- United States

- /

- IT

- /

- NYSE:TWLO

Twilio (TWLO) Profitability Milestone Reinforces Bull Case, Earnings Growth Outpaces US Market

Reviewed by Simply Wall St

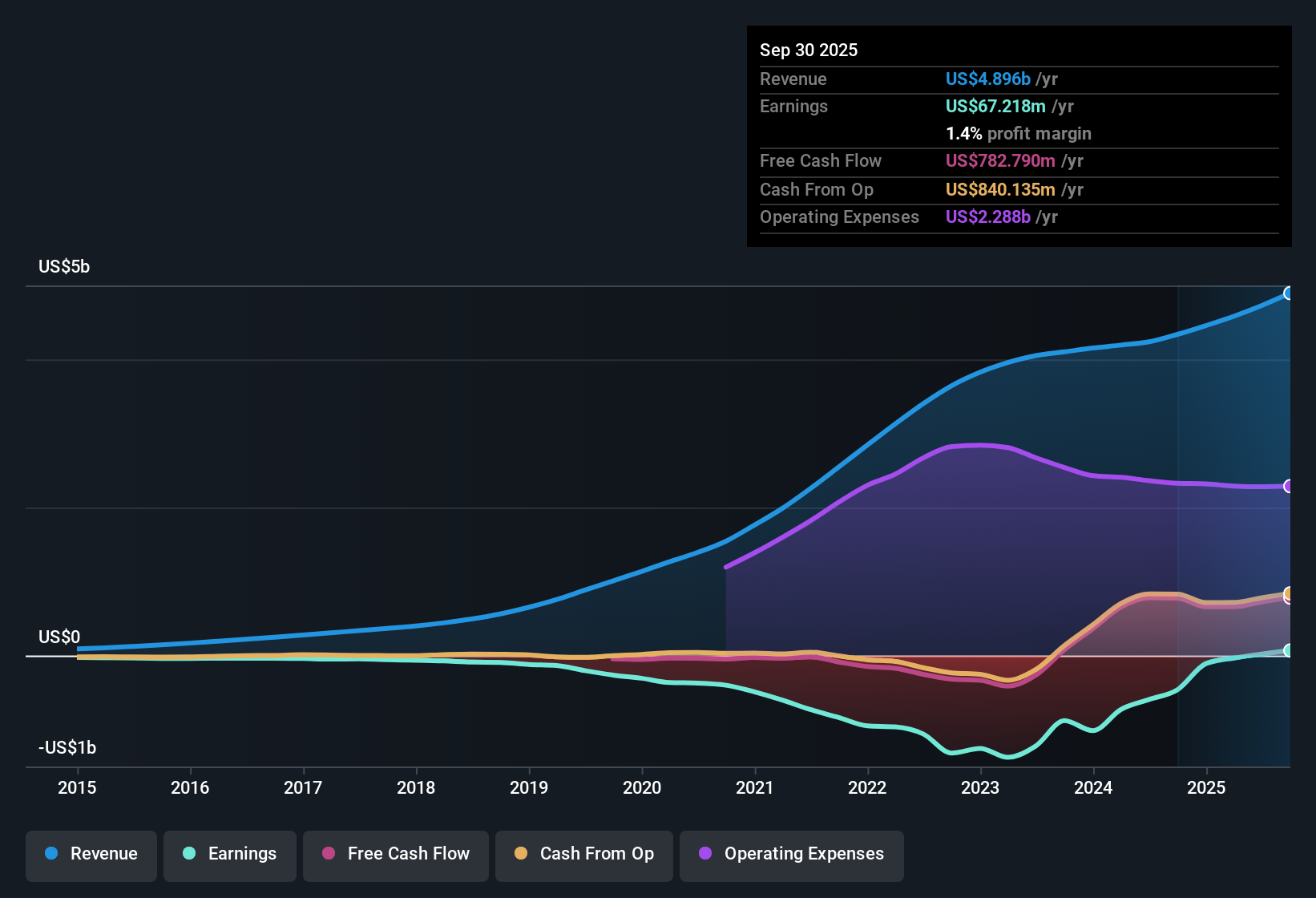

Twilio (TWLO) swung to profitability over the past year, delivering a robust 40.8% annual earnings growth rate that far outpaces the US market average of 15.9%. Over the last five years, the company posted an average annual earnings increase of 17.5%, while revenue is forecast to rise at a steadier 7.2% per year, trailing the broader market’s 10.4% projection. Margins have turned positive with consistently high earnings quality, setting up a strong foundation for future growth and helping shape an upbeat outlook among investors.

See our full analysis for Twilio.Next, we’re placing Twilio’s headline numbers side by side with the most widely discussed narratives to see which stories really hold up, and where some expectations might need a rethink.

See what the community is saying about Twilio

Margin Expansion Sets the Pace

- Net profit margins are now positive, and analysts expect further improvement to 7.6% within three years, reflecting a strong shift toward sustained profitability supported by operational discipline and product focus.

- According to analysts' consensus view, Twilio’s ongoing investment in high-margin software and AI-powered platform features is expected to drive margins higher, but several tensions remain:

- Gross margin faces downward pressure from a heavy mix of low-margin messaging revenue and rising international carrier fees. These factors could blunt long-term margin gains if not offset by growth in higher-value products.

- The company’s strategies around product integration and cross-selling, such as combining Segment’s data platform with communications tools, are viewed as essential to stabilizing and expanding margins. Execution in these areas is crucial to meeting optimistic forecasts.

- To see how the latest margin progress fits into the big-picture narrative, check which themes analysts believe could drive the next move for Twilio. 📊 Read the full Twilio Consensus Narrative.

Mixed Signals in Valuation

- At $134.88, Twilio's share price trades just above its DCF fair value of $131.89, and 0.9% below the current analyst price target of $135.25. This signals an unusually tight gap between current price, fair value, and Wall Street consensus.

- Consensus narrative notes that the stock stands out as good value against direct peers with a 4.2x Price-To-Sales ratio versus 6.5x for competitors, but looks expensive compared to the broader US IT sector at only 2.6x. This highlights a nuanced valuation setup:

- The forecasted earnings growth would require Twilio to be valued at a PE ratio of 57.5x in 2028, which remains above the entire US IT industry's current average of 32.4x. As a result, expectations for ongoing high growth are already priced in.

- There is significant analyst disagreement, with high and low targets ranging from $170.0 to $75.0. Investors should sense-check their own growth and margin assumptions against these sharply divided valuation outlooks.

Long-Term Growth Hinges on Revenue Mix

- Over the next three years, analysts expect annual revenue growth of 7.9% for Twilio, which is below the US market’s 10.4% projection. Customer demand for AI-driven omnichannel solutions and platform innovation are expected to underpin recurring top-line gains.

- Consensus narrative highlights that while strategies like international expansion and omnichannel product rollouts could unlock new customer segments and boost annual revenue per user, Twilio’s persistent reliance on low-margin messaging and sluggish adoption of its software (Segment/CDP) platform continues to threaten sustained revenue diversification:

- The risks are compounded by regulatory hurdles and intensified competition from cloud giants and AI-powered vertical players. Any of these could curb Twilio’s ability to shift its revenue mix toward higher-margin offerings.

- Success is determined by Twilio’s execution on cross-selling and customer retention strategies. Failure to accelerate growth outside its core communications segment may limit margin improvements and long-term revenue potential.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Twilio on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you interpret Twilio’s story another way? Share your insights and build your own narrative in just a few minutes. Do it your way

A great starting point for your Twilio research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Twilio’s continued reliance on low-margin messaging and challenges in driving broader software adoption create uncertainty about its long-term growth and revenue diversification.

If you want exposure to names with steadier growth profiles, use our stable growth stocks screener (2101 results) to compare companies that consistently deliver revenue and earnings expansion across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Twilio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWLO

Twilio

Offers customer engagement platform solutions in the United States and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion