While Visa’s (NYSE:V) Stock Price Appears Weak, its Financials are in Great Shape

The share price of Visa ( NYSE:V ) has stood out due to it's weak performance since the company released results on 27th July. The stock price has fallen nearly 12%, and briefly breached its 200-day moving average yesterday - the first time it has done so since January. Visa was also the worst performing of the 30 constituents of the Dow Jones Industrial Average in August.

Despite the price weakness, Visa's underlying fundamentals appear strong. We decided to have a look at Visa's ROE, to see how it is trending and how it stacks up against the market.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital.In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

View our latest analysis for Visa

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Visa is:

29% = US$11b ÷ US$38b (Based on the trailing twelve months to June 2021).

The 'return' is the amount earned after tax over the last twelve months.So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.29.

An ROE of 15% is generally considered respectable, so 29% is excellent. Visa's ROE is also trending in the right direction. It has been above 15% since 2013, and current forecasts imply it will continue to rise.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings.We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company.Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Visa's Earnings Growth And 29% ROE

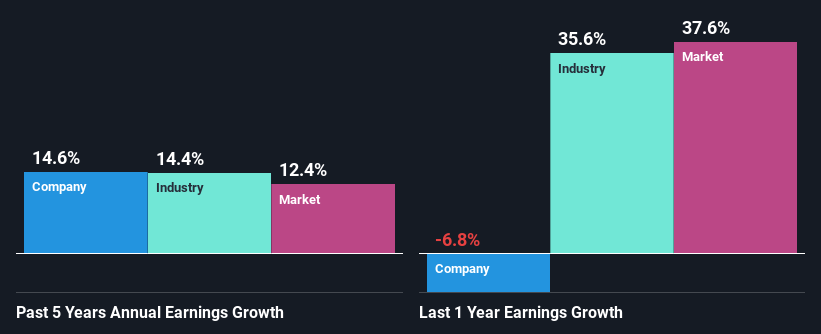

Firstly, we acknowledge that Visa has a significantly high ROE.Secondly, even when compared to the industry average of 17% the company's ROE is quite impressive.Probably as a result of this, Visa was able to see a decent net income growth of 15% over the last five years.

We then performed a comparison between Visa's net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 14% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth.The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in.Doing so will help them establish if the stock's future looks promising or ominous.

Why is the Share Price Falling?

Given that Visa's ROE is improving, it seems strange that the stock price has underperformed the market with no clear reason. We estimate that Visa's intrinsic value is about $220 , based on analyst forecasts. That means the stock is now trading at a very small premium.

The next graphic shows Visa's P/E ratio, along with the P/E ratio for the US IT industry and the equity market. Typically a higher P/E ratio, as is the case for Visa, means the market is optimistic about earnings growth.

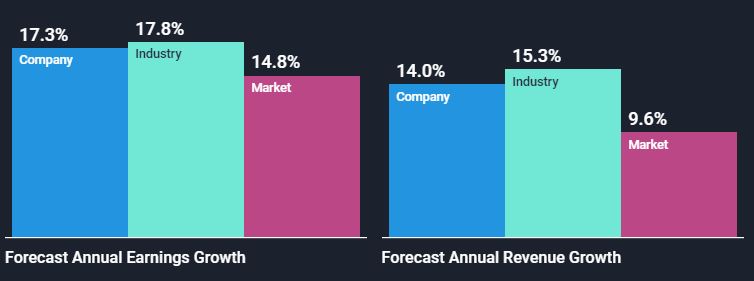

However, when we look at the earnings and revenue growth rates, we see that forecasts for Visa are just above forecasts for the market, and just below forecasts for the industry. Investors may be reluctant to pay such a high multiple for a stock that isn't expected to outperform the industry.

The other possible reasons for Vias's weak stock price are more qualitative. There has been a lot of positive news flow around several companies that compete in one way or another with Visa. In particular, Square (NYSE: SQ) is acquiring Afterpay , and Affirm (Nasdaq:AFRM) struck a massive deal with Amazon(Nasdaq: AMZN). These deals have reminded the market that there is competition out there.

Conclusion

There isn't an obvious reason for the recent weakness in Visa's stock price. However, the company appears to now be fairly priced and the ROE is excellent. Just how quickly competition might eat into Visa's growth remains to be seen - but it's unlikely to happen overnight. To learn more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NYSE:V

Visa

Operates as a payment technology company in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.