- United States

- /

- IT

- /

- NYSE:SNOW

Snowflake (SNOW) Valuation Check as Enterprise AI Partnerships With Anthropic and Accenture Deepen

Reviewed by Simply Wall St

Snowflake (SNOW) just delivered another expectation beating quarter, and the stock reaction has been oddly muted, even as the company doubles down on enterprise AI through new Anthropic and Accenture partnerships plus broader ecosystem initiatives.

See our latest analysis for Snowflake.

Despite the strong AI narrative and fresh alliances with Anthropic, Accenture, and OSI partners, Snowflake’s 30 day share price return of minus 20.17% shows momentum cooling in the short term. Its year to date share price return of 37.48% and three year total shareholder return of 51.81% still point to a solid longer term wealth creation story.

If Snowflake’s AI push has your attention, this is also a good moment to explore other high growth tech names and see how they stack up in high growth tech and AI stocks.

With the share price sliding even as AI bookings climb and free cash flow beats expectations, are investors being offered a rare discount on Snowflake’s next growth leg, or is the market already pricing in years of expansion?

Most Popular Narrative: 20.6% Undervalued

Compared with Snowflake’s last close of $216.55, the most widely followed narrative points to a materially higher fair value anchored in future earnings power.

Improving operational rigor, growing gross margins (76.4% gross margin this quarter), and recent investments in sales capacity suggest potential for further operating leverage and net margin expansion as new product lines and regions (such as EMEA) reach scale enhancing future earnings power.

Curious how robust revenue growth, a sharp margin shift and an aggressive future earnings multiple can all coexist in one story? The key assumptions behind this fair value may surprise you. Unlock the narrative to see exactly how those moving parts combine into a higher valuation roadmap.

Result: Fair Value of $272.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing migration-driven workloads or intensifying competition from hyperscalers and AI-focused rivals could cap Snowflake’s upside and pressure long-term growth assumptions.

Find out about the key risks to this Snowflake narrative.

Another Angle on Value

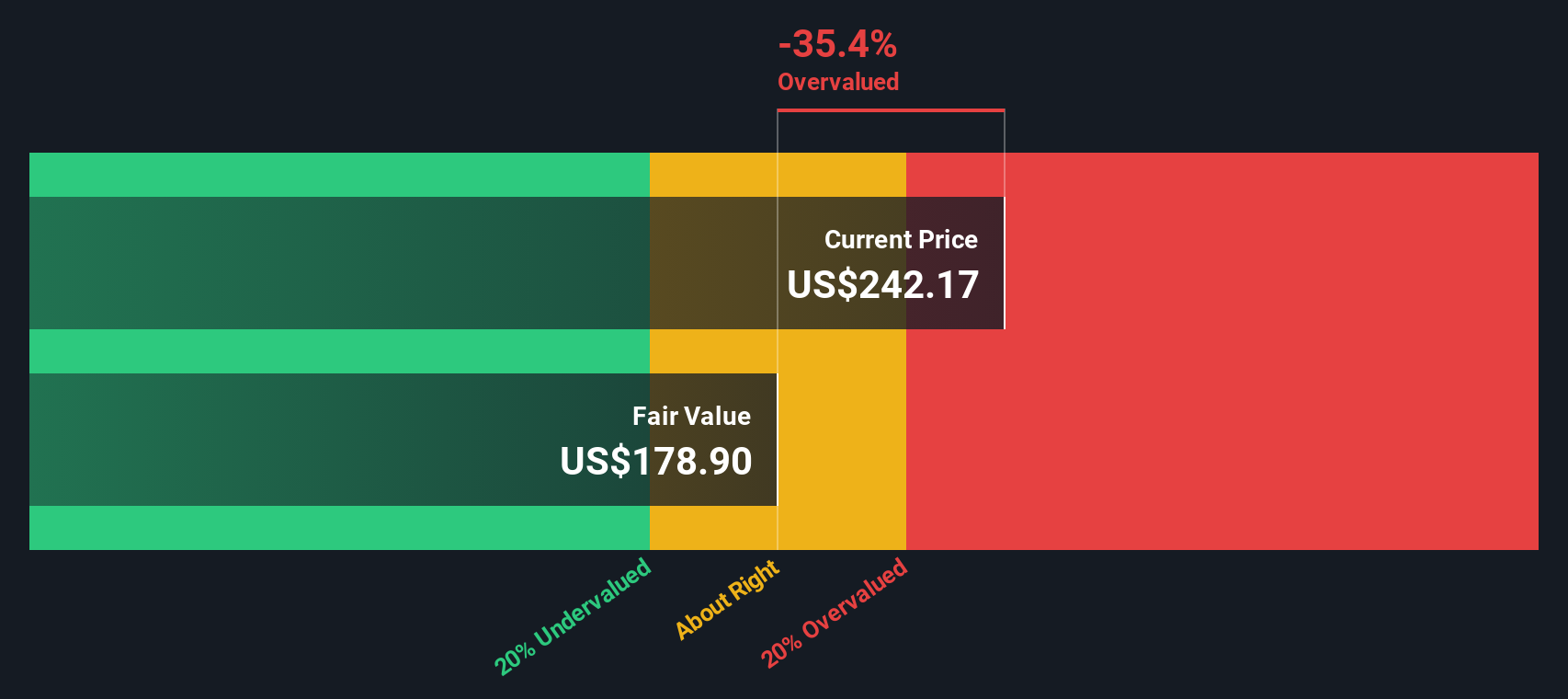

Our SWS DCF model paints a less generous picture, putting Snowflake’s fair value around $161.57, meaning the current $216.55 price screens as overvalued rather than cheap. If cash flows are right and the narrative is wrong, how much upside is really left in the tank?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Snowflake for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Snowflake Narrative

If you see the setup differently or want to run your own numbers, you can spin up a personalized Snowflake thesis in just minutes, Do it your way.

A great starting point for your Snowflake research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, consider your next step by scanning a few curated stock shortlists that could uncover opportunities that Snowflake alone might not show you.

- Explore resilient cash generators by reviewing these 12 dividend stocks with yields > 3% that can potentially support income needs while still offering room for capital growth.

- Look into transformative innovation by scanning these 28 quantum computing stocks that may benefit as real world applications of quantum computing develop.

- Refine your search for mispriced potential by filtering through these 908 undervalued stocks based on cash flows that may offer different opportunities compared with widely followed names like Snowflake.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNOW

Snowflake

Provides a cloud-based data platform for various organizations in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026