- United States

- /

- IT

- /

- NYSE:SQSP

Why Profitability may be Understated - Squarespace, Inc. (NYSE:SQSP) is Free Cash Flow Positive, with a New Buyback Program

Key takeaways:

- Negative net income, but a cash generating company with $45.5m in free cash flows

- Q1 revenue growth 16.6% y/y, expected to decelerate to 12% for FY 2023

- $200m buyback program, at current price, can return about 6.6% to investors

Squarespace, Inc.'s (NYSE:SQSP) posted earnings results last week, and now is a great time to revise the company. We will interpret what earnings mean for investors and see if the current price of Squarespace is justified.

Earnings Results

We start off with the highlights of current results:

- Q1 revenues were in line with expectations, at US$208m - growth 16% y/y.

- Net loss of $92.9 million vs. net loss of $1.1 million a year ago.

- Free cash flow was $45.5 million vs. $51.8 million a year ago, driven primarily by increased marketing and research & product development spend.

The positive free cash flow indicates that the company is self sustainable, which means that their business model produces value.

Considering that it is still a relatively young company, investors should expect profits later in the future, but the positive free cash flows are a great marker that Squarespace is heading in the right direction.

Buyback Program

The company also authorized a general share repurchase program of the Company's Class A common stock of up to $200 million. At the current price, that would represent some 6.6% of the total market cap, which can be returned to shareholders - Note that the execution strategy of the repurchase program is not disclosed/left to the discretion of the company.

The current cost of equity for the company is between 6.6% and 9.3%, meaning that "on average" investors expect at least a 6.6% return from the company.

It is good to see the company putting forth a return scheme for investors.

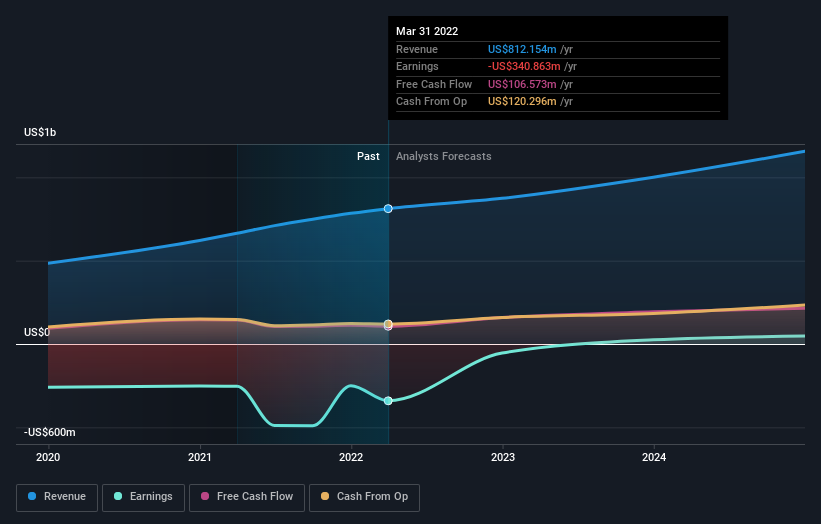

Focusing on the future is key in investing, and the chart below makes the picture clearer for what we can expect from Squarespace.

See our latest analysis for Squarespace

Future Outlook

For the full FY 2022, Squarespace expects:

- Revenue of US$867m to US$879m, or y/y growth of 11.5%.

- Free cash flow of US$156m to US$169m.

After the latest results, the 14 analysts covering Squarespace are now predicting revenues of US$873.9m in 2022. If met, this would reflect a modest 7.6% improvement in sales compared to the last 12 months.

As a result, there was no major change to the consensus price target of US$31.57, with the analysts implicitly confirming that the business looks to be performing in line with expectations.

Looking at the range of price target estimates, we see that the most bullish analyst values Squarespace at US$48 per share, while the most bearish prices it at US$22. This is a fairly broad spread of estimates, suggesting that the future of the business is still highly speculative.

Conclusion

Squarespace is a cash generating company, which has a good chance to become profitable in the future. The company also decided to start returning capital to shareholders via their share buyback program.

While the company is still young, their service is somewhat at risk from rising technology trends that lower the costs of producing an online web site/app.

We also found 3 warning signs for Squarespace (1 shouldn't be ignored!) that you need to be mindful of.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:SQSP

Squarespace

Operates platform for businesses and independent creators to build online presence, grow their brands, and manage their businesses across the internet in the United States and internationally.

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives