- United States

- /

- Software

- /

- NYSE:TDC

How Investors Are Reacting To Teradata (TDC) Launching AgentBuilder for Enterprise AI Agents

Reviewed by Sasha Jovanovic

- In September 2025, Teradata unveiled AgentBuilder, a new suite for developing and deploying autonomous AI agents, which integrates the Teradata AI platform, domain-specific templates, and support for open-source frameworks to accelerate multi-agent system adoption across hybrid IT environments.

- This launch marks a meaningful expansion of Teradata's AI capabilities, embedding business context and actionable intelligence directly into customizable agents designed to operate securely at enterprise scale.

- Now, we'll assess how AgentBuilder's focus on enterprise-ready autonomous AI agents could influence the evolving investment narrative for Teradata.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Teradata Investment Narrative Recap

Teradata shareholders need to believe the company’s enterprise focus and product innovation can offset continued revenue pressure and rising competition. The launch of AgentBuilder expands its AI platform capabilities, but given persistent top-line headwinds and recurring revenue declines, the most pressing short-term catalyst remains Teradata’s ability to convert AI-driven offerings into new customer wins. The biggest risk remains slow cloud migration and net-new growth, and the AgentBuilder news does not fundamentally change this calculus in the near term.

The August introduction of MCP Server - Community Edition stands out as particularly relevant, since it provides the core engine that underpins AgentBuilder’s smart agent capabilities. This synergy showcases how Teradata is expanding its AI product toolkit to support enterprise workloads, aligning with growing adoption of GenAI initiatives, an area expected to drive demand for the company’s hybrid architecture.

However, investors should keep in mind that, despite this product momentum, sustained revenue growth still depends on overcoming...

Read the full narrative on Teradata (it's free!)

Teradata's narrative projects $1.6 billion in revenue and $101.6 million in earnings by 2028. This requires a 0.9% annual revenue decline and a $8.4 million decrease in earnings from the current $110.0 million.

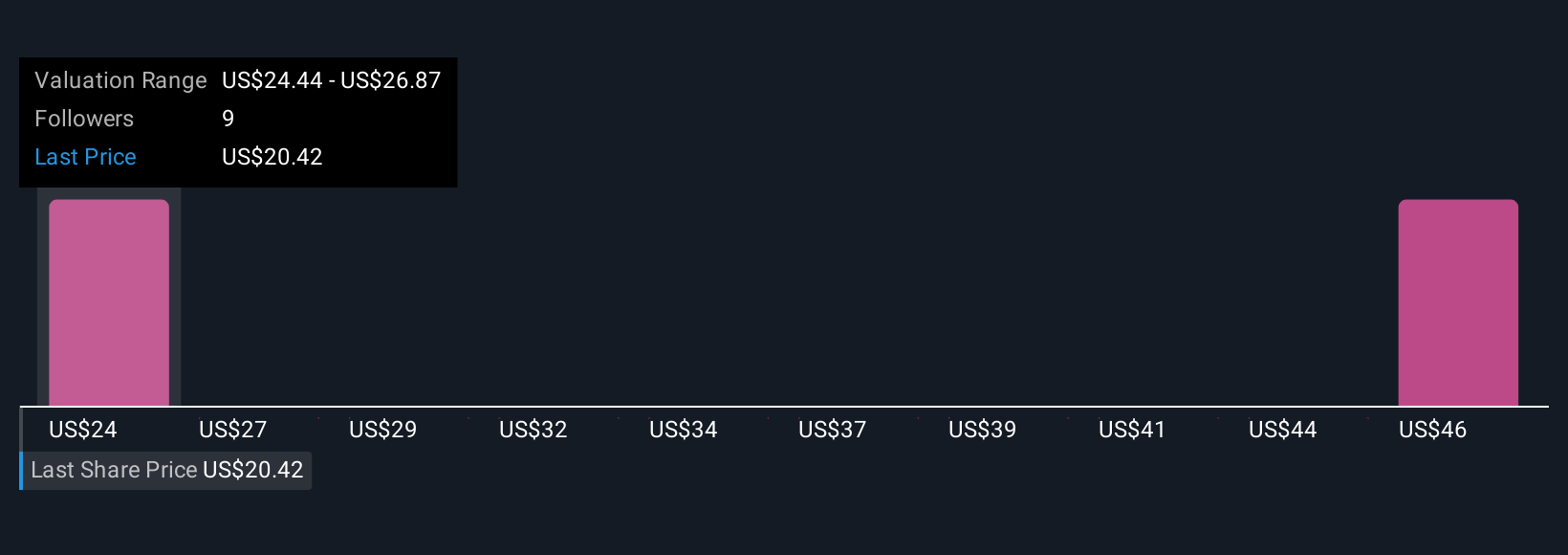

Uncover how Teradata's forecasts yield a $24.44 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community members estimate fair value for Teradata between US$24.44 and US$47.40. This broad range of opinions comes as competitive pressures on pricing and market share remain an ongoing concern for future results.

Explore 2 other fair value estimates on Teradata - why the stock might be worth over 2x more than the current price!

Build Your Own Teradata Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teradata research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Teradata research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teradata's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teradata might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDC

Teradata

Provides a connected hybrid cloud analytics and data platform in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives