- United States

- /

- Software

- /

- NYSE:U

Unity Software's (NYSE:U) Acquisitions Should Bring the Needed Revenue Diversification

Few Wall Street proverbs echo more than "Big bases create big breakouts."

After 8 months of ranging, Unity Software Inc.(NYSE: U) finally recaptured the key level of US$150 and broke out in a parabolic fashion, with no signs of slowing down yet.

View our latest analysis for Unity Software

Q3 Earnings Results

The company reported a solid third-quarter result with reduced losses, improved revenues, and improved control over expenses.

- Revenue: US$286.3m (up 43% from 3Q 2020).

- Net loss: US$115.2m (loss narrowed 20% from 3Q 2020).

Guidance for Q4

- Revenue: US$285-290m

- Non-GAAP Operating loss: US$20-25m

Meanwhile, the company reached a definitive deal to buy Weta Digital, a well-known digital visual effects company founded by Peter Jackson. The deal is worth US$1.625b while Weta will remain a stand-alone entity.

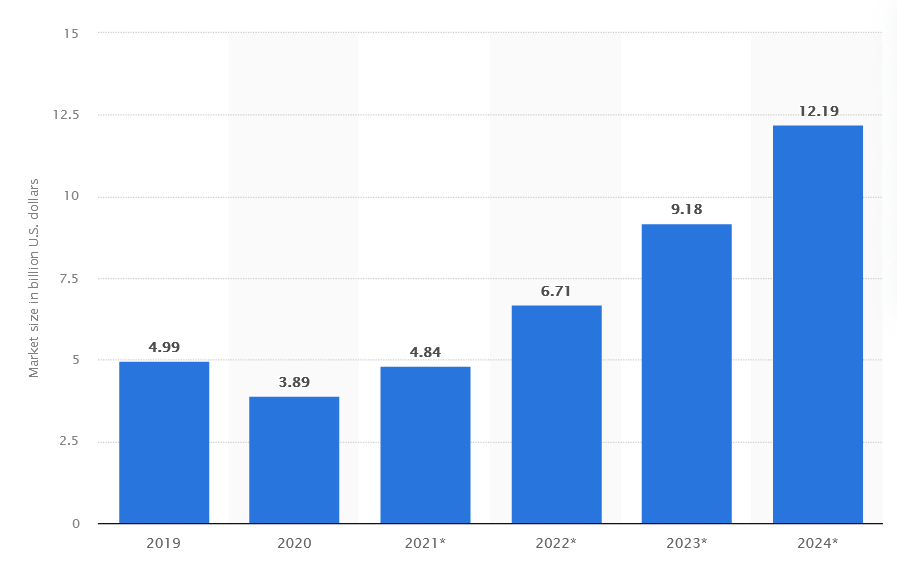

This acquisition is a tailwind to Unity's plans as the company looks for a strong position in the booming AR/ VR market. Although a fast-growing market already, Morgan Stanley argues that the VR market will explode, with just the hardware market reaching US$60b by 2030 and US$250b by 2040.

However, the company will have to work on its revenue diversification as 90% of its revenues currently come from the gaming industry. So far, the company is working on partnerships with automotive manufacturers, eye-wear, and media& entertainment – especially with their latest acquisition.

A Look Into the Revenue Growth

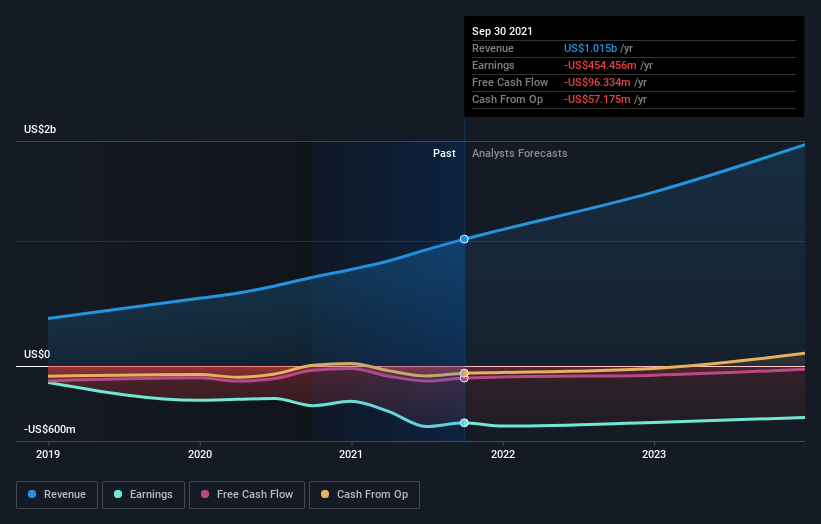

Given that Unity Software didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year, Unity Software saw its revenue grow by 43%. We respect that sort of growth, no doubt. While the share price performed well, gaining 71% over twelve months, you could argue the revenue growth warranted it. If revenue stays on-trend, there may be plenty more share price gains to come. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow).

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Unity Software is well known by investors, and plenty of clever analysts have tried to predict future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

Unity Software boasts a total shareholder return of 71% for the last year. And the share price momentum remains respectable, with a gain of 61% over the previous three months. This suggests the company is continuing to win over new investors.

However, those who are thinking about investing in the stock should think twice about chasing parabolic moves. An orderly market move is in waves - price goes up and then retraces before making the next move.

If you're interested in an in-depth review, we've spotted 4 warning signs for Unity Software you should be aware of. Furthermore, if you're interested in growth companies, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market-weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:U

Unity Software

Operates a platform to develop, deploy, and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Spotify - A Fundamental and Historical Valuation

Very Bullish

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.