- United States

- /

- Software

- /

- NYSE:YOU

Will Clear Secure's (YOU) Retail Expansion Reveal More About Its Long-Term Competitive Edge?

Reviewed by Simply Wall St

- Clear Secure recently expanded its presence beyond airports by opening a new TSA PreCheck enrollment and renewal center at Aventura Mall in Aventura, Florida, complementing its 62 airport-based locations and additional off-airport sites across the U.S.

- This expansion highlights Clear Secure's focus on increasing accessibility and convenience for consumers, reflecting an ongoing effort to strengthen its national network for trusted traveler services.

- We'll look at how the addition of enrollment locations in high-traffic retail centers may influence Clear Secure's broader investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Clear Secure Investment Narrative Recap

To be a Clear Secure shareholder, you need confidence in the company's ability to expand its identity and security platform beyond airports and generate consistent membership growth. The new TSA PreCheck enrollment center at Aventura Mall supports this broader accessibility strategy, but on its own, is unlikely to move the needle on short-term revenue or address the key risk of operational execution tied to new leadership. Still, the initiative serves as a signal that the business is investing in diversified growth and consumer convenience.

Among recent company announcements, the rollout of TSA PreCheck services at additional non-airport retail locations earlier in 2025 stands out as directly relevant. Both moves reinforce the catalyst that Clear Secure’s access expansion, especially where members already frequent, could smooth renewal patterns and help balance seasonal membership volatility, a challenge flagged by analysts.

However, with new enrollment channels opening, it’s important for investors to remember that leadership changes continue to introduce a level of execution risk that...

Read the full narrative on Clear Secure (it's free!)

Clear Secure's narrative projects $1.0 billion in revenue and $152.9 million in earnings by 2028. This requires 10.5% yearly revenue growth but reflects a decrease of $16.8 million in earnings from $169.7 million currently.

Uncover how Clear Secure's forecasts yield a $43.29 fair value, a 44% upside to its current price.

Exploring Other Perspectives

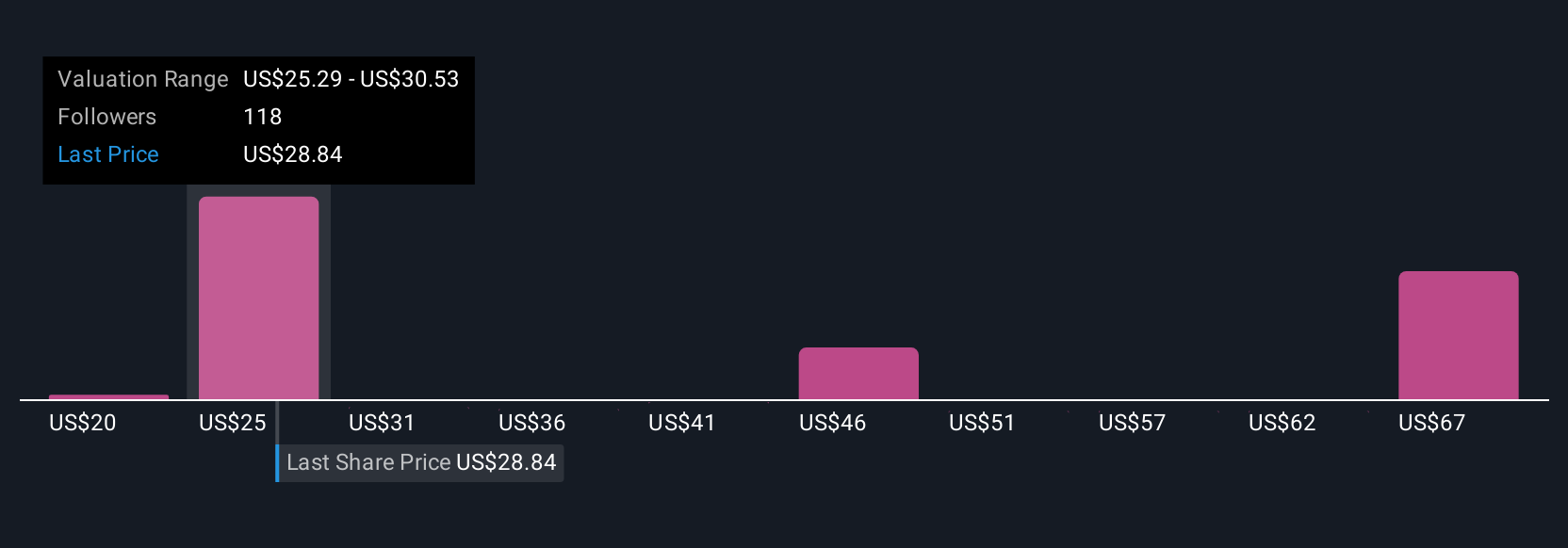

Simply Wall St Community members posted 12 fair value estimates for Clear Secure, ranging from US$20.05 to US$72.36 per share. While opinions are varied, the importance of management stability comes up frequently as a potential deciding factor for future business performance, inviting you to consider these differing viewpoints.

Explore 12 other fair value estimates on Clear Secure - why the stock might be worth over 2x more than the current price!

Build Your Own Clear Secure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clear Secure research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Clear Secure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clear Secure's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YOU

Clear Secure

Operates a secure identity platform under the CLEAR brand name primarily in the United States.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives