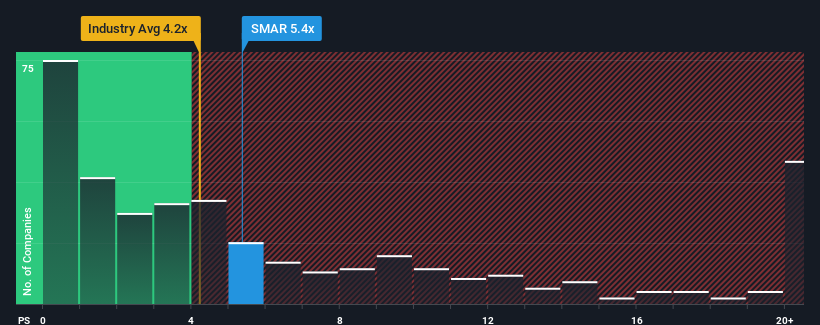

With a price-to-sales (or "P/S") ratio of 5.4x Smartsheet Inc. (NYSE:SMAR) may be sending bearish signals at the moment, given that almost half of all Software companies in the United States have P/S ratios under 4.2x and even P/S lower than 1.7x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Smartsheet

How Smartsheet Has Been Performing

With revenue growth that's superior to most other companies of late, Smartsheet has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Smartsheet's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Smartsheet would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 25% last year. The latest three year period has also seen an excellent 149% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 17% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 15% per year, which is not materially different.

With this in consideration, we find it intriguing that Smartsheet's P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On Smartsheet's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given Smartsheet's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Smartsheet that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SMAR

Smartsheet

Provides enterprise platform to plan, capture, manage, automate, and report on work for teams and organizations.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives