- United States

- /

- IT

- /

- NYSE:SNOW

Does Snowflake’s (SNOW) Financial Services AI Suite Redefine Its Strategy for Regulated Markets?

Reviewed by Sasha Jovanovic

- Snowflake has announced the launch of Cortex AI for Financial Services, introducing an industry-focused suite of AI features and a managed Model Context Protocol Server designed to unify financial data and enable secure, compliant AI deployment for regulated industries.

- This move signals Snowflake's ambition to offer tailored AI tools and enhanced data ecosystem connectivity, positioning the company to serve highly regulated sectors with solutions that address both interoperability and stringent compliance needs.

- We’ll explore how Snowflake’s new industry-specific AI suite and data partnerships shape the company’s long-term investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Snowflake Investment Narrative Recap

To believe in Snowflake as a shareholder is to bet on sustained enterprise adoption of AI and cloud data services, driven by its expanding product suite and migration momentum. The launch of Cortex AI for Financial Services directly targets a regulated vertical, aiming to deepen customer stickiness and reinforce Snowflake’s relevance in areas where trust, security, and compliance are critical, strengthening the most important short-term catalyst: increased AI-driven workload expansion. However, while this innovation supports the growth narrative, risks remain if broader AI monetization does not accelerate materially or if migration-driven revenue normalizes sooner than expected.

Among recent announcements, Snowflake’s partnership with UiPath stands out as especially relevant, as it embeds automation directly into the AI Data Cloud ecosystem. By enabling businesses to orchestrate automation from insights derived within Snowflake, this collaboration enhances workflow connectivity and could increase the value proposition for existing enterprise clients, supporting migration and AI-related adoption, the core drivers central to both current performance and forward-looking expectations.

But just as new AI offerings enhance the story, investors should be aware of the risk that if AI adoption across the user base is slower than anticipated ...

Read the full narrative on Snowflake (it's free!)

Snowflake's narrative projects $7.8 billion in revenue and $497.5 million in earnings by 2028. This requires 23.8% yearly revenue growth and a $1.9 billion increase in earnings from the current earnings of -$1.4 billion.

Uncover how Snowflake's forecasts yield a $263.43 fair value, a 12% upside to its current price.

Exploring Other Perspectives

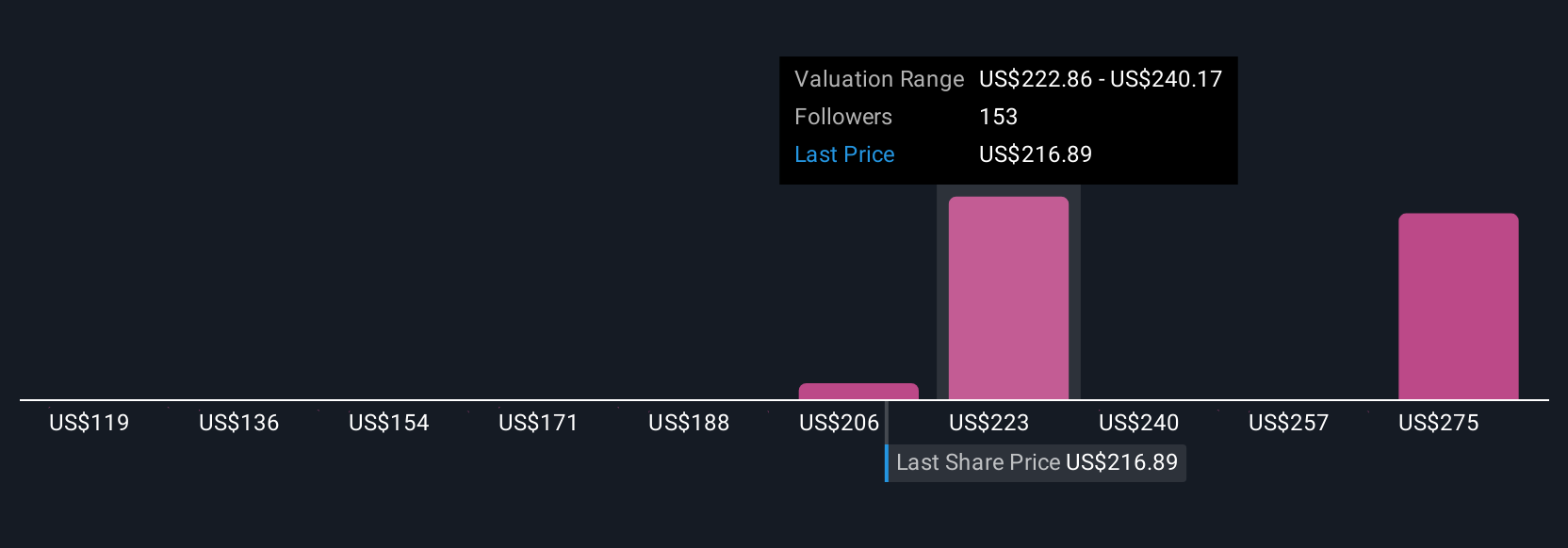

Twenty fair value estimates from the Simply Wall St Community span US$107 to US$263 per share, highlighting both bullish and cautious views. Many readers are weighing rapid product innovation against the challenge of translating new AI features into consistent, broad-based revenue growth, compare, consider, and question each viewpoint.

Explore 20 other fair value estimates on Snowflake - why the stock might be worth as much as 12% more than the current price!

Build Your Own Snowflake Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Snowflake research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Snowflake research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Snowflake's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNOW

Snowflake

Provides a cloud-based data platform for various organizations in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>