- United States

- /

- Professional Services

- /

- NasdaqGM:WLDN

Undiscovered Gems In The US Market April 2025

Reviewed by Simply Wall St

The United States market has experienced a robust upward trajectory, climbing 7.1% in the last week and 7.7% over the past year, with earnings anticipated to grow by 14% annually in the coming years. In this dynamic environment, identifying undiscovered gems involves seeking out stocks that offer unique value propositions and growth potential amid favorable market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Willdan Group (NasdaqGM:WLDN)

Simply Wall St Value Rating: ★★★★★★

Overview: Willdan Group, Inc., along with its subsidiaries, offers professional, technical, and consulting services primarily in the United States and has a market capitalization of approximately $556.55 million.

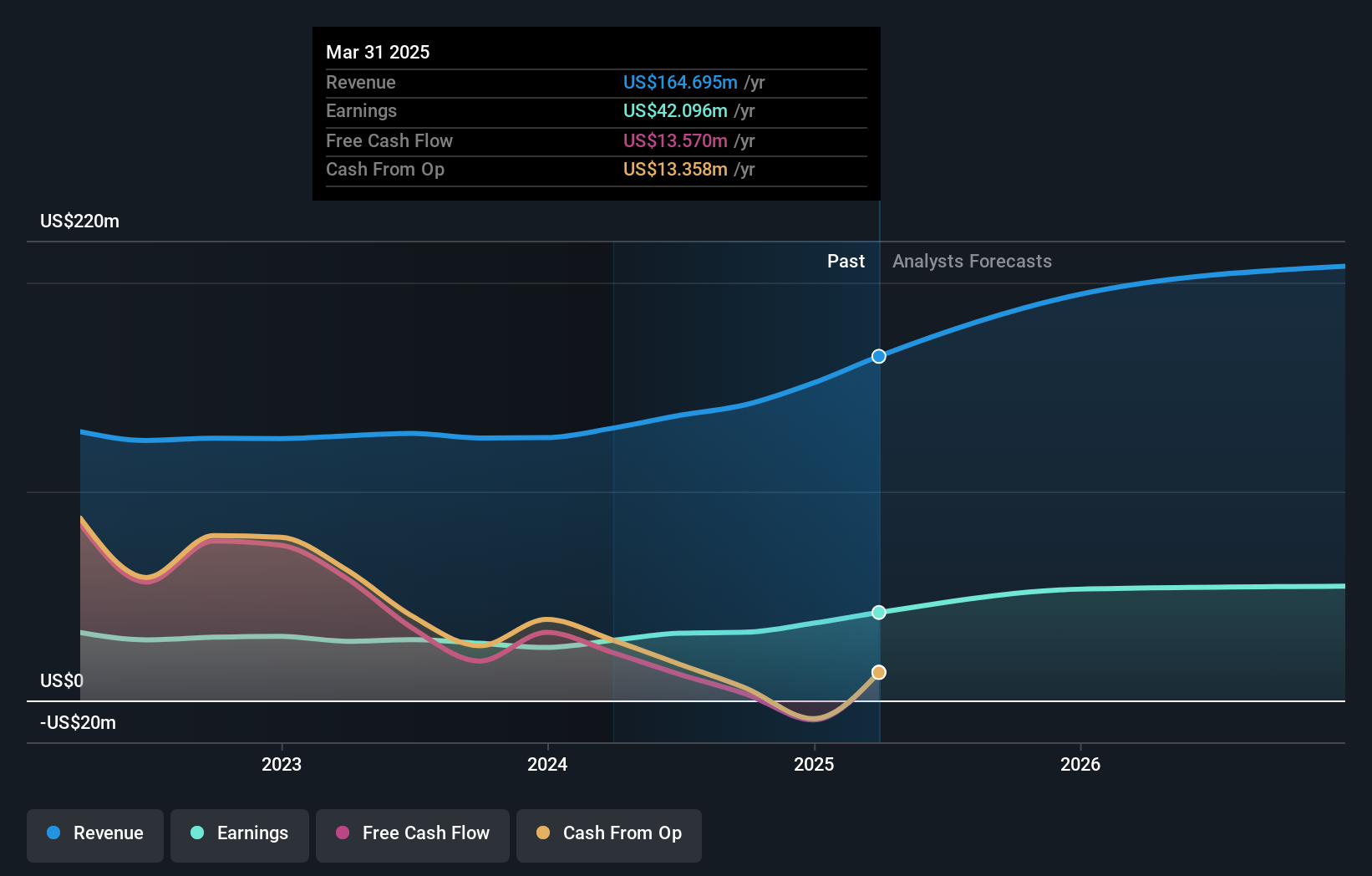

Operations: Willdan Group generates revenue primarily through its Energy segment, contributing $473.31 million, and its Engineering and Consulting segment, which adds $92.49 million. The company's focus on these segments highlights a diversified revenue model within the professional services industry.

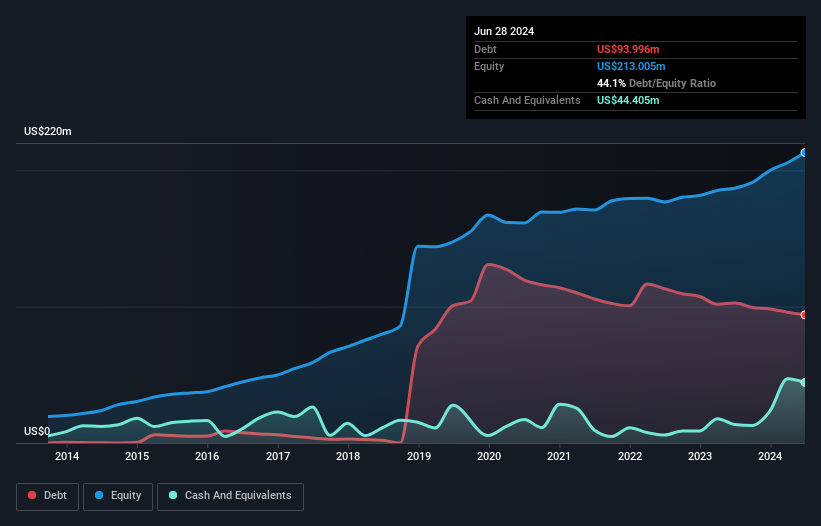

Willdan Group, a promising player in the engineering services sector, has seen its debt to equity ratio drop from 78.3% to 38.3% over five years, reflecting improved financial health. Its earnings growth of 110.1% last year outpaced the industry average of 11%, showcasing strong performance despite significant insider selling recently. The net debt to equity ratio stands at a satisfactory 6.6%, indicating manageable leverage levels while maintaining positive free cash flow and high-quality earnings. Recent contracts worth $30 million and $17.7 million for energy projects highlight expanding opportunities in energy efficiency and infrastructure modernization sectors, further solidifying its market position.

Northrim BanCorp (NasdaqGS:NRIM)

Simply Wall St Value Rating: ★★★★★★

Overview: Northrim BanCorp, Inc. is a bank holding company for Northrim Bank, offering commercial banking products and services to businesses and professional individuals, with a market capitalization of $429.36 million.

Operations: Northrim BanCorp generates revenue primarily from its home mortgage lending segment, contributing $36.79 million. The company's market capitalization stands at approximately $429.36 million.

With total assets of US$3.1 billion and total equity of US$279.8 million, Northrim BanCorp stands out with its robust financial health. Total deposits amount to US$2.8 billion, while loans reach US$2.1 billion, reflecting a solid lending base supported by a net interest margin of 4.3%. The company has an appropriate allowance for bad loans at 0.6%, indicating prudent risk management practices in place, and it benefits from primarily low-risk funding sources as 97% of liabilities are customer deposits. Recent earnings growth was impressive at 46%, surpassing the industry average significantly, showcasing strong performance momentum within the banking sector.

ReposiTrak (NYSE:TRAK)

Simply Wall St Value Rating: ★★★★★★

Overview: ReposiTrak, Inc. is a North American software-as-a-service company that specializes in designing, developing, and marketing proprietary software products, with a market capitalization of $390.10 million.

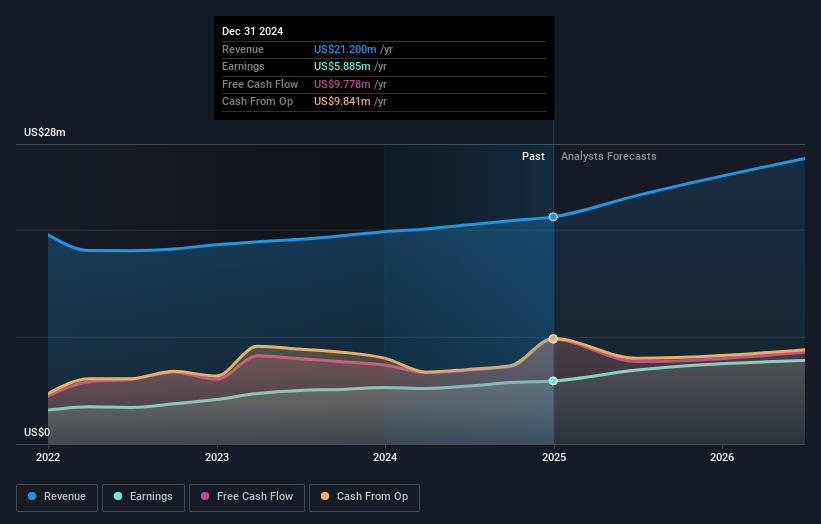

Operations: ReposiTrak generates revenue primarily from its Software & Programming segment, which reported $21.20 million. The company's financial performance is reflected in its market capitalization of $390.10 million.

ReposiTrak, a nimble player in the software-as-a-service realm, has carved out a niche with its traceability solutions tailored for the grocery sector. With no debt on its books compared to a 10.9% debt-to-equity ratio five years ago, it showcases financial prudence. The company's earnings have surged by an impressive 26.8% annually over the past five years, although last year's growth of 11.4% lagged behind the broader software industry at 28.2%. Recent developments include adding numerous suppliers to its Traceability Network®, enhancing compliance and operational efficiency without additional hardware investments—a strategic move likely to bolster future revenue streams significantly.

Taking Advantage

- Embark on your investment journey to our 293 US Undiscovered Gems With Strong Fundamentals selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willdan Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WLDN

Willdan Group

Provides professional, technical, and consulting services primarily in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives