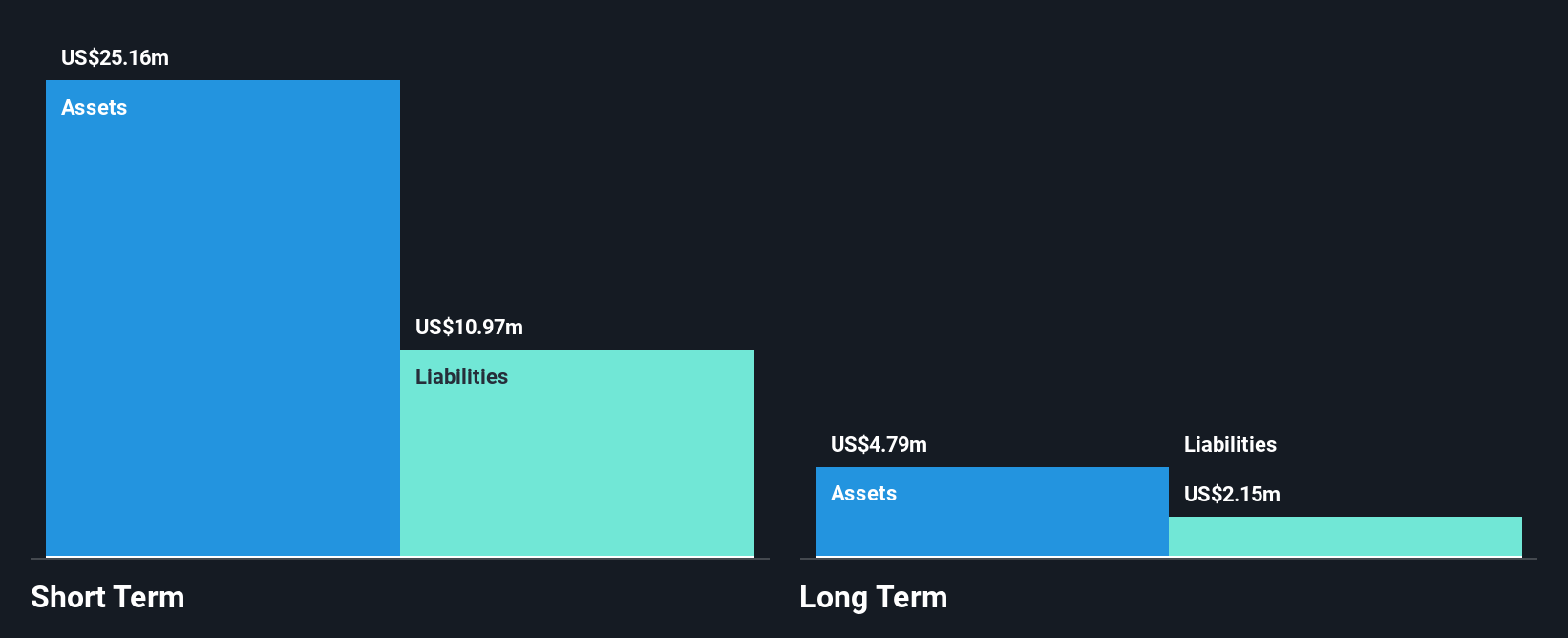

FDCTech, Inc., with a market cap of US$37.40 million, is leveraging its seasoned management and board to navigate the penny stock environment. Despite being unprofitable with a negative return on equity of -2.96%, FDCTech has more cash than debt and reduced losses over five years at 34.9% annually. Its short-term assets exceed liabilities, indicating financial stability amidst volatility in share price and earnings growth challenges compared to the software industry. The recent formation of Prime Intermarket Group Eurasia in Mauritius marks a strategic expansion into international markets, potentially enhancing its global operational capabilities and revenue streams.

- Click here and access our complete financial health analysis report to understand the dynamics of FDCTech.

- Understand FDCTech's track record by examining our performance history report.

Investview (INVU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Investview, Inc. is a financial technology services company operating both in the United States and internationally, with a market cap of $27.68 million.

Operations: The company's revenue is derived from two segments: Foreign, contributing $38.7 million, and the United States, accounting for $8 million.

Market Cap: $27.68M

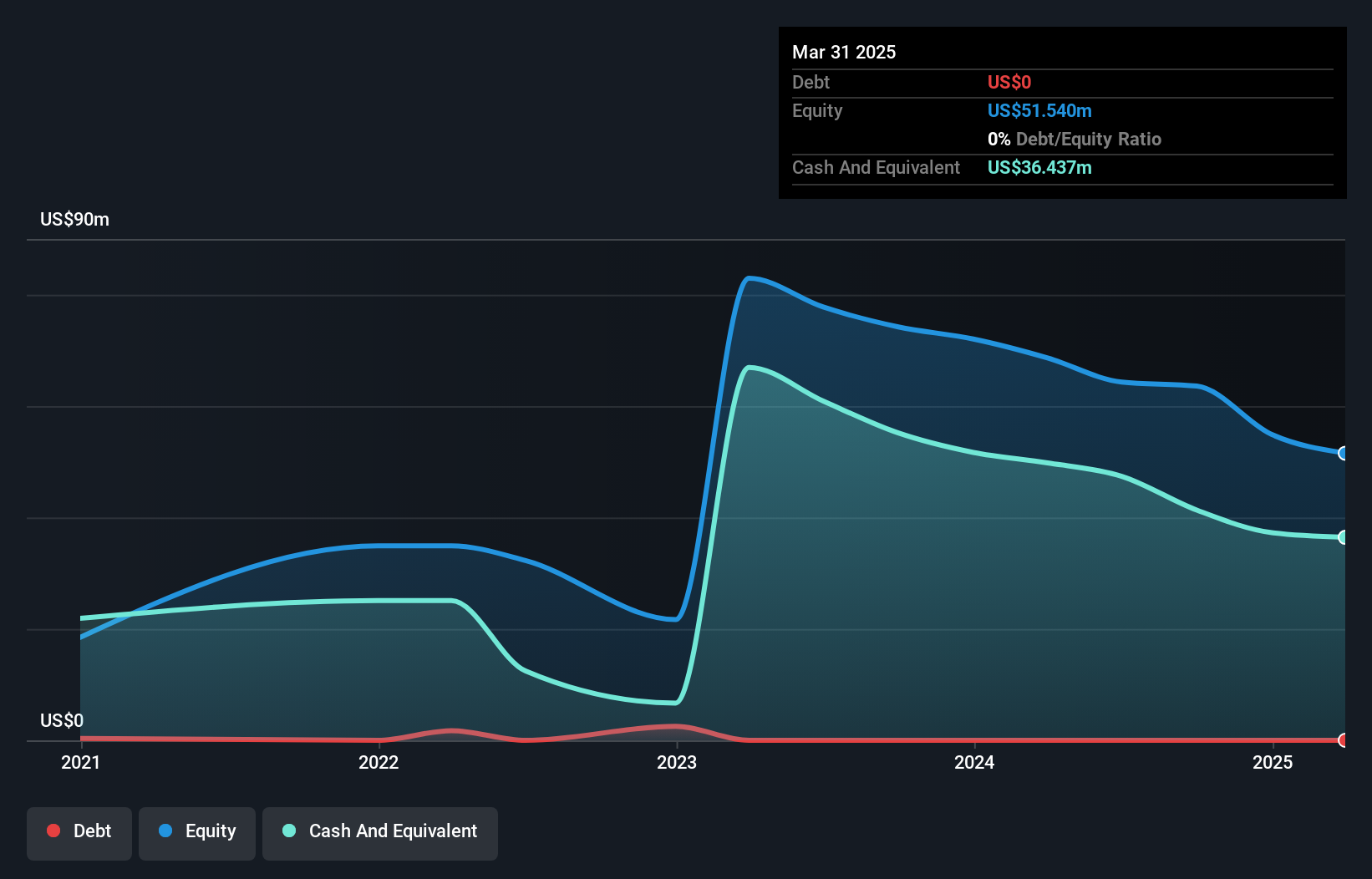

Investview, Inc., with a market cap of US$27.68 million, operates in the financial technology sector and faces challenges typical of penny stocks. The company reported a decline in first-quarter revenue to US$10.03 million from US$15.67 million the previous year, alongside a net loss of US$0.69 million compared to a prior net income of US$1.67 million. Despite this, Investview's short-term assets exceed both its long-term liabilities and short-term liabilities by significant margins, indicating some financial stability amidst volatility and unprofitability challenges. The management team is experienced with an average tenure exceeding four years, providing strategic leadership through turbulent times.

- Click to explore a detailed breakdown of our findings in Investview's financial health report.

- Gain insights into Investview's past trends and performance with our report on the company's historical track record.

Taking Advantage

- Reveal the 412 hidden gems among our US Penny Stocks screener with a single click here.

- Interested In Other Possibilities? We've found 16 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:INVU

Investview

Through its subsidiaries, operates as a financial technology services company in the United States and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives