- United States

- /

- IT

- /

- NYSE:SNOW

Snowflake (NYSE:SNOW) Teams Up With Attentive For Bi-Directional Integration On Marketplace

Reviewed by Simply Wall St

Snowflake (NYSE:SNOW) saw its stock climb 25% over the past month, bolstered by several significant developments. The company's integration with Attentive® potentially strengthened its position in the data cloud sector by enhancing marketing personalization and data activation capabilities. Additionally, the expansion of Snowflake's AI Data Cloud for manufacturing, alongside its automotive industry partnerships, reflected a strategic expansion into Industry 4.0 solutions. Broader market dynamics, such as the tech sector rally and improved market sentiment following tariff reductions between the U.S. and China, may have also provided a supportive backdrop for Snowflake's price movement.

We've identified 1 weakness for Snowflake that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

Snowflake's recent developments, including its integration with Attentive and expansion into AI-driven manufacturing solutions, have potential implications for its future market position. These initiatives may drive enhanced product adoption, supporting revenue growth and improved earnings forecasts. Over the past three years, Snowflake’s total return stood at 24.15%, offering a broader perspective on its long-term performance beyond the recent share price surge. Comparatively, in the last year, Snowflake matched the broader US market return of 11.5%, though it underperformed the US IT industry's 28.8% increase.

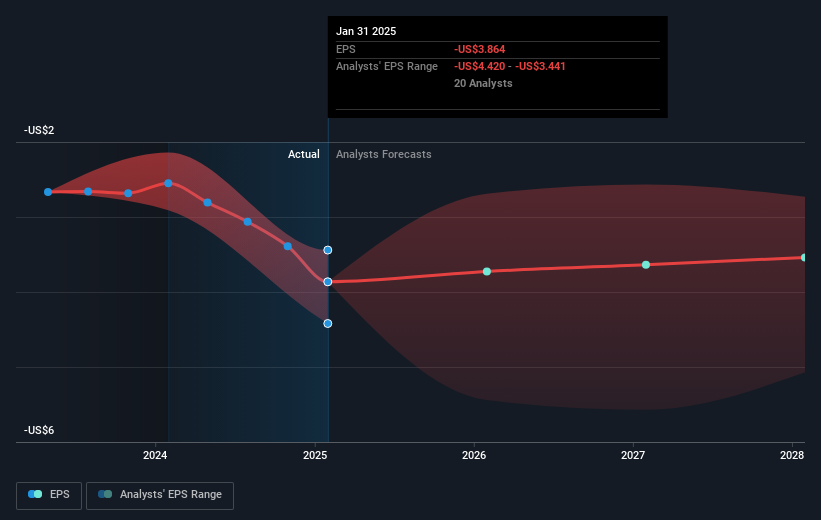

The announcement of Snowflake’s AI advancements and partnerships, like those with Microsoft, is expected to bolster its revenue through expanding product capabilities. However, challenges remain, particularly in terms of revenue consistency sparked by competitive pressures and the reliance on new product adoption. The recent share price movement, buoyed by these positive developments, still shows a 17.8% discount compared to the consensus analyst price target of US$195.17. This suggests potential room for further growth, albeit with inherent risks. Analysts project revenue to grow annually by 17.5% over the next three years, though profitability remains a distant goal, reinforcing the need for careful consideration of the company's ongoing strategic efforts and market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNOW

Snowflake

Provides a cloud-based data platform for various organizations in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)