- United States

- /

- IT

- /

- NYSE:VTEX

Anavex Life Sciences And 2 Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

As U.S. markets continue their upward momentum, with major indexes on track for their best week since June, investors are keeping a close eye on emerging opportunities in the stock market. Penny stocks, often seen as relics of past market eras, remain relevant due to their potential for growth at lower price points. By focusing on companies with strong financials and solid fundamentals, these stocks can offer unique opportunities for investors seeking value in smaller or newer enterprises.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.72 | $377.18M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.76 | $614.83M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.842 | $146.26M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.30 | $575.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.21 | $1.4B | ✅ 5 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.49 | $576.39M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| Cricut (CRCT) | $4.75 | $1.02B | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.837 | $6.08M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.51 | $82.24M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 350 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Anavex Life Sciences (AVXL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anavex Life Sciences Corp. is a biopharmaceutical company with a market cap of $309.14 million.

Operations: Anavex Life Sciences Corp. does not report any revenue segments.

Market Cap: $309.14M

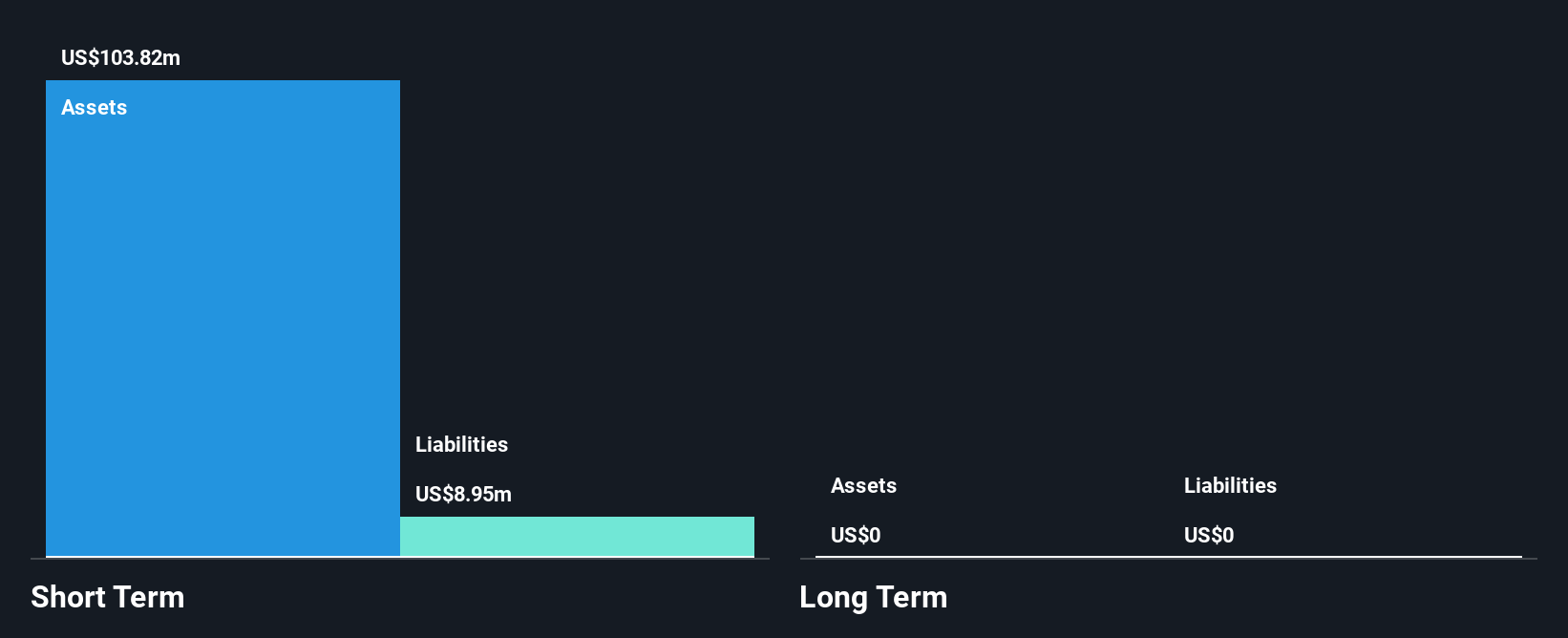

Anavex Life Sciences, with a market cap of US$309.14 million, is a pre-revenue biopharmaceutical company focused on innovative treatments for Alzheimer's and schizophrenia. Despite its unprofitability and negative return on equity, the company benefits from an experienced board and management team. Anavex is debt-free with sufficient cash runway for over two years. Recent clinical trials show promising results for blarcamesine in Alzheimer's treatment, though regulatory hurdles remain following a negative trend vote from the EMA. The stock's high volatility reflects both its potential upside in successful drug development and inherent risks associated with clinical-stage biotech firms.

- Jump into the full analysis health report here for a deeper understanding of Anavex Life Sciences.

- Gain insights into Anavex Life Sciences' future direction by reviewing our growth report.

EVgo (EVGO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: EVgo, Inc. owns and operates a direct current fast charging network for electric vehicles in the United States, with a market cap of approximately $930.11 million.

Operations: EVgo generates revenue primarily from its Retail - Gasoline & Auto Dealers segment, amounting to $333.13 million.

Market Cap: $930.11M

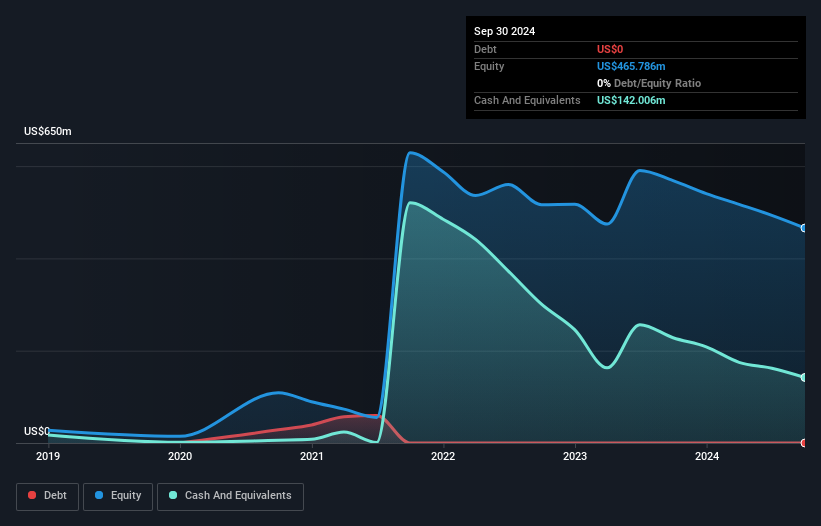

EVgo, Inc., with a market cap of approximately $930.11 million, operates in the electric vehicle charging sector and is currently unprofitable. Recent earnings reports show revenue growth to $92.3 million for Q3 2025, up from $67.54 million a year ago, though net losses have also increased slightly to $12.39 million. Despite having more cash than debt and sufficient short-term assets to cover liabilities, EVgo's long-term liabilities exceed its short-term assets by a significant margin. The management team is relatively new with an average tenure of 1.7 years, while the board is considered experienced at 3.5 years average tenure.

- Get an in-depth perspective on EVgo's performance by reading our balance sheet health report here.

- Understand EVgo's earnings outlook by examining our growth report.

VTEX (VTEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: VTEX offers a software-as-a-service digital commerce platform for enterprise brands and retailers, with a market cap of $692.97 million.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $234.12 million.

Market Cap: $692.97M

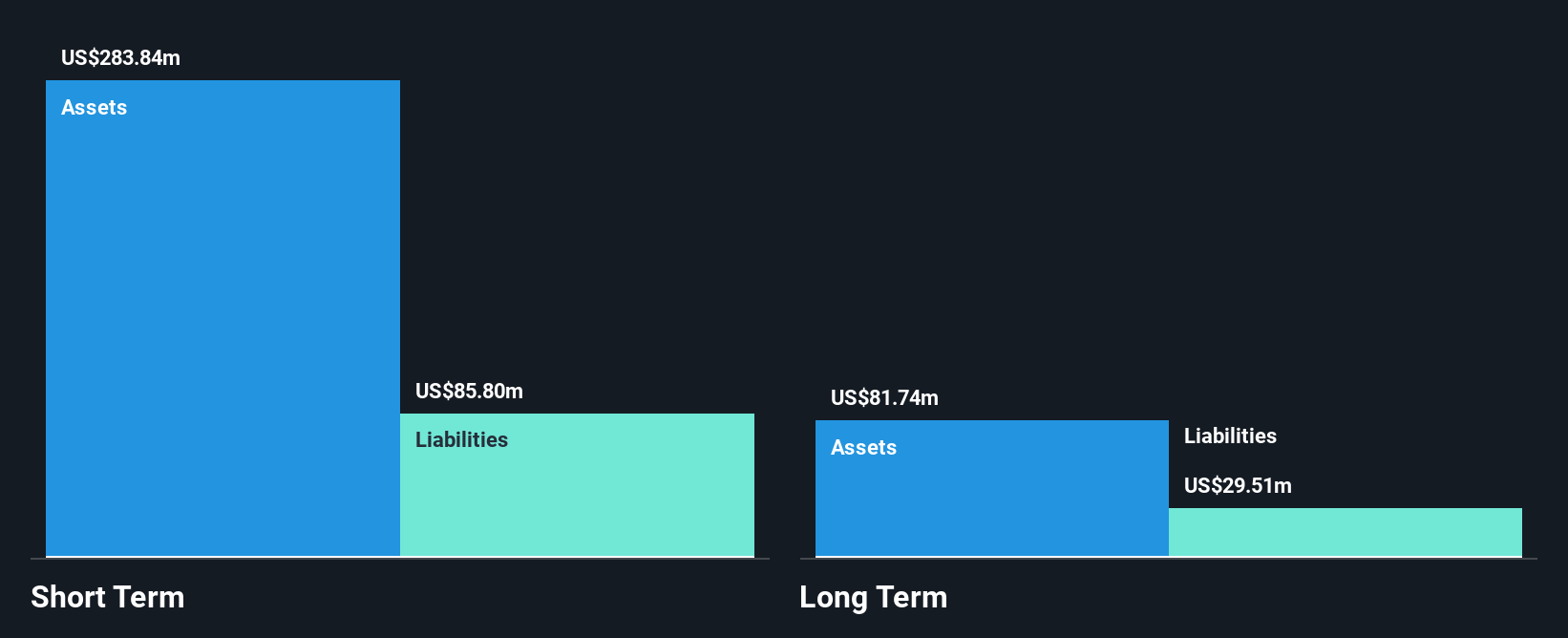

VTEX, with a market cap of US$692.97 million, has shown stable financial performance in the software-as-a-service sector. Recent earnings reports indicate revenue growth to US$59.61 million for Q3 2025, up from US$55.99 million a year ago, and net income improved to US$6.35 million from US$3.37 million last year. The company is debt-free and maintains strong liquidity with short-term assets of US$272 million exceeding both short-term and long-term liabilities significantly. Despite experiencing a large one-off loss impacting recent results, VTEX's management and board are seasoned with average tenures of 3.9 and 4.5 years respectively.

- Take a closer look at VTEX's potential here in our financial health report.

- Gain insights into VTEX's outlook and expected performance with our report on the company's earnings estimates.

Make It Happen

- Take a closer look at our US Penny Stocks list of 350 companies by clicking here.

- Seeking Other Investments? These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VTEX

VTEX

Provides software-as-a-service digital commerce platform for enterprise brands and retailers.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success