- United States

- /

- IT

- /

- NYSE:SNOW

Snowflake (SNOW): Evaluating Valuation Following Launch of Cortex AI Suite for Financial Services

Reviewed by Kshitija Bhandaru

Snowflake (SNOW) is expanding its footprint in financial services, announcing the launch of Cortex AI for Financial Services, its first industry-focused suite of AI tools, along with a managed Model Context Protocol Server for securely deploying tailored AI apps.

See our latest analysis for Snowflake.

This ambitious rollout adds to a flurry of recent partnerships and industry recognition for Snowflake, from deepening ties with automation leader UiPath to playing a central role in open data standards initiatives like OSI. With all eyes on Snowflake's expansion into vertical-specific AI, its latest share price sits at $240.54. While the one-year total shareholder return has edged up just over 1%, momentum appears to be building on the back of strategic announcements and product launches that could reshape its long-term growth story.

If Snowflake's latest moves have sparked your interest in the broader tech and AI landscape, there is a world of innovation to explore. See the full list of opportunities with See the full list for free.

With analyst optimism growing and industry partnerships accelerating, the real question is whether Snowflake’s current valuation reflects all this future growth or if investors still have room to capture upside from these ambitious AI bets.

Most Popular Narrative: 8.7% Undervalued

Snowflake's most-followed narrative places fair value at $263.43 per share, a premium to the latest closing price of $240.54. This divergence highlights the market’s appetite for growth and the potential triggers at play in the business model.

Accelerating enterprise adoption of AI and advanced analytics is fueling incremental demand for Snowflake's platform, as evidenced by nearly 50% of new customers citing AI as a primary driver, and over 25% of all deployed use cases leveraging AI. This is setting up higher future revenue growth as companies increasingly budget for AI-driven workloads.

What’s the secret sauce behind this premium? The formula is built on aggressive revenue trajectories and a targeted shift in profitability. Want to see the ambitious profit leap and bold valuation math that set this price? Unravel exactly how future megatrends shape the story in the full narrative.

Result: Fair Value of $263.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing migration-driven growth or intensified competition from major hyperscalers could present challenges for Snowflake’s ability to maintain its rapid revenue acceleration.

Find out about the key risks to this Snowflake narrative.

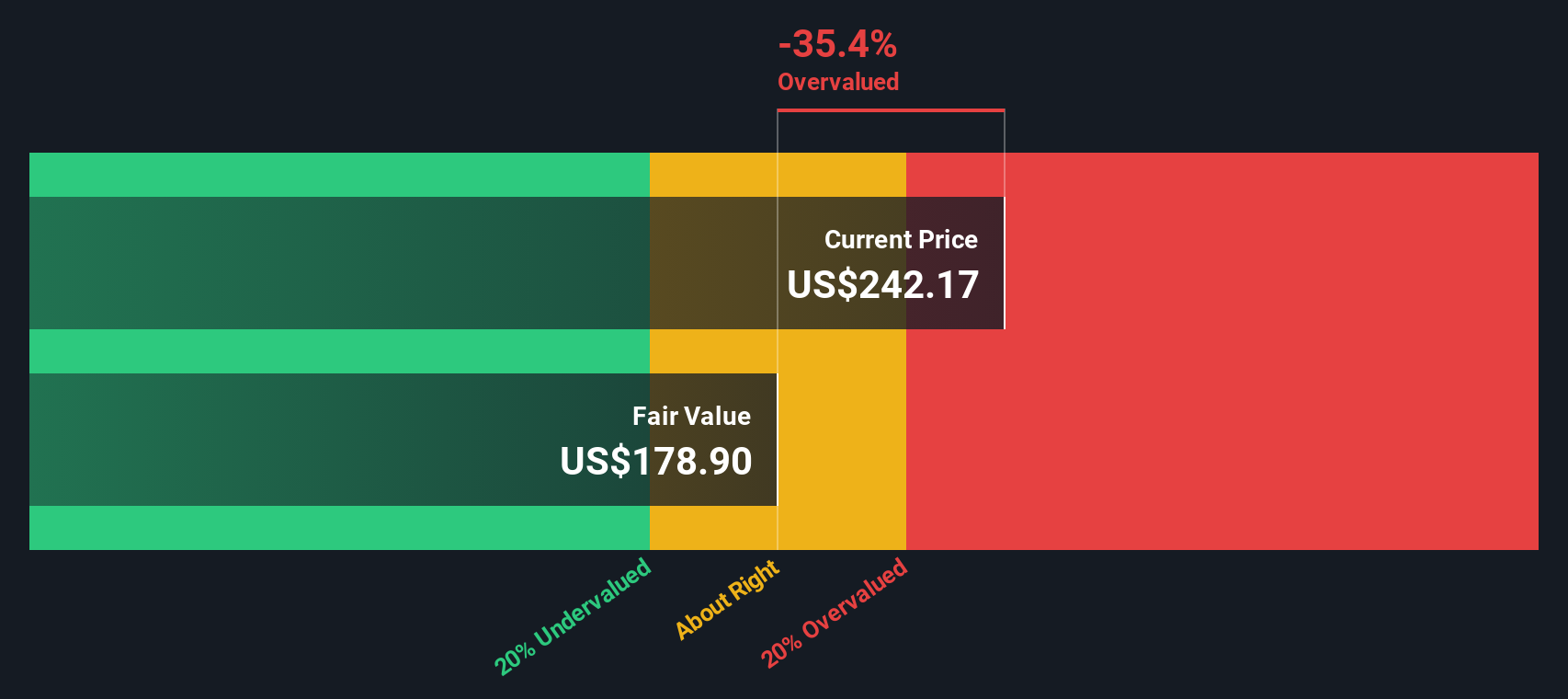

Another View: Our DCF Model Points to Overvaluation

Looking at Snowflake through the lens of our SWS DCF model offers a very different perspective. The DCF calculation puts fair value at just $178.04, which is well below the current market price. While market optimism runs high, this gap highlights the uncertainty in forecasting long-term growth for a business that is still in its rapid investment phase. Which story will prove right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Snowflake Narrative

If you want to dive deeper and look at the numbers yourself, crafting your own narrative takes just a few minutes and can give you fresh perspective. Do it your way

A great starting point for your Snowflake research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for Your Next Winning Idea?

Seize your edge by taking action today. Don’t let fresh investment opportunities slip away. Use the right screeners to uncover stocks that are making waves in the market.

- Target consistent yields and stay ahead of inflation with stocks offering reliable income streams like these 19 dividend stocks with yields > 3%.

- Ride the momentum of breakthrough companies by getting into these 24 AI penny stocks driving AI innovations across industries.

- Tap into tomorrow’s titans at bargain prices by checking out these 900 undervalued stocks based on cash flows poised for value-driven growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNOW

Snowflake

Provides a cloud-based data platform for various organizations in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives