- United States

- /

- Software

- /

- NYSE:U

Unity Software (U) Valuation Check As Bullish Options And Q4 Earnings Optimism Build

Reviewed by Simply Wall St

Unity Software (U) heads into its upcoming fourth quarter earnings with rising attention, as bullish options activity, upbeat analyst ratings, and a fresh Coda integration highlight potential shifts in investor expectations.

See our latest analysis for Unity Software.

Recent trading has been choppy, with a 1 day share price return of a 6.89% decline and a 30 day share price return of an 11.78% decline. However, the 1 year total shareholder return of 88.10% shows that longer term holders have still seen strong gains. This helps explain why options activity and the Coda integration are drawing so much attention around the upcoming earnings report.

If Unity’s latest moves around monetization tools have caught your eye, it could be a good moment to see what else is happening across high growth tech and AI names with high growth tech and AI stocks.

With Unity trading at US$40.95, below an average analyst price target of about US$47.60 and an indicated intrinsic value gap of roughly 27%, the key question is simple: is this a genuine opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 10.3% Undervalued

With Unity's last close at US$40.95 and a narrative fair value of about US$45.63, the widely followed view has buyers and sellers weighing a modest valuation gap against some punchy assumptions on growth, margins, and future multiples.

The analysts have a consensus price target of $31.67 for Unity Software based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $44.0, and the most bearish reporting a price target of just $18.0.

Curious how a higher fair value can sit alongside mixed profit expectations and a very rich future earnings multiple assumption? The core of this narrative leans on revenue expansion, margin repair, and a compressed share count. Want to see how those moving parts are combined into one target number? Read on for the full breakdown behind that projected fair value path.

Result: Fair Value of $45.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are clear pressure points too, including heavy AI and product spend that could keep losses elevated, and fierce engine competition that could cap Unity's pricing power.

Find out about the key risks to this Unity Software narrative.

Another View: What P/S Says About Unity

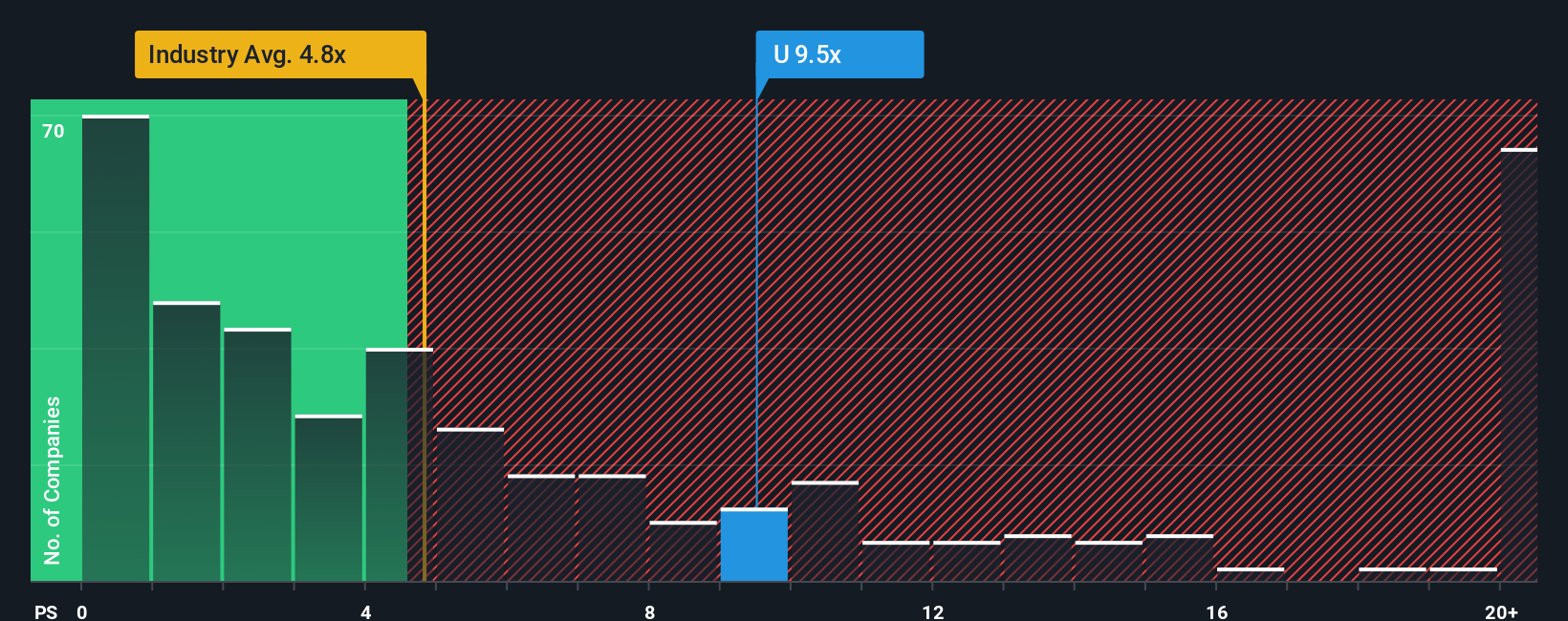

While the narrative fair value suggests Unity shares are 10.3% undervalued, the P/S ratio tells a different story. At 9.7x sales, Unity trades richer than the US Software industry at 4.7x and above its own fair ratio of 8.5x, which may point to valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Unity Software Narrative

If you are not on board with this view or prefer to lean on your own work, you can build a fresh Unity thesis yourself in just a few minutes, starting with Do it your way.

A great starting point for your Unity Software research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Unity has your attention but you still want other angles, do not stop here. Widen your search and pressure test your thinking against fresh ideas.

- Target potential bargains early by scanning these 873 undervalued stocks based on cash flows that line up market prices against underlying cash flows and fundamentals.

- Tap into long term themes in automation and data by checking out these 24 AI penny stocks that sit at the intersection of software and machine learning.

- Add a different growth engine to your watchlist with these 80 cryptocurrency and blockchain stocks tied to blockchain infrastructure, payments, and digital asset ecosystems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Very Bullish

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Very Bullish

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026