- United States

- /

- Software

- /

- NYSE:YOU

Is Wellstar’s CLEAR1 Rollout Shaping the Investment Case for CLEAR Secure (YOU)?

Reviewed by Sasha Jovanovic

- Wellstar Health System recently announced a partnership to implement CLEAR Secure's CLEAR1 identity platform across over 150 locations, enhancing patient check-ins through digital identity verification and integration with Epic Welcome.

- A joint case study revealed that this rollout improved digital check-in adoption, patient satisfaction, and operational efficiency, supporting measurable cost savings and new use cases in healthcare administration.

- We'll examine how CLEAR1's ability to free up significant staff time could shape Clear Secure's broader investment narrative moving forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Clear Secure Investment Narrative Recap

For someone considering Clear Secure, the investment thesis centers on the company's ability to broaden its reach beyond airports by leveraging its identity verification technology, moving into new sectors like healthcare where operational pain points are significant. The recent Wellstar Health System partnership underscores CLEAR1's potential to scale, but this momentum does not appear likely to directly influence the most important near-term catalyst, airport enrollment and travel partnerships, nor does it alleviate the most immediate risk of execution challenges amid management transitions.

Among recent company announcements, the expansion of CLEAR+ enrollment for international travelers stands out as closely relevant. Both initiatives reinforce Clear Secure’s narrative of diversifying and growing recurring revenue streams, yet the success of CLEAR1 in healthcare also highlights how application in new industries can complement growth in travel and drive the overall business forward.

However, investors should be aware that despite these operational wins, risks such as execution during a management overhaul still loom, especially if...

Read the full narrative on Clear Secure (it's free!)

Clear Secure's outlook anticipates $1.1 billion in revenue and $149.9 million in earnings by 2028. This is based on an annual revenue growth rate of 9.7% and a $27 million decrease in earnings from the current $176.9 million figure.

Uncover how Clear Secure's forecasts yield a $35.22 fair value, a 13% upside to its current price.

Exploring Other Perspectives

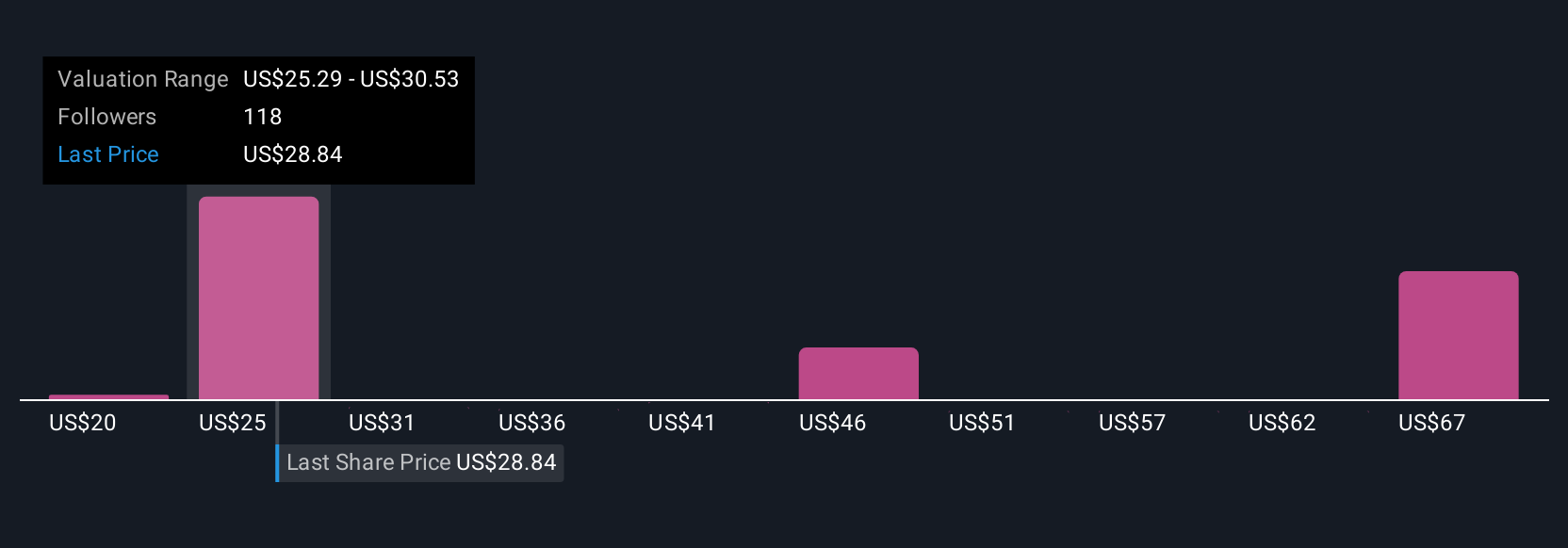

The Simply Wall St Community published 11 distinct fair value estimates for Clear Secure stock, ranging from US$20.05 up to US$71.51 per share. With management changes introducing execution risk, the variety of perspectives invites you to explore how others assess the company's outlook.

Explore 11 other fair value estimates on Clear Secure - why the stock might be worth over 2x more than the current price!

Build Your Own Clear Secure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clear Secure research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Clear Secure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clear Secure's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YOU

Clear Secure

Operates a secure identity platform under the CLEAR brand name primarily in the United States.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives