- United States

- /

- Software

- /

- NYSE:YEXT

Yext (YEXT): Exploring the Stock’s Valuation After Recent Trading Activity

Reviewed by Simply Wall St

If you have been watching Yext (YEXT), the recent activity might have caught your eye and left you wondering what it signals for the stock’s next move. With little headline news to trigger a sharp reaction, this uptick in trading could be a moment for investors to pause and consider whether there is a deeper story behind the momentum in Yext’s share price.

Over the past year, Yext shares have climbed about 35%, with momentum holding steady through recent months. The stock’s performance since January has tracked similarly, which may suggest growing investor optimism or changing sentiment around the company. It is worth noting that while Yext’s three-year return is up significantly, its five-year performance still reflects some weakness. This gives us a mixed long-term picture.

So after these gains, is Yext undervalued or are investors simply catching up to its potential? Is now the time to get in, or has the market already priced in future growth?

Most Popular Narrative: 6.9% Undervalued

According to the most widely followed narrative on Yext, shares are currently trading at a meaningful discount to analysts’ estimates of fair value.

Recent M&A activity and expansion into verticals like healthcare and financial services through AI-powered platforms are opening up new, higher-value enterprise use cases. This can drive higher average contract values and boost future revenue and gross margins through operating leverage.

Want to know what’s driving this bullish outlook? The most important part of the narrative is a forecast of dramatic changes in profits and top-line growth, underpinned by new platform launches. Want to see which aggressive assumptions set Yext apart from the average software stock? Dig into the details behind the surprising analyst price target and the figures that power it.

Result: Fair Value of $9.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing market competition and potential setbacks in new product adoption could quickly challenge the current bullish outlook for Yext’s future growth.

Find out about the key risks to this Yext narrative.Another View: Taking a Look Through a Different Lens

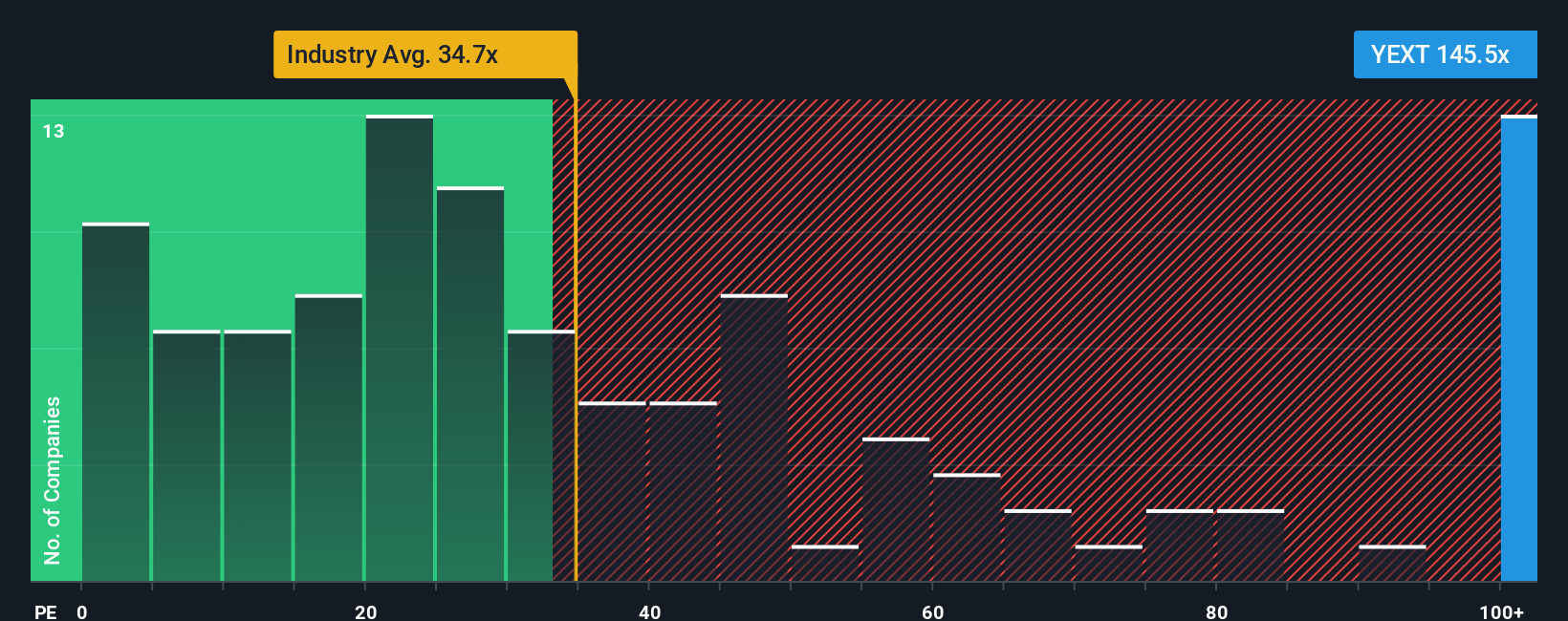

While analyst models suggest Yext is trading below fair value, a look at the company’s valuation based on recent price-to-earnings ratios relative to the wider industry presents a far more expensive picture. Which approach tells the true story?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Yext to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Yext Narrative

If you want to take a closer look from your own perspective or would rather dig into the details yourself, you can easily build your own narrative in just a few minutes. Do it your way

A great starting point for your Yext research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Winning Stock Ideas?

Don’t watch great opportunities pass by. With the right stock screeners, you’ll spot standout investments that others miss and find ideas tailored to your goals. Give yourself an edge and start your search now. Your next strong pick could be waiting.

- Unlock hidden bargains others overlook by using our undervalued stocks based on cash flows for stocks priced below their true worth.

- Tap into the booming world of artificial intelligence and pinpoint breakthrough innovators with our expertly curated AI penny stocks.

- Secure steady income and stability by uncovering companies offering robust yields through our reliable dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YEXT

Yext

Provides a platform that offers answers to consumer questions in North America and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives