- United States

- /

- Software

- /

- NYSE:U

Unity Software (U): Revisiting Valuation After an 82% Year-to-Date Rebound

Unity Software (U) has quietly turned into one of this year’s comeback stories, with the stock up roughly 82% year to date despite lingering losses and a still evolving path to consistent profitability.

See our latest analysis for Unity Software.

That surge has come in bursts, with a 21.38% 1 month share price return offsetting some recent weakness, and an 80.74% 1 year total shareholder return suggesting momentum is still rebuilding after a tough few years.

If Unity’s rebound has your attention, it might be a good moment to explore other high growth tech and AI names through high growth tech and AI stocks for your watchlist.

With shares now hovering just below Wall Street’s target and sporting a modest intrinsic discount, the key question for investors is simple: is Unity still mispriced, or is the market already baking in its next leg of growth?

Most Popular Narrative Narrative: 15.8% Overvalued

According to the narrative by andreas_eliades, Unity's fair value of $38.48 sits below the recent $44.57 close, setting up a cautiously optimistic long term picture.

With analysts predicting no real growth until 2028 Unity holds a significant upside if it executes its strategy successfully.

Curious how flat near term expectations can still support a premium price tag? The narrative leans on faster growth, richer margins, and a punchy future earnings multiple. Want to see exactly how those pieces add up to that valuation call?

Result: Fair Value of $38.48 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competitive pressure in gaming and advertising, or slower adoption of Unity’s non gaming initiatives, could easily derail this optimistic long term thesis.

Find out about the key risks to this Unity Software narrative.

Another Lens on Value

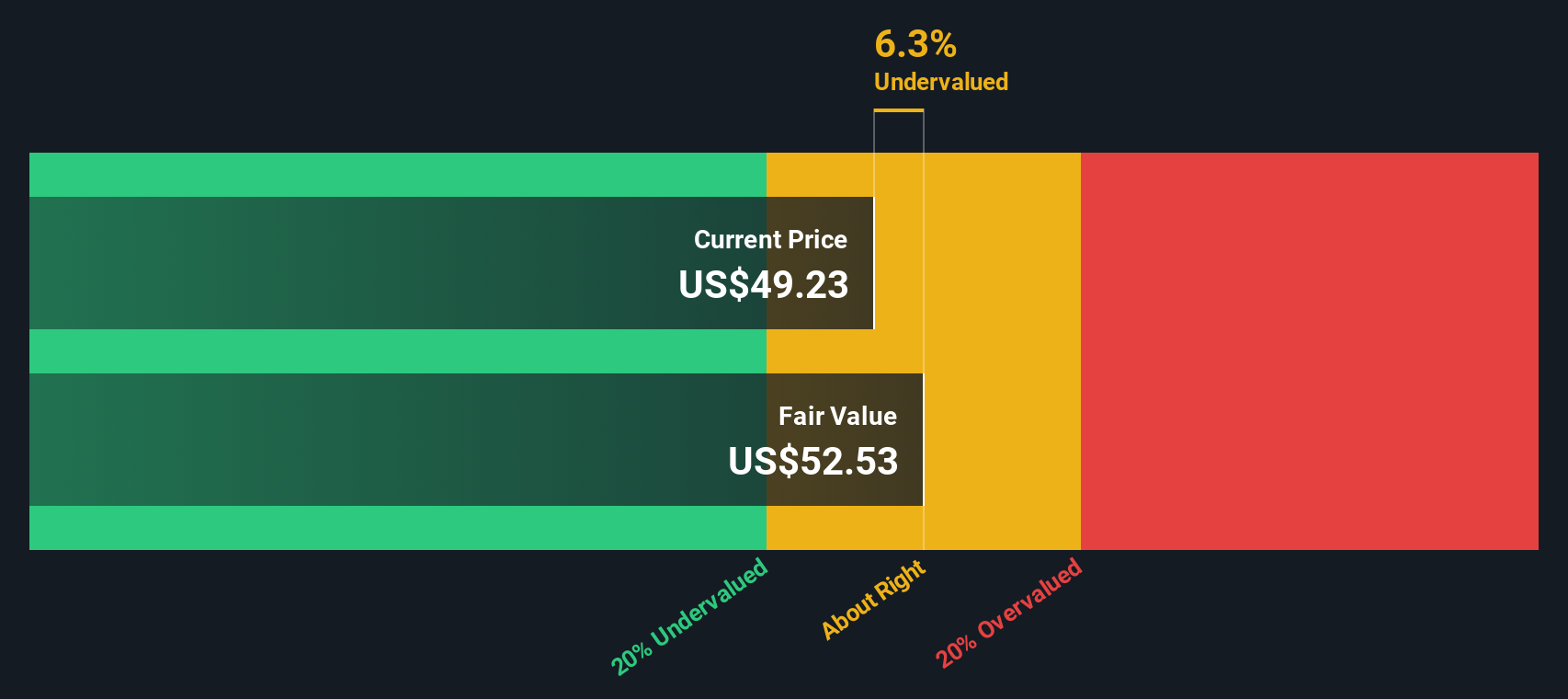

While the narrative model calls Unity 15.8% overvalued at $44.57, our DCF model suggests the opposite, with a fair value of $52.68 and the stock trading about 15.4% below that level. If cash flows win out over sentiment, is today closer to a risk or an opening?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Unity Software for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 910 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Unity Software Narrative

If you see Unity’s story differently, or want to stress test the numbers yourself, you can build a complete narrative in minutes: Do it your way.

A great starting point for your Unity Software research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you close this tab, lock in your momentum by lining up fresh stock ideas on Simply Wall St that match your exact investing style and goals.

- Boost your income game by targeting reliable payouts with these 13 dividend stocks with yields > 3% and uncover companies that may keep cash flowing into your account through market cycles.

- Position yourself early in transformative trends by scanning these 26 AI penny stocks and locating potential leaders at the heart of the AI acceleration.

- Turn volatility into opportunity by using these 80 cryptocurrency and blockchain stocks to pinpoint listed plays on digital assets and blockchain infrastructure before the next big swing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

A Tale of Two Engines: Coca-Cola HBC (EEE.AT)

This strategic transformation of TTE? Significant re-rating potential

Q3 Outlook modestly optimistic

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.