Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Zuora, Inc. (NYSE:ZUO) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Zuora

What Is Zuora's Net Debt?

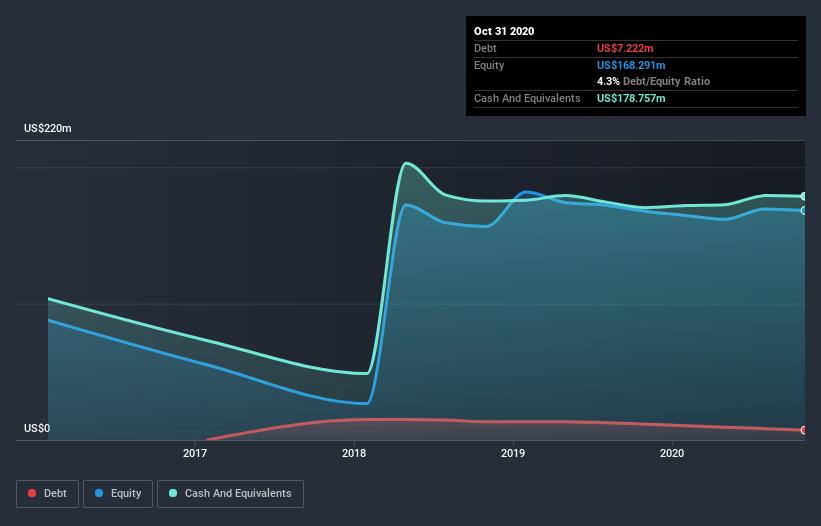

As you can see below, Zuora had US$7.22m of debt at October 2020, down from US$11.6m a year prior. However, it does have US$178.8m in cash offsetting this, leading to net cash of US$171.5m.

How Strong Is Zuora's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Zuora had liabilities of US$162.0m due within 12 months and liabilities of US$65.1m due beyond that. On the other hand, it had cash of US$178.8m and US$61.2m worth of receivables due within a year. So it can boast US$12.9m more liquid assets than total liabilities.

Having regard to Zuora's size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the US$1.64b company is short on cash, but still worth keeping an eye on the balance sheet. Simply put, the fact that Zuora has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Zuora's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Zuora wasn't profitable at an EBIT level, but managed to grow its revenue by 10%, to US$297m. We usually like to see faster growth from unprofitable companies, but each to their own.

So How Risky Is Zuora?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And we do note that Zuora had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through US$8.5m of cash and made a loss of US$78m. While this does make the company a bit risky, it's important to remember it has net cash of US$171.5m. That means it could keep spending at its current rate for more than two years. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 4 warning signs for Zuora (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade Zuora, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zuora might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:ZUO

Zuora

Provides a monetization suite for modern businesses to help companies launch and scale new services and operate dynamic customer-centric business models in the United States and Japan.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.