- United States

- /

- IT

- /

- NYSE:TWLO

Will Twilio’s (TWLO) Addition to Multiple S&P Indices Reshape Its Institutional Investment Story?

Reviewed by Simply Wall St

- Twilio Inc. (NYSE:TWLO) was recently added to several S&P indices, including the S&P 1000, S&P 400, S&P Composite 1500, and S&P 400 Information Technology sector, following a series of announcements made earlier in August 2025.

- Index inclusion can often drive significant fund-driven demand as investment funds tracking these indices adjust portfolios to include the newly added company, potentially impacting trading volumes and investor interest.

- We'll explore how Twilio's multiple index additions may influence its investment narrative and future exposure within institutional portfolios.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Twilio Investment Narrative Recap

To be a Twilio shareholder, you need to believe in the company’s ability to transition from low-margin messaging revenue toward higher-margin platform and software growth. The recent inclusion in multiple S&P indices can increase institutional exposure and short-term trading interest, but does not fundamentally alter the longer-term focus on gross margin improvement or the risks tied to messaging commodification and expanding carrier fees. The main catalyst ahead remains how effectively Twilio can scale its higher-value platform and AI-powered capabilities.

Among the latest announcements, Twilio’s Q2 earnings report drew attention, showing a move from losses to positive earnings while raising full-year guidance for revenue growth. This shift highlights ongoing progress in operational discipline and stronger execution, which supports the investment narrative, though it does not remove concerns around margin pressures driven by international growth and messaging mix. Enhanced index exposure from recent news aligns with these positive operating signals, but investors will remain watchful for sustained, margin-accretive growth.

In contrast, investors should be mindful of how persistent increases in carrier fees threaten margin sustainability and...

Read the full narrative on Twilio (it's free!)

Twilio's outlook projects $5.9 billion in revenue and $441.4 million in earnings by 2028. This is based on a 7.8% annual revenue growth and a $421.2 million increase in earnings from the current $20.2 million.

Uncover how Twilio's forecasts yield a $131.31 fair value, a 23% upside to its current price.

Exploring Other Perspectives

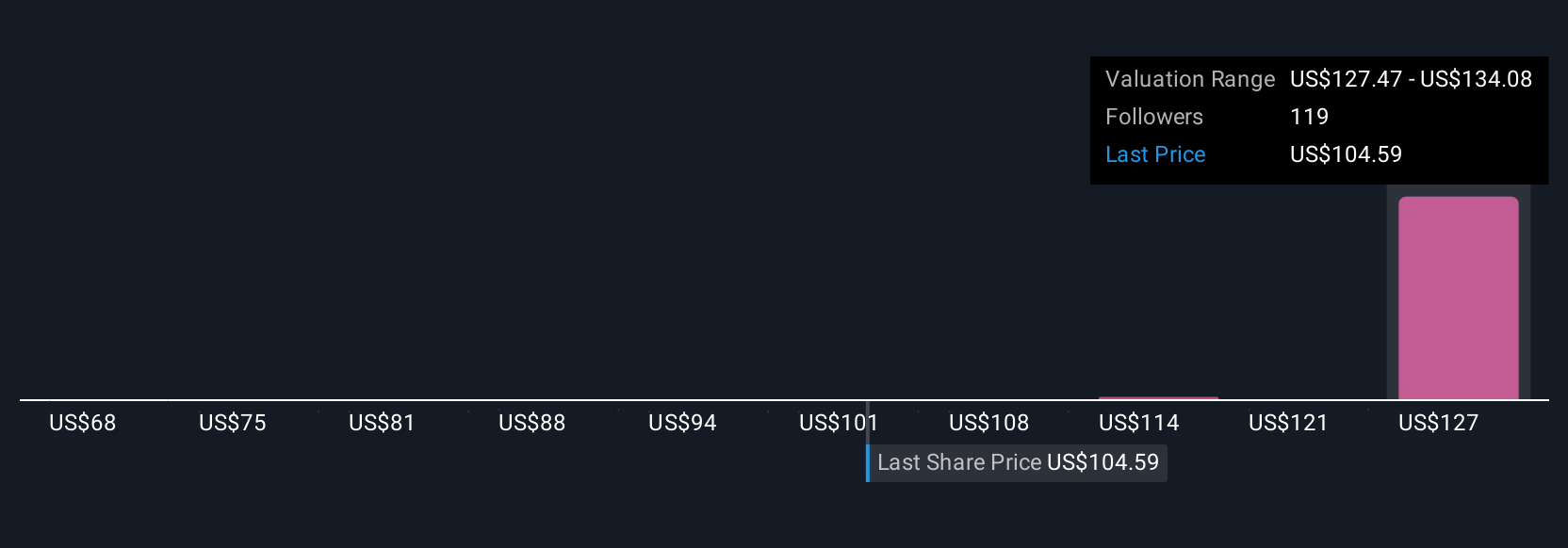

The Simply Wall St Community’s fair value estimates for Twilio range from US$68 to US$134 across 7 viewpoints. Against this diversity, many continue to watch how Twilio’s gross margin pressures could shape shareholder outcomes over time.

Explore 7 other fair value estimates on Twilio - why the stock might be worth as much as 26% more than the current price!

Build Your Own Twilio Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Twilio research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Twilio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Twilio's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Twilio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWLO

Twilio

Offers customer engagement platform solutions in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives