- United States

- /

- Software

- /

- NYSE:YOU

Clear Secure (YOU): Assessing Valuation After Upbeat Q3 Earnings, Guidance, and Dividend Announcement

Reviewed by Simply Wall St

Clear Secure (NYSE:YOU) shares moved higher after the company posted its third quarter results, revealing increased sales and net income. Investors also took note of new revenue guidance as well as the announcement of a quarterly dividend.

See our latest analysis for Clear Secure.

Clear Secure’s upbeat Q3 results and fresh revenue guidance have clearly caught investors’ attention, helping the stock deliver a 16% share price return over the last month and 35.5% year-to-date. With a 1-year total shareholder return of nearly 44% and a three-year return over 37%, momentum is building as the company sustains growth and signals confidence through its dividend announcement. Recent launches, like CLEAR Verified expanding into Canada, reinforce a positive tone around security innovation and trust, strengthening the story behind the numbers.

If you’re curious what else is showing strong momentum and ownership themes, this might be the moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock already up sharply and new growth signals on the table, the key question for investors is whether Clear Secure remains undervalued or if the market has already priced in its future prospects. Is there still a buying opportunity ahead?

Most Popular Narrative: Fairly Valued

With Clear Secure trading at $36.65 and the most widely followed narrative setting fair value near $36.22, the narrative currently aligns with market pricing but offers a deeper look at why.

The company's public-private partnership initiatives for deploying end-to-end automated lanes in airports can significantly expand market reach without incurring extra government costs. This strategy may support higher revenues and potentially wider net margins due to the cost-saving advantages of automation.

Curious what numbers justify this price tag? The full narrative unpacks bullish projections about member growth, fresh revenue initiatives, and earnings trajectories powering this valuation. Which aggressive financial assumptions underpin the price target, and will they hold?

Result: Fair Value of $36.22 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, leadership changes and uncertainty in travel patterns may disrupt Clear Secure’s momentum. These factors could act as potential catalysts to shift the current valuation narrative.

Find out about the key risks to this Clear Secure narrative.

Another View: What Does the SWS DCF Model Say?

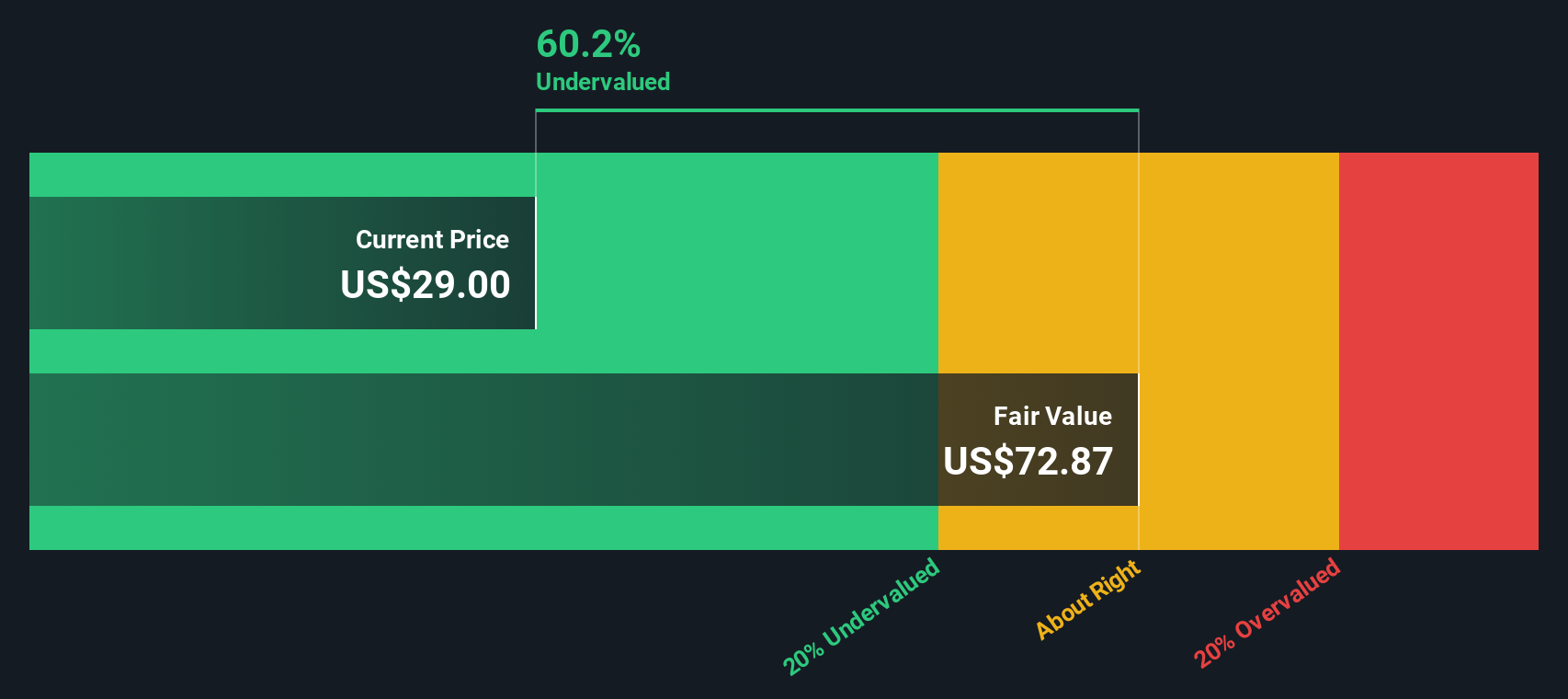

While many investors look at typical earnings multiples for guidance, our SWS DCF model paints a much more optimistic picture. According to this approach, Clear Secure’s fair value is estimated around $73.86 per share, which is almost double where it trades now. This suggests notable undervaluation. If the DCF view is right, what could unlock this upside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Clear Secure Narrative

If you have a different take on Clear Secure or want to dig deeper into the numbers, you can craft your own narrative quickly and easily. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Clear Secure.

Ready for Your Next Investment Move?

Don’t stop at just one opportunity. Make your research count by sizing up stocks with the Simply Wall Street Screener. The right idea could be one click away, so act now and give your portfolio more ways to win.

- Uncover fresh income streams by tapping into these 16 dividend stocks with yields > 3% with reliable yields and strong financial footing from industry leaders.

- Position yourself ahead of the curve and grow with these 25 AI penny stocks, harnessing artificial intelligence to transform tomorrow’s businesses.

- Accelerate your strategy with these 879 undervalued stocks based on cash flows that offer compelling value and could reward patient investors as sentiment shifts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YOU

Clear Secure

Operates a secure identity platform under the CLEAR brand name primarily in the United States.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives