- United States

- /

- Software

- /

- NYSE:TYL

Tyler Technologies (TYL): Exploring Valuation After Recent 11% Stock Decline

Reviewed by Kshitija Bhandaru

See our latest analysis for Tyler Technologies.

With the recent 11% dip, Tyler Technologies’ stock has lost some momentum, reflecting cooling investor sentiment after a period of long-term growth. Despite the weaker mood, the company’s three-year total shareholder return of 44.4% highlights the underlying resilience in its performance even as the year’s trend has faded.

If you're recalibrating your outlook on tech leaders, it might be a good time to broaden your search and discover fast growing stocks with high insider ownership

But with Tyler Technologies’ shares now trading well below analyst price targets, investors face a key question: could this downturn signal an undervalued entry point, or is the company’s growth story fully priced in?

Most Popular Narrative: 26.9% Undervalued

Tyler Technologies’ last closing price of $496.23 sits well below the most widely followed narrative’s fair value estimate of $678.78. This suggests substantial upside potential and sets the stage for a robust debate about whether the company’s projected growth and margin improvements justify such a valuation gap.

Ongoing investment in AI-powered tools and automation, evident in product launches like the AI-driven Resident Assistant and enhanced budgeting solutions, caters to public sector labor challenges and the need for data-driven decision-making. These advances can enable premium pricing, reduce customer churn, and unlock scalable margin improvements over time.

Want to know what’s fueling this bullish target? The narrative’s secret sauce is a bold forecast of rapid earnings growth and ambitious margin expansion, projected years into the future. Curious how these financial leaps and competitive advantages translate into a price far above today’s level? Discover the surprising assumptions and scenarios inside the full narrative.

Result: Fair Value of $678.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Tyler’s exposure to unpredictable government spending and the risk of slower recurring revenue growth could challenge this bullish view going forward.

Find out about the key risks to this Tyler Technologies narrative.

Another View: Market Multiples Tell a Different Story

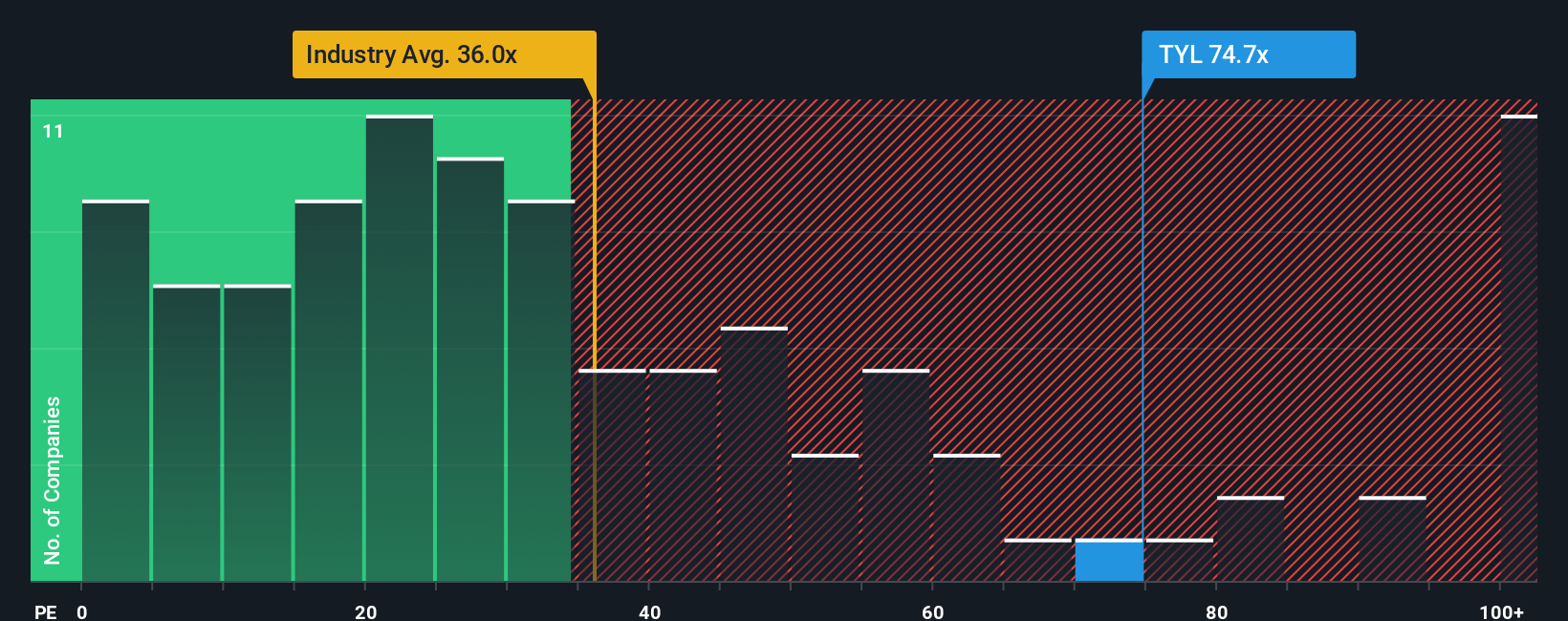

While analyst forecasts suggest Tyler Technologies may be undervalued, a closer look at its price-to-earnings ratio offers a cautionary perspective. The company trades at 70 times earnings, which is significantly higher than the US Software industry average of 35.7 times, its peer average of 61.2 times, and a fair ratio of 35 times. This sizable premium signals that much of Tyler’s growth narrative may already be factored into the price, increasing the risk if future performance falls short. Are investors being too optimistic, or is there still room for upside if the company delivers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tyler Technologies Narrative

If the numbers or narratives above do not quite fit your perspective, you can dive into the data and craft your own analysis in just a few minutes. Why not Do it your way?

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Tyler Technologies.

Looking for more investment ideas?

Smart investors stay ahead by seeking out tomorrow’s opportunities, not just today’s leaders. Broaden your watchlist with stocks making waves in dynamic sectors.

- Capitalize on rapid market shifts by backing these 78 cryptocurrency and blockchain stocks as it transforms the digital economy with innovative blockchain and fintech solutions.

- Unlock steady growth and income through these 19 dividend stocks with yields > 3% which delivers yields that outpace traditional savings and provide resilience in changing markets.

- Seize the upside in healthcare innovation with these 32 healthcare AI stocks that uses AI to revolutionize diagnostics, treatment, and global patient care.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyler Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TYL

Tyler Technologies

Provides integrated software and technology management solutions for the public sector.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives