- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:MVIS

High Growth Tech Stocks To Watch In October 2024

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, but over the past 12 months, it has risen by 30%, with earnings forecast to grow by 15% annually. In this context of robust growth and stable short-term performance, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and adaptability to evolving market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.11% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Ardelyx | 27.19% | 66.44% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.45% | ★★★★★★ |

| Blueprint Medicines | 26.49% | 66.74% | ★★★★★★ |

| Travere Therapeutics | 26.51% | 69.33% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 252 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

MicroVision (NasdaqGM:MVIS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MicroVision, Inc. focuses on developing and selling lidar sensors and software for automotive safety and autonomous driving applications, with a market capitalization of $255.30 million.

Operations: The company generates revenue primarily from the sale and servicing of lidar hardware and software, amounting to $9.00 million.

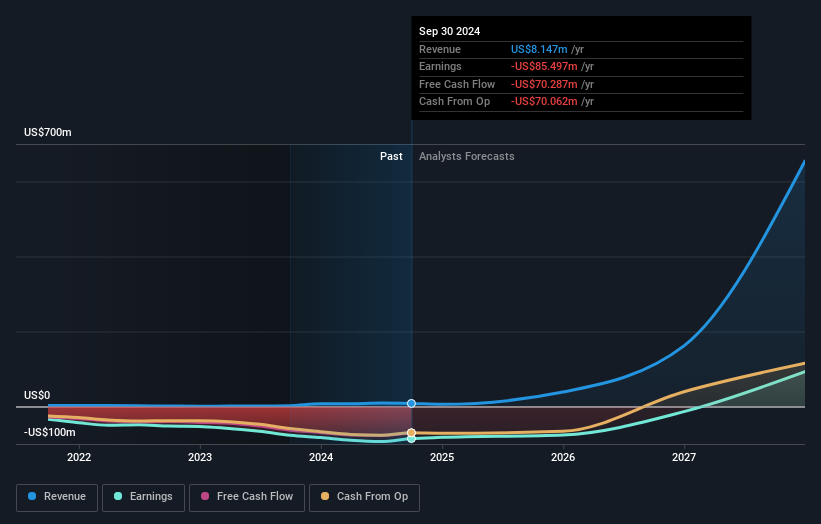

MicroVision, despite recent board changes and a challenging profitability path, demonstrates notable growth potential with its revenue expected to surge by 68.3% annually. This outpaces the broader U.S. market's growth rate of 8.8%. However, the company faces hurdles with a volatile share price and ongoing shareholder dilution over the past year. While still unprofitable—with a net loss widening to $50.24 million in the first half of 2024 from $39.64 million in the previous year—forecasts suggest an impressive earnings growth of 60.45% per year moving forward as it navigates towards profitability within three years. The firm's substantial investment in R&D could be pivotal for future success, evidenced by significant sales improvements from $1.11 million to $2.86 million over six months, reflecting a strategic focus on innovation despite financial losses currently overshadowing performance metrics like basic loss per share which slightly improved from -$0.12 to -$0.11 quarterly year-over-year.

- Delve into the full analysis health report here for a deeper understanding of MicroVision.

Gain insights into MicroVision's historical performance by reviewing our past performance report.

Marcus (NYSE:MCS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Marcus Corporation, with a market cap of $509.63 million, owns and operates movie theatres and hotels and resorts across the United States.

Operations: Marcus generates revenue primarily from its movie theatres, which contribute $407.89 million, and its hotels and resorts segment, adding $238.52 million. The company's operations are focused within the United States.

Marcus Corporation, amidst a challenging market, has demonstrated resilience with its strategic R&D investments, which are pivotal for future growth. The company's revenue is projected to grow by 8.9% annually, slightly outpacing the U.S. market average of 8.7%. This growth is supported by a robust increase in earnings forecasted at 107.55% per year, positioning Marcus well for profitability within the next three years. Recent activities including a $150 million Shelf Registration and substantial dividend declarations underline its financial strategies aimed at sustaining and fueling growth. These moves could enhance Marcus's ability to innovate and expand further in the competitive tech landscape.

Smartsheet (NYSE:SMAR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Smartsheet Inc. offers an enterprise platform designed to help teams and organizations plan, capture, manage, automate, and report on work, with a market capitalization of approximately $7.73 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling $1.04 billion. The platform is designed to enhance work management for teams and organizations through various functionalities like planning, capturing, managing, automating, and reporting tasks.

Despite being unprofitable, Smartsheet's strategic positioning in the high-growth tech sector is underscored by its robust projected revenue growth of 14.3% annually, outpacing the U.S. market average of 8.7%. This growth trajectory is complemented by an expected surge in earnings, forecasted to grow at an impressive rate of 58.5% per year as it moves towards profitability within three years. The company's commitment to innovation is evident from its R&D expenses, which are crucial for sustaining this growth momentum and enhancing its competitive edge in the evolving software industry landscape. Recently, Smartsheet entered into a significant acquisition agreement valued at approximately $8.4 billion, reflecting a premium on its stock price and underscoring confidence in its future prospects from major investment firms like Blackstone and Vista Equity Partners.

- Get an in-depth perspective on Smartsheet's performance by reading our health report here.

Understand Smartsheet's track record by examining our Past report.

Turning Ideas Into Actions

- Embark on your investment journey to our 252 US High Growth Tech and AI Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MVIS

MicroVision

Develops and commercializes perception solutions for autonomy and mobility applications.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives