- United States

- /

- Software

- /

- NYSE:TUFN

Can You Imagine How Tufin Software Technologies' (NYSE:TUFN) Shareholders Feel About The 24% Share Price Increase?

One way to deal with stock volatility is to ensure you have a properly diverse portfolio. But if you're going to beat the market overall, you need to have individual stocks that outperform. One such company is Tufin Software Technologies Ltd. (NYSE:TUFN), which saw its share price increase 24% in the last year, slightly above the market return of around 23% (not including dividends). Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

Check out our latest analysis for Tufin Software Technologies

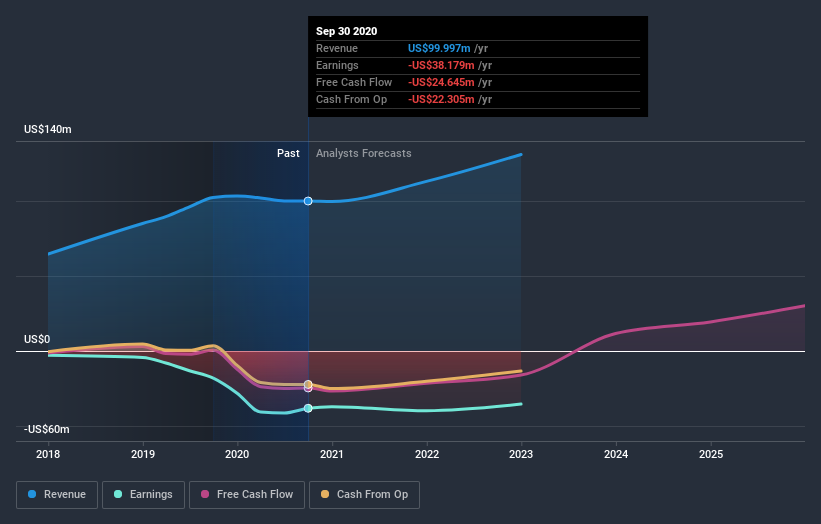

Tufin Software Technologies isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Tufin Software Technologies actually shrunk its revenue over the last year, with a reduction of 2.3%. The stock is up 24% in that time, a fine performance given the revenue drop. To us that means that there isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Tufin Software Technologies' financial health with this free report on its balance sheet.

A Different Perspective

Tufin Software Technologies shareholders have gained 24% over twelve months, which isn't far from the market return of 26%. And the stock has been on a nice little run lately, with the price climbing 170% higher in 90 days. This suggests the share price maintains some momentum, and investors are taking a more positive view of the stock. It's always interesting to track share price performance over the longer term. But to understand Tufin Software Technologies better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Tufin Software Technologies you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Tufin Software Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tufin Software Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:TUFN

Tufin Software Technologies

Tufin Software Technologies Ltd., together with its subsidiaries, develops, markets, and sells software-based solutions primarily in the United States, Israel, Europe, the Middle East, and Africa, Germany, the Asia Pacific, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion