- United States

- /

- Software

- /

- NYSE:VYX

NCR Voyix (VYX): Analyst Upgrades Spark Fresh Look at Stock’s Valuation

Reviewed by Simply Wall St

When a stock like NCR Voyix (NYSE:VYX) gets an upgrade to a Zacks Rank #2 (Buy), investors often scramble to make sense of what is driving the renewed optimism. In this case, the upgrade is due to a steady stream of upward earnings estimate revisions. While these analyst moves might seem routine on the surface, they can signal that the company’s underlying business is improving, potentially shifting risk perceptions and offering opportunity for those watching from the sidelines.

This uptick in sentiment comes after a bit of a mixed stretch for NCR Voyix. Shares are up about 23% in the past three months, a bright spot following a flat past year and a tough three-year run for long-term holders. The recent momentum has caught investor attention, especially as analysts have nudged their earnings forecasts higher and the company works through an annual revenue decline. It is a reminder that market expectations can change quickly, especially when company fortunes appear to be shifting.

With NCR Voyix picking up steam after a sluggish year, the real question is whether the stock is an undervalued growth story or if investors are already pricing in those brighter days ahead. Where do you land?

Most Popular Narrative: 13.6% Undervalued

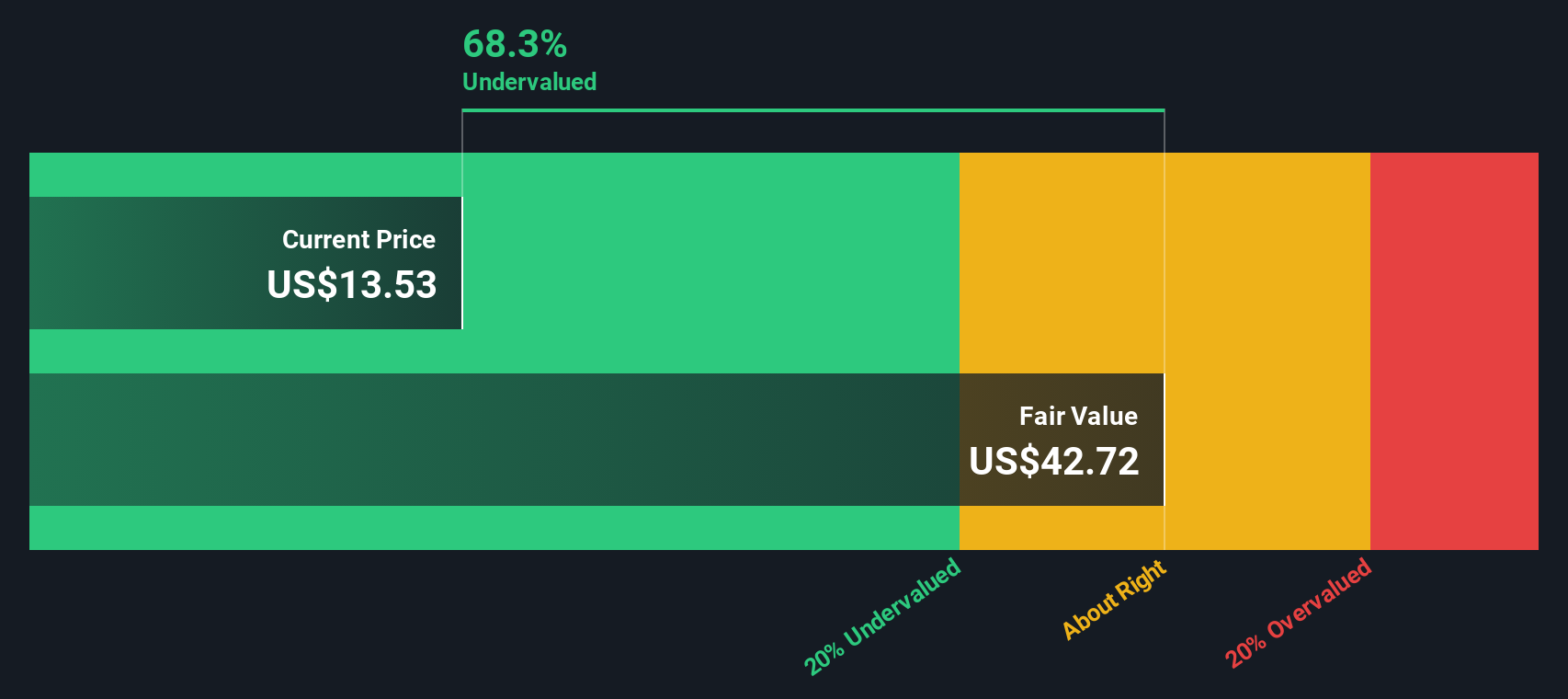

According to the community narrative, NCR Voyix is viewed as undervalued on a fair value estimate basis, with analysts projecting future business transformation, margin growth, and elevated recurring revenue streams. The valuation hinges on these forward-looking assumptions, creating a gap between the current share price and analyst consensus target.

"Accelerating consumer and merchant shift to cashless, contactless, and digitally integrated payments is increasing the need for advanced payment infrastructure. NCR Voyix's strategic expansion of end-to-end payment capabilities via its Worldpay and Voyix Pay platforms broadens wallet share opportunities, supports cross-selling, and is expected to boost net margins due to higher-margin payment streams."

Ready for a deeper dive into what is driving this bold undervaluation call? There is a secret sauce in these projections, and it is not just about revenue direction. Big changes are underway, under the hood. A key transformation, via new business models and profitability strategies, could unlock value few are expecting. What big leap is built into the fair value math? Keep reading for the full story behind this intriguing price target.

Result: Fair Value of $15.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent hardware declines and mounting transition costs could challenge NCR Voyix’s recovery, particularly if recurring software growth does not accelerate as expected.

Find out about the key risks to this NCR Voyix narrative.Another View: Testing Fair Value With Our DCF Model

While the analyst consensus focuses on future profits and business transformation, our DCF model uses a different approach to valuation. This method also suggests the shares may be undervalued. Could this confirmation be a sign, or is there still something missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NCR Voyix Narrative

If you see things differently or are eager to dig into the facts firsthand, you can easily craft your own perspective in just a few minutes. do it your way.

A great starting point for your NCR Voyix research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why stop now when you could tap into more exciting opportunities? Powerful tools await you to uncover stocks that align with your strategy. Missing out means watching others succeed instead. Take the reins and unlock fresh ideas built on real data.

- Capitalize on high-yield potential and strengthen your portfolio by checking out dividend stocks with yields > 3%.

- Jump ahead of the curve by exploring industry leaders in innovation through AI penny stocks.

- Supercharge your investments with robust, undervalued picks for growth by tapping into undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCR Voyix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VYX

NCR Voyix

Provides digital commerce solutions for retail stores and restaurants in the United States, the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives