- United States

- /

- Software

- /

- NYSE:U

Unity Software (NYSE:U): Evaluating Valuation Following Analyst Upgrades and Latest Product Enhancements

Reviewed by Simply Wall St

Unity Software (NYSE:U) just made waves by rolling out a unified global commerce management platform for game developers. This comes shortly after the company boosted its Android XR support in Unity 6. Recent bullish moves by key analysts suggest investor sentiment is shifting upward.

See our latest analysis for Unity Software.

Unity's latest innovations arrive as the share price recovers from a rough patch, with the 1-day gain of 2.8% and a 7-day share price return of 5.8% hinting at fresh momentum. Despite a sharp 16.1% drop over the past month, the stock is still up more than 52% year-to-date and boasts a remarkable 89.1% total shareholder return over the past year. While longer-term holders remain underwater due to earlier volatility, recent analyst optimism and new product launches are fueling renewed interest in Unity's growth story.

If tech breakthroughs are on your radar, consider what else is possible. See the full list of leading innovators with See the full list for free.

After such a rapid rebound, the big question is clear: is Unity actually undervalued at today’s price, or have investors already priced in most of the anticipated growth ahead? Is there still a real buying opportunity, or is the market one step ahead?

Most Popular Narrative: 3.1% Undervalued

Unity Software’s most widely followed narrative, according to andreas_eliades, pegs fair value at $38.48 compared to the last close at $37.29. This sets the stage for a fresh look at growth potential just above current pricing. The focus now shifts to whether Unity’s unique position will be enough to close this gap as the market weighs risks and opportunities.

Unity's increasingly diversified revenue streams in non-gaming sectors decrease its riskiness and bolster its long-term growth potential. Significant restructuring progress with the new management addressing past missteps, evident by the rollback of the controversial runtime fee.

Want the inside scoop behind this fair value? The author’s calculations hinge on growth far beyond games, smart financial decisions, and a management shakeup. Which factor matters most? Only the full narrative reveals how these bold assumptions drive the price target and whether Unity’s evolution can really fuel a new chapter.

Result: Fair Value of $38.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition in the gaming and advertising markets, as well as delays in realizing non-gaming growth, could swiftly shift sentiment around Unity's outlook.

Find out about the key risks to this Unity Software narrative.

Another View: Multiple-Based Valuation Raises Caution

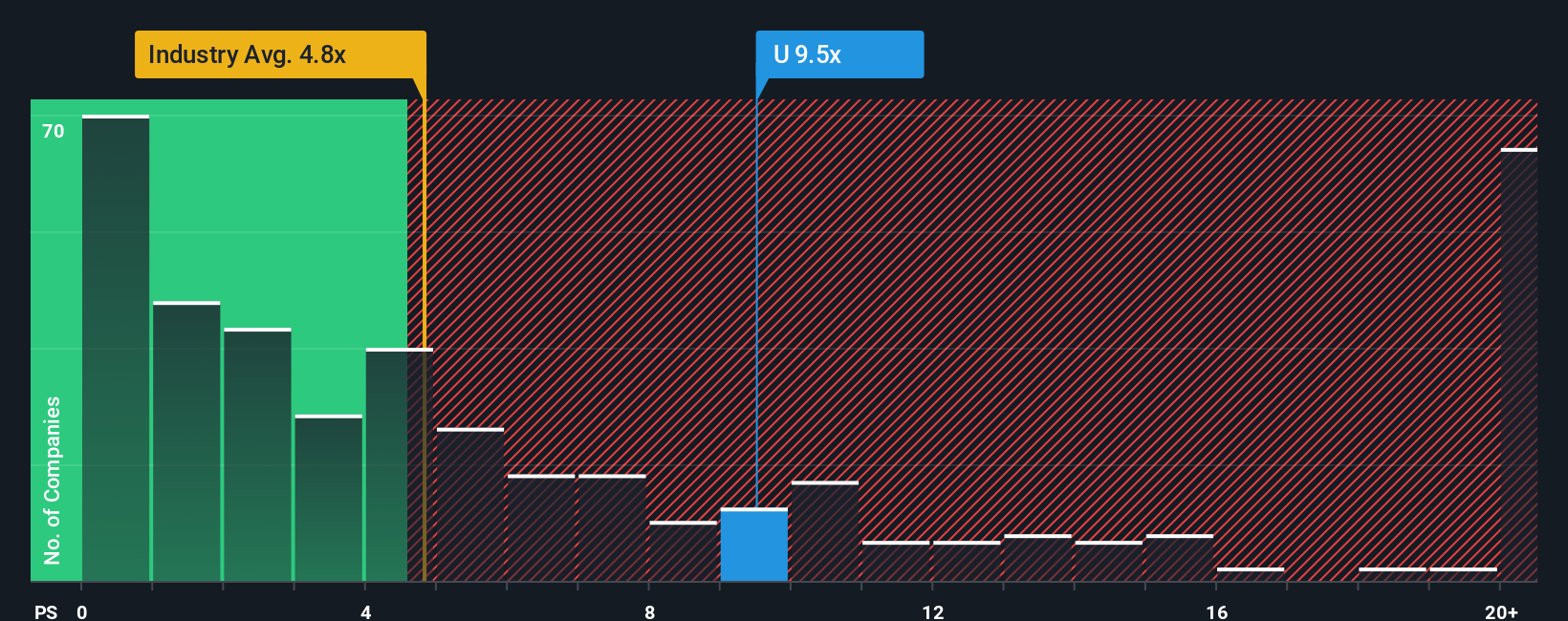

Looking at Unity’s price-to-sales ratio of 8.9x, it sits well above the US software industry average of 5.3x and even tops its own fair ratio benchmark of 7.8x. This suggests the stock might be expensively valued versus its sector, despite the recent optimism. Is the premium justified by Unity's growth, or are investors overlooking risks in search of upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Unity Software Narrative

If you have a different perspective or want to test your own assumptions, you can craft your own narrative with just a few clicks. Do it your way

A great starting point for your Unity Software research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye on new opportunities. Take the next step by expanding your watchlist with stocks in fast-moving sectors and emerging trends, all backed by real data from the Simply Wall Street screener.

- Tap into innovation by checking out these 27 AI penny stocks driving advancements in artificial intelligence and powering tomorrow’s smart solutions.

- Build income potential and stability when you explore these 17 dividend stocks with yields > 3% with consistent yields above 3%, providing returns in any market climate.

- Ride the growing wave of healthcare technology by researching these 33 healthcare AI stocks at the forefront of life-changing medical and AI breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Hims & Hers Health aims for three dimensional revenue expansion

Endeavour Group's Future PE Expected to Climb to 15.51%

A Quality Compounder Marked Down on Overblown Fears

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion