- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:SANM

High Growth US Tech Stocks To Watch In December 2025

Reviewed by Simply Wall St

As the Dow Jones and S&P 500 approach record highs, buoyed by expectations of a potential Federal Reserve rate cut, the U.S. tech sector remains a focal point for investors navigating an evolving economic landscape marked by mixed employment data and fluctuating Treasury yields. In such a dynamic environment, identifying high-growth tech stocks involves assessing factors like innovation potential, market positioning, and adaptability to macroeconomic shifts that can influence performance in the ever-competitive technology industry.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.01% | 24.80% | ★★★★★☆ |

| Palantir Technologies | 27.16% | 29.98% | ★★★★★★ |

| Pelthos Therapeutics | 48.34% | 110.99% | ★★★★★☆ |

| Sanmina | 31.01% | 33.24% | ★★★★★☆ |

| Workday | 11.18% | 32.18% | ★★★★★☆ |

| Circle Internet Group | 23.14% | 84.30% | ★★★★★☆ |

| RenovoRx | 71.45% | 71.45% | ★★★★★☆ |

| Zscaler | 15.83% | 45.89% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

| Procore Technologies | 11.61% | 116.48% | ★★★★★☆ |

Click here to see the full list of 75 stocks from our US High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

QuinStreet (QNST)

Simply Wall St Growth Rating: ★★★★☆☆

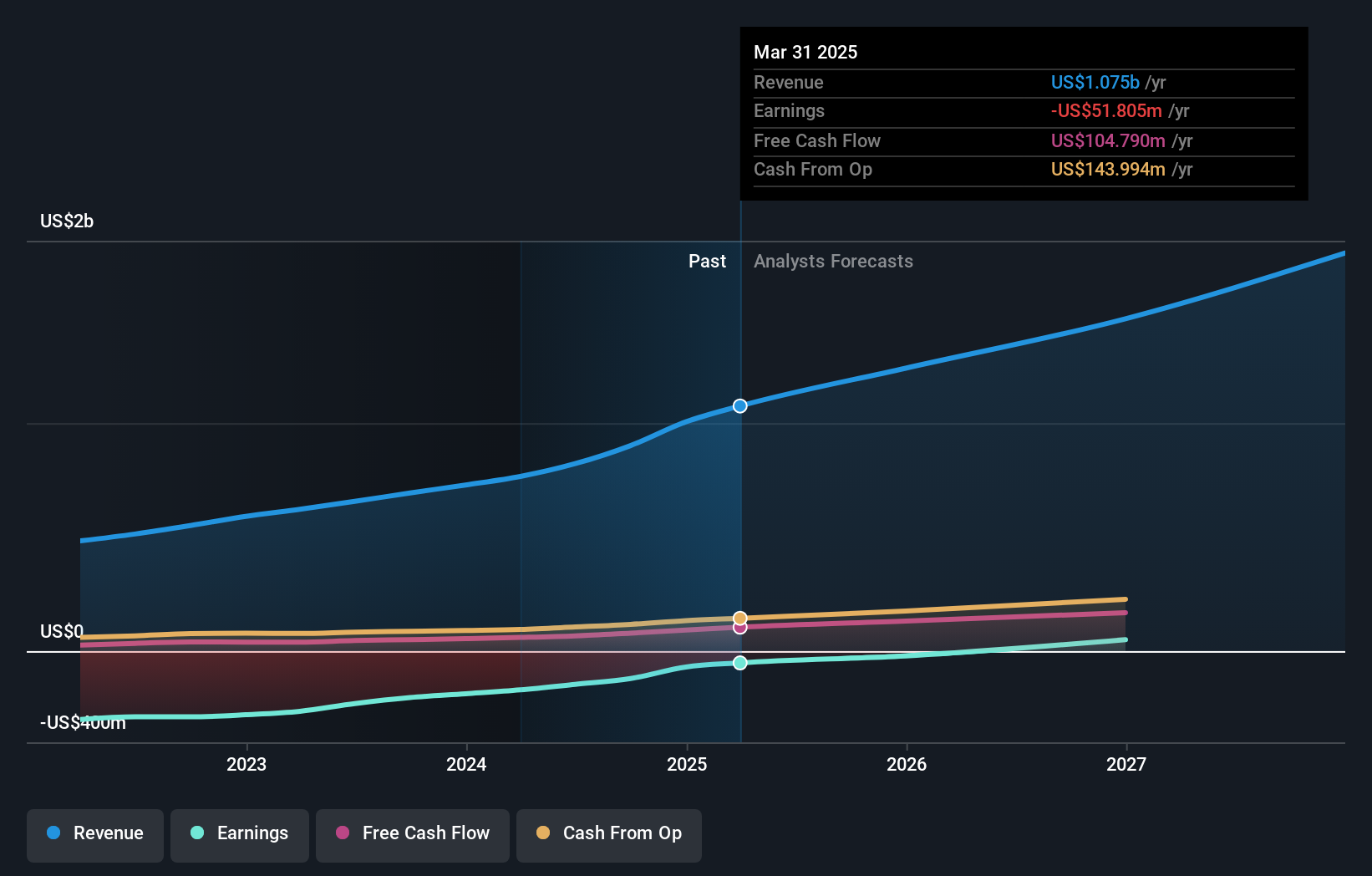

Overview: QuinStreet, Inc. is an online performance marketing company that offers customer acquisition services to clients both in the United States and internationally, with a market capitalization of approximately $860.35 million.

Operations: The company generates revenue primarily through its direct marketing segment, which accounts for $1.10 billion.

QuinStreet has demonstrated a robust turnaround, transitioning from a net loss of $1.37 million to a net income of $4.54 million in the latest quarter, underpinned by an increase in sales from $279.22 million to $285.85 million year-over-year. This growth trajectory is complemented by an aggressive share repurchase program valued at $40 million, underscoring confidence in its financial health and commitment to shareholder value. Moreover, with revenue expected to grow at least 10% next year and earnings forecasted to surge by 46.5% annually, QuinStreet is positioning itself as a resilient contender in the competitive tech landscape despite slower than industry average revenue growth projections of 10.6%.

- Delve into the full analysis health report here for a deeper understanding of QuinStreet.

Evaluate QuinStreet's historical performance by accessing our past performance report.

Sanmina (SANM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sanmina Corporation offers integrated manufacturing solutions and a range of services, including components and after-market support, across various regions globally, with a market cap of approximately $8.59 billion.

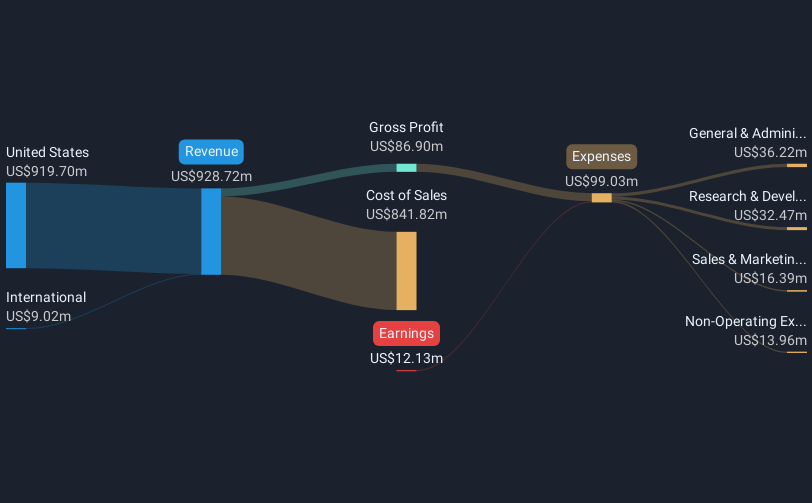

Operations: Sanmina generates revenue primarily through its Integrated Manufacturing Solutions (IMS), which contributed $6.56 billion, and Components, Products and Services (CPS), accounting for $1.70 billion.

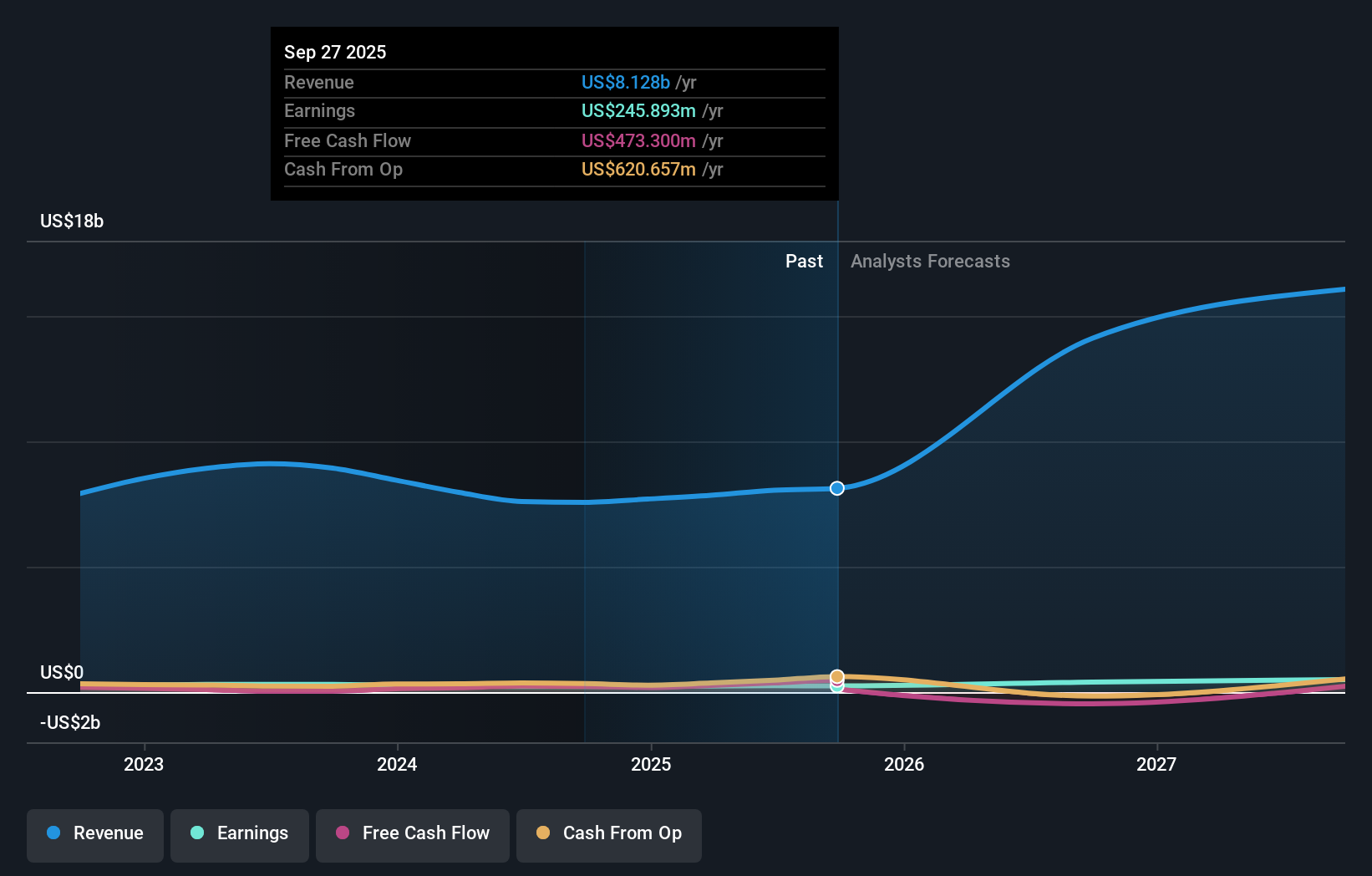

Sanmina's recent activities, including presenting at multiple high-profile finance conferences, underscore its strategic efforts to bolster investor confidence and business prospects. Despite a slight dip in net income from $61.38 million to $48.07 million in the latest quarter, annual figures show a promising increase with net income rising to $245.89 million from $222.54 million last year and sales climbing robustly from $7.57 billion to over $8.12 billion. This financial uptrend is paired with an aggressive earnings forecast projecting growth of 33% annually, significantly outpacing the industry average of 16%. Sanmina's commitment is further evidenced by its strategic debt refinancing and amendments aimed at enhancing financial flexibility for forthcoming ventures, positioning it as an agile player in tech amidst evolving market dynamics.

- Navigate through the intricacies of Sanmina with our comprehensive health report here.

Explore historical data to track Sanmina's performance over time in our Past section.

Zeta Global Holdings (ZETA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zeta Global Holdings Corp. operates an omnichannel data-driven cloud platform offering consumer intelligence and marketing automation software to enterprises both in the United States and internationally, with a market cap of approximately $4.43 billion.

Operations: Zeta Global Holdings generates revenue primarily from its Internet Software & Services segment, amounting to $1.22 billion. The company provides a cloud platform that enhances consumer intelligence and marketing automation for enterprises globally.

Zeta Global Holdings is steering through the high-growth tech landscape with a robust focus on innovation and market expansion. Recently, the company raised its revenue guidance significantly, projecting a 20-21% increase for Q4 2025 and an impressive annual growth rate of 34% for 2026, largely driven by contributions from its Marigold enterprise software segment. This upward revision reflects strong demand and strategic acquisitions that enhance Zeta's product offerings, such as the launch of Athena by Zeta™—a superintelligent agent designed to optimize digital marketing efficiency through AI-driven insights. With R&D expenses consistently fueling these innovations, Zeta's commitment to integrating cutting-edge technology positions it well within a competitive industry landscape where AI and data analytics are increasingly critical.

Turning Ideas Into Actions

- Dive into all 75 of the US High Growth Tech and AI Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SANM

Sanmina

Provides integrated manufacturing solutions, components, products and repair, logistics, and after-market services in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026