- United States

- /

- Software

- /

- NYSE:U

Unity Software Valuation Check After Surprise Profit And New AI And Coda Growth Push

Why Unity Software (U) is back on investors’ radar

Unity Software (U) has jumped back into focus after a surprise profitable Q3 2025, driven by its AI-powered Vector ad platform, along with a new Coda partnership for streamlined global in-app purchasing.

See our latest analysis for Unity Software.

Unity’s recent Coda integration and the profitable Q3 2025 have arrived during a choppy period, with a 30 day share price return of a 10.85% decline and a 90 day share price return of 11.15%. The 1 year total shareholder return of 75.07% points to strong longer term momentum despite mixed options activity and insider selling.

If you are watching how AI centric platforms like Unity are being priced, it could be a good moment to scan other high growth tech and AI names through high growth tech and AI stocks.

With Unity posting a surprise profit, a 1 year total return of 75.07% and the stock still trading below one estimate of intrinsic value, the key question is whether there is still a buying opportunity here or if markets already price in future growth.

Most Popular Narrative: 12% Undervalued

Unity Software’s most followed narrative pegs fair value at about $45.63 versus the last close of $40.16, putting a modest valuation gap in focus.

The expansion of Unity's client base and deepened partnerships with top-tier global gaming and enterprise players (e.g., Tencent, Scopely, Nintendo, BMW), along with unique cross-platform capabilities (including leading presence in China), are unlocking new long-term customer pipelines and diversified revenue streams, supporting both top-line growth and improved earnings stability.

Curious what kind of revenue growth, margin path, and future earnings multiple need to line up to support that valuation gap? The full narrative lays out a detailed financial roadmap that ties together Unity’s AI tools, subscriptions, and ecosystem partnerships into one coherent pricing story.

Result: Fair Value of $45.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still real pressure points here, including heavy AI spending that could keep Unity in a loss position, and tough competition from rival game engines and in house tools.

Find out about the key risks to this Unity Software narrative.

Another View: Rich Sales Multiple Versus “Undervalued” Tag

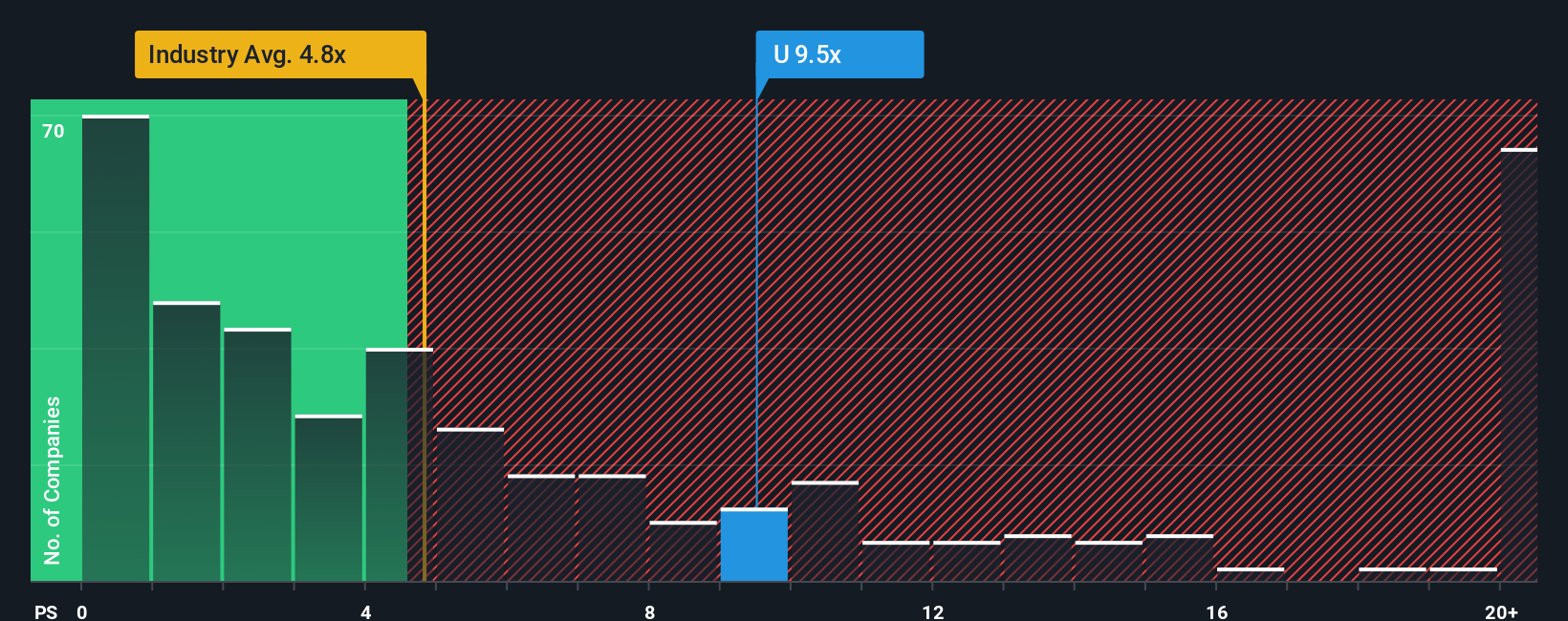

The SWS DCF model suggests Unity is trading about 29.3% below an estimate of future cash flow value at $56.81, which supports the undervalued label. However, the P/S of 9.5x is well above the US Software average of 4.6x, the peer average of 6.3x, and even the 8.5x fair ratio. This points to a full price for each dollar of current revenue.

With cash flows indicating “room to run” and sales multiples indicating “already expensive,” which signal do you place more weight on for your own thesis?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Unity Software Narrative

If you look at the numbers and come to a different conclusion, or simply want to test your own assumptions, you can build a custom thesis that fits your view in just a few minutes using Do it your way.

A great starting point for your Unity Software research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Unity has your attention, do not stop there. Use the Simply Wall St Screener to spot other opportunities that could fit your portfolio before others do.

- Spot early stage potential by checking out these 3515 penny stocks with strong financials that already back their stories with solid financials.

- Target fast growing themes by scanning these 24 AI penny stocks that are tied to the build out of artificial intelligence across industries.

- Focus on price discipline by reviewing these 876 undervalued stocks based on cash flows that are flagged as trading below estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion