- United States

- /

- Biotech

- /

- NasdaqGS:QNCX

Spotlight On US Penny Stocks For November 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations with technology shares stumbling and indices like the Dow Jones reaching record highs, investors are closely monitoring economic indicators and Federal Reserve policies to gauge future movements. Despite these larger market dynamics, penny stocks continue to capture attention for their potential to offer unique investment opportunities. While often associated with smaller or newer companies, these stocks can provide a blend of affordability and growth prospects when underpinned by strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7805 | $5.74M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $142.61M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2255 | $8.74M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $4.27 | $559M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.57 | $51.15M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9511 | $80.94M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.98 | $435.65M | ★★★★☆☆ |

| Information Services Group (NasdaqGM:III) | $3.11 | $175.19M | ★★★★☆☆ |

Click here to see the full list of 717 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

GrowGeneration (NasdaqCM:GRWG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GrowGeneration Corp. operates retail hydroponic and organic gardening stores across the United States with a market cap of $116.71 million.

Operations: The company's revenue is derived from two main segments: Cultivation and Gardening, which generates $172.35 million, and Storage Solutions, contributing $28.54 million.

Market Cap: $116.71M

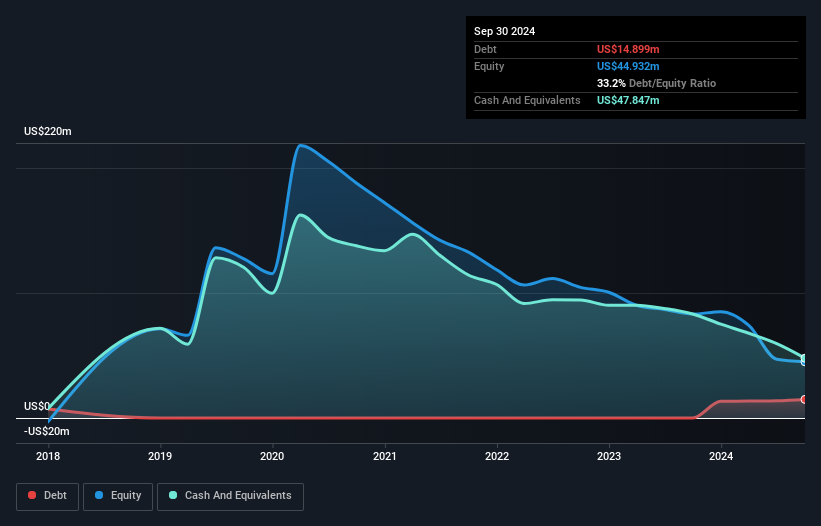

GrowGeneration Corp., with a market cap of US$116.71 million, is navigating the challenges typical of penny stocks, including unprofitability and increased losses over five years. Despite reporting a net loss for Q3 2024, the company maintains a strong cash position with short-term assets exceeding liabilities and no debt burden. Recent product launches aim to boost proprietary brand sales to 35% by 2025, potentially enhancing future revenue streams. The management and board are experienced, supporting strategic initiatives amidst industry volatility. However, profitability remains elusive in the near term as per analyst forecasts.

- Click here and access our complete financial health analysis report to understand the dynamics of GrowGeneration.

- Learn about GrowGeneration's future growth trajectory here.

Quince Therapeutics (NasdaqGS:QNCX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quince Therapeutics, Inc. is a biopharmaceutical company dedicated to acquiring, developing, and commercializing therapeutics for patients with debilitating and rare diseases, with a market cap of $87.12 million.

Operations: Quince Therapeutics, Inc. has not reported any revenue segments.

Market Cap: $87.12M

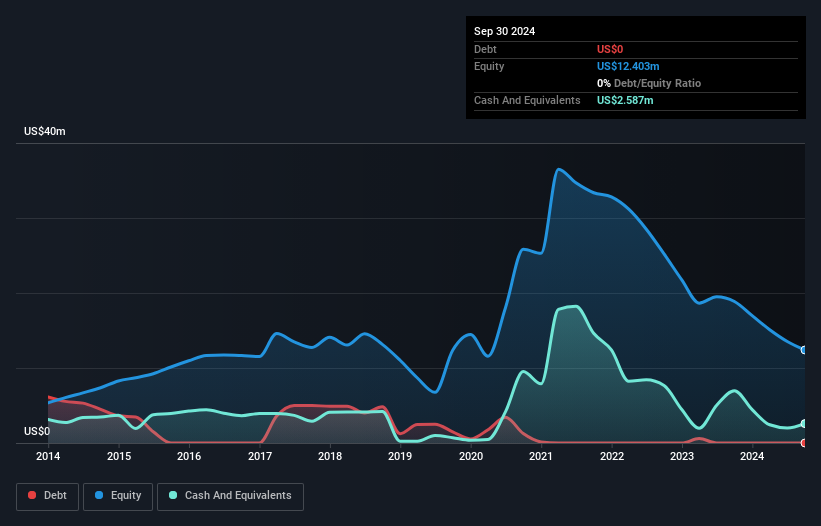

Quince Therapeutics, Inc., with a market cap of US$87.12 million, exemplifies the volatility and challenges of penny stocks, being pre-revenue and unprofitable. The company recently reported a net loss of US$5.49 million for Q3 2024, with losses widening over nine months to US$44.37 million compared to the previous year. Despite having more cash than debt and short-term assets covering liabilities, long-term liabilities exceed its current assets by a significant margin. Quince's management is relatively new, which may impact strategic execution as it progresses through clinical trials for its lead asset EryDex in treating Ataxia-Telangiectasia (A-T).

- Get an in-depth perspective on Quince Therapeutics' performance by reading our balance sheet health report here.

- Gain insights into Quince Therapeutics' future direction by reviewing our growth report.

Inuvo (NYSEAM:INUV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Inuvo, Inc. operates in the advertising technology and services sector primarily in the United States, with a market cap of $41.63 million.

Operations: The company generates revenue primarily through its Software & Programming segment, totaling $78.45 million.

Market Cap: $41.63M

Inuvo, Inc., with a market cap of US$41.63 million, reflects the typical volatility and financial hurdles faced by penny stocks in the advertising technology sector. The company reported a net loss of US$2.04 million for Q3 2024, though revenue showed slight improvement over nine months to US$57.6 million from the previous year. Despite being debt-free and having an experienced management team, Inuvo struggles with profitability and has less than a year's cash runway under current conditions. Upcoming product updates may drive growth as analysts predict significant stock price appreciation amidst ongoing financial challenges.

- Dive into the specifics of Inuvo here with our thorough balance sheet health report.

- Understand Inuvo's earnings outlook by examining our growth report.

Next Steps

- Click this link to deep-dive into the 717 companies within our US Penny Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Quince Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Quince Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QNCX

Quince Therapeutics

A biopharmaceutical company, focuses on acquiring, developing, and commercializing therapeutics for patients with debilitating and rare diseases.

Slight with mediocre balance sheet.

Market Insights

Community Narratives