- United States

- /

- Healthtech

- /

- NasdaqGM:LFMD

US Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

In the current U.S. market landscape, stocks have shown slight gains following a benign CPI inflation reading, with major indices like the Dow Jones, S&P 500, and Nasdaq Composite inching higher. Amidst this backdrop of cautious optimism and interest rate adjustments by the Federal Reserve, growth companies with high insider ownership are particularly noteworthy as they often reflect strong internal confidence and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 31.5% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.5% |

| New Fortress Energy (NasdaqGS:NFE) | 32.6% | 83% |

| Coastal Financial (NasdaqGS:CCB) | 18% | 46.1% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 41.3% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 50.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Underneath we present a selection of stocks filtered out by our screen.

LifeMD (NasdaqGM:LFMD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LifeMD, Inc. is a direct-to-patient telehealth company in the United States that facilitates connections between consumers and healthcare professionals for medical care, with a market cap of $307.52 million.

Operations: The company's revenue is derived from its Telehealth segment, which generated $139.81 million, and its Worksimpli segment, which contributed $53.25 million.

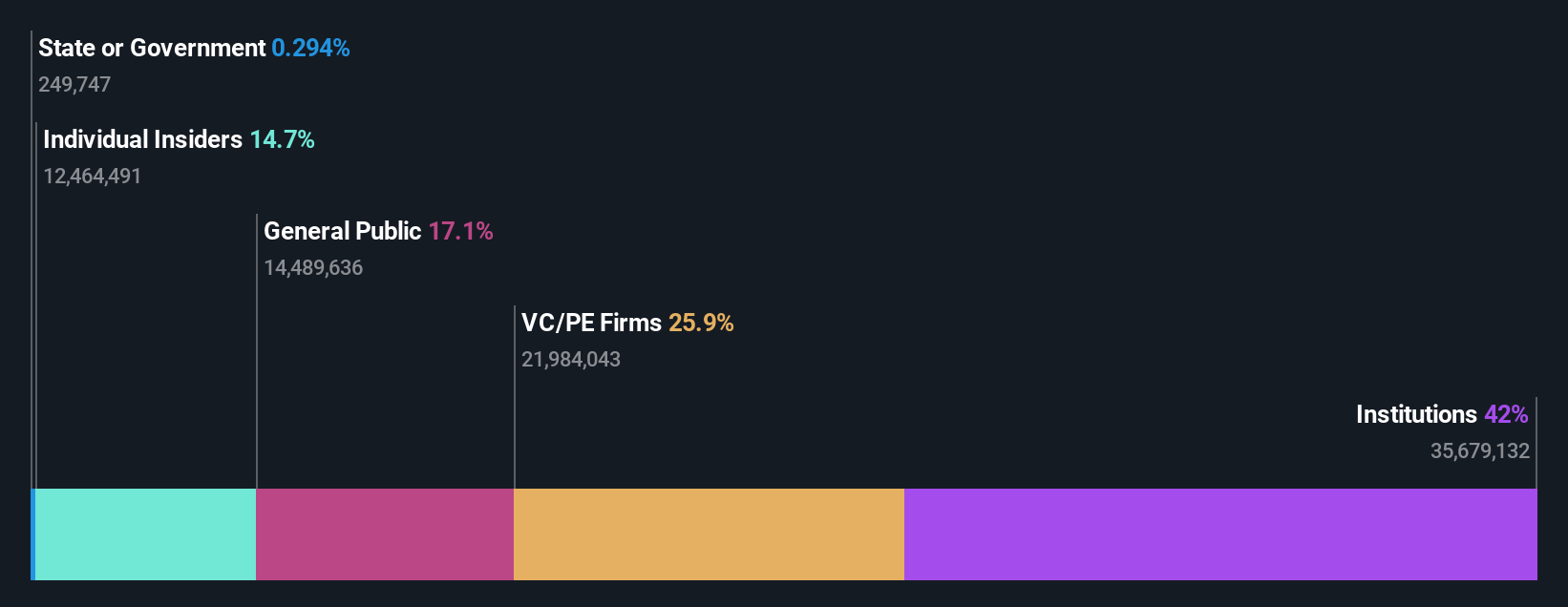

Insider Ownership: 12.8%

Earnings Growth Forecast: 104.6% p.a.

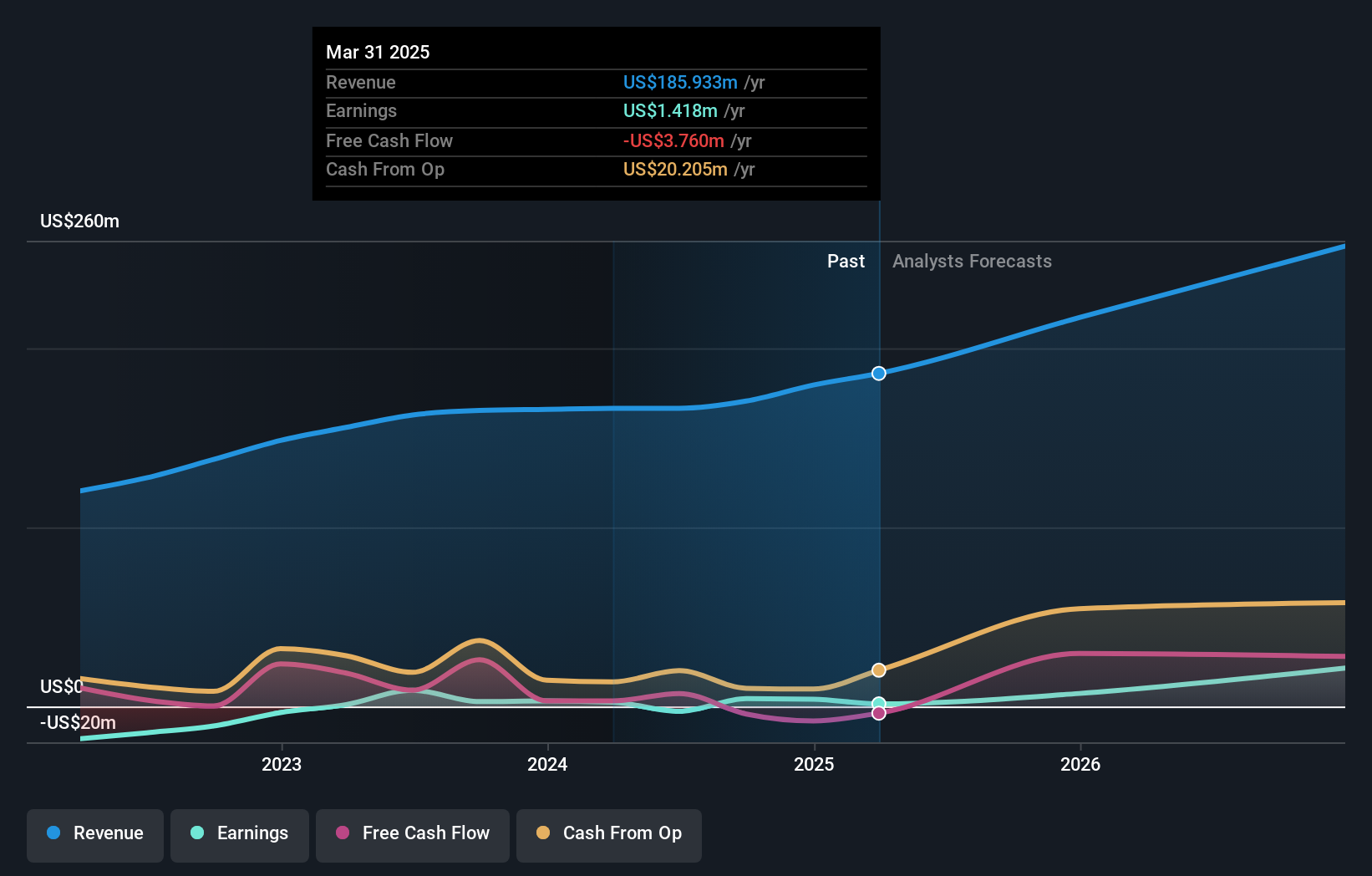

LifeMD has demonstrated significant revenue growth, with recent quarterly earnings showing an increase to US$53.39 million from US$38.61 million year-over-year, while net losses narrowed slightly. The company is enhancing its telehealth platform by integrating pharmacy services, projecting US$5 million in annualized savings. Despite past shareholder dilution and high share price volatility, insider buying suggests confidence in future prospects. Revenue is forecasted to grow at 18.8% annually, outpacing the broader U.S. market rate of 8.9%.

- Delve into the full analysis future growth report here for a deeper understanding of LifeMD.

- Our valuation report here indicates LifeMD may be undervalued.

PDF Solutions (NasdaqGS:PDFS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PDF Solutions, Inc. offers proprietary software, intellectual property products for integrated circuit designs, electrical measurement hardware tools, methodologies, and professional services across the United States, China, Japan, and globally with a market cap of approximately $1.29 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated $170.51 million.

Insider Ownership: 17.5%

Earnings Growth Forecast: 121.9% p.a.

PDF Solutions has shown promising growth, with third-quarter sales increasing to US$46.41 million from US$42.35 million year-over-year and net income turning positive at US$2.21 million compared to a loss last year. The company forecasts revenue growth aligning with its long-term target of 20%, surpassing the broader U.S. market's rate of 8.9%. Analysts anticipate significant earnings growth over the next three years, indicating strong potential for future performance despite limited recent insider trading activity.

- Click to explore a detailed breakdown of our findings in PDF Solutions' earnings growth report.

- In light of our recent valuation report, it seems possible that PDF Solutions is trading beyond its estimated value.

Similarweb (NYSE:SMWB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Similarweb Ltd. offers cloud-based digital intelligence solutions across various regions including the United States, Europe, and Asia Pacific, with a market cap of approximately $848.10 million.

Operations: The company generates revenue of $231.21 million from its online financial information provider segment.

Insider Ownership: 25.6%

Earnings Growth Forecast: 113.9% p.a.

Similarweb is experiencing robust growth, with third-quarter sales rising to US$64.71 million from US$54.83 million year-over-year and a reduced net loss of US$2.57 million compared to last year's US$4.84 million loss. The company forecasts 15% revenue growth for Q4, indicating sustained expansion despite shareholder dilution from recent equity offerings. Analysts expect substantial earnings growth and profitability within three years, supported by strategic board appointments enhancing its market positioning and global reach.

- Get an in-depth perspective on Similarweb's performance by reading our analyst estimates report here.

- The analysis detailed in our Similarweb valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 198 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LFMD

LifeMD

Operates as a direct-to-patient telehealth company that connects consumers to healthcare professionals for medical care in the United States.

Very undervalued with reasonable growth potential.