- United States

- /

- Software

- /

- NYSE:U

Unity Software's (NYSE:U) Lack of Profitability is Hardly a Minor Concern

Unity Software(NYSE: U) went public in the middle of the 2020 pandemic. After the first virtual bell ringing in the New York stock exchange history, the stock surged over 100% before losing steam.

Yet, in 2021 it gave back all of those gains before consolidating for a prolonged period of time. Now, it is on the verge of another leg up as price action gets increasingly bullish.

Since the stock remains unprofitable, which is not surprising for the sector, we will examine the company's cash burn to check if there are any red flags.

The company posted the following Q2 results

- Non-GAAP EPS: -US$0.02 (beat by US$0.10)

- GAAP EPS: -US$0.53(miss by US$0.19)

- Revenue: US$273.6m (beat by US$30.85m)

With revenue jumping almost 50% year-over-year, it is not a surprise to see such a bullish outlook on the charts, although the company announced lower quarter-over-quarter revenue guidance at US$260m. Time will show whether this was mandated or just cautious.

Acquisitions Fuel the Growth

Meanwhile, the company continues to expand, announcing an acquisition of OTO, an AI-driver acoustic intelligence platform. This deal, which should bring Unity expertise in acoustic analysis, closed on August 12, but the details are yet to be disclosed.

In addition, the Parsec acquisition is now officially finalized, and it will be worth approximately US$320m in cash. Parsec is a high-performance remote desktop and streaming tech company that should help to develop a flexible, state-of-art, remote workplace.

See our latest analysis for Unity Software

How Long Is Unity Software's Cash Runway?

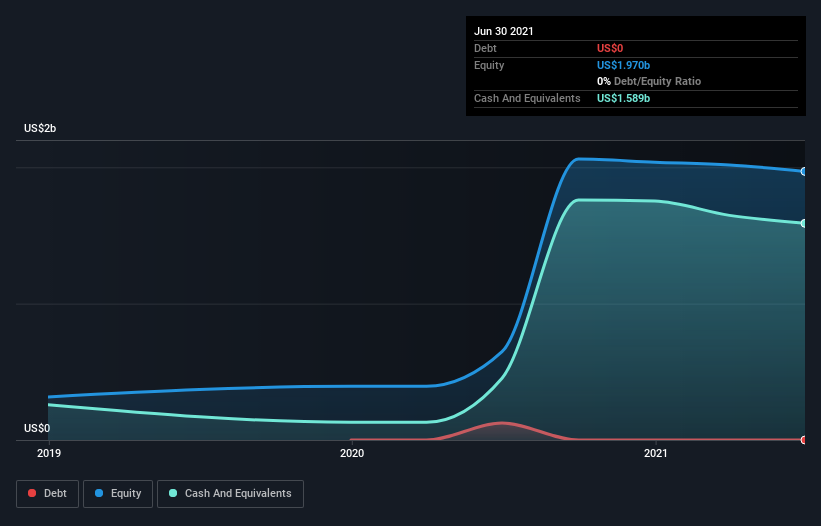

When Unity Software last reported its balance sheet in June 2021, it had zero debt and cash worth US$1.6b. Looking at the last year, the company burnt through US$120m.

That means it had a cash runway of over a decade as of June 2021. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. Depicted below, you can see how its cash holdings have changed over time.

Examining Unity Software Growth

At first glance, it's a bit worrying to see that Unity Software actually boosted its cash burn by 19%, year on year. The good news is that operating revenue increased by 45% last year, indicating that the business is gaining some traction.

It seems to be growing nicely. Clearly, however, the crucial factor is whether the company will grow its business from now on. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can Unity Software Raise More Cash Easily?

We are certainly impressed with the progress Unity Software has made over the last year, but it is also worth considering how costly it would be to raise more cash to fund faster growth.

Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalization to see how many new shares a company would have to issue to fund one year's operations.

Unity Software's cash burn of US$120m is about 0.3% of its US$36b market capitalization. That means it could easily issue a few shares to fund more growth and might well be in a position to borrow cheaply.

Lack of Profitability is Not a Concern Right Now

As you can probably tell by now, we're not too worried about Unity Software's cash burn. For example, we think its cash runway suggests that the company is on a good path. While its increasing cash burn wasn't great, the other factors mentioned in this article more than make up for weakness on that measure.

Finally, looking at the company's position, it is one of the prime candidates to become a leading force in Multiverse - the envisioned 3-D virtual reality for both work and leisure.

Once that scenario starts unfolding, it wouldn't be surprising to see Unity acquired by one of the tech giants or become a tech giant itself.

Readers need to be cognizant of the risks that can affect the company's operations, and we've picked out 3 warning signs for Unity Software that investors should know when investing in the stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives