- United States

- /

- IT

- /

- NasdaqGS:SHOP

Outstanding Growth, but Some Shopify (NYSE:SHOP) Insiders are Harvesting Profits

Shopify (NYSE:SHOP) set their expectations for the full year 2021, which seem to be following the trajectory they have set in February. The company expects subscription revenue growth to be driven by more merchants joining at a rate below that in 2020. Shopify also expects a leveling off in growth rates from the record 2020, based on the activity in GMV. The growth will also be driven by further utilization of Shopify's expanded menu of offerings, such as: Shopify Payments, Shopify Shipping, and Shopify Capital.

In this article, after looking at the fundamental performance thus far, we will take a dive into what insiders have been doing with Shopify stock.

View our latest analysis for Shopify

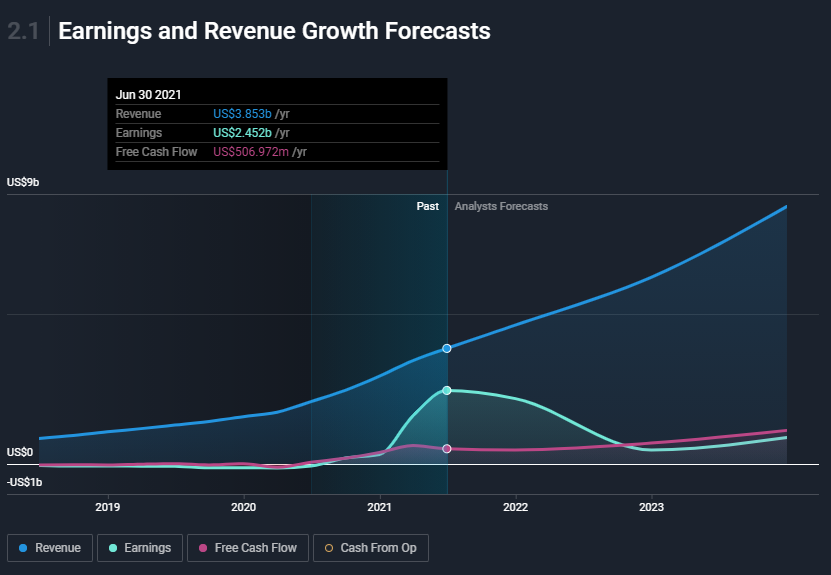

Shopify had a great year, is currently a US$187b Market Cap company, and the number two ecommerce retailer in the US behind Amazon (NASDAQ:AMZN). A better picture of Shopify's growth story and analysts expectations can be seen in the chart below:

What is evident from the chart above, is that there is a continuation of growth on the long term for Shopify. We also noticed a high bump in the net income, and after some digging, we found that this is the result of a one off activity, not related to Shopify's main operations.

In these situations, we trust the cash flows instead of booked profits to give us a better picture of the profitability of the company.

Now that we have gone over the financial performance, growth drivers for the company, and analysts estimates, we need to ask ourselves the key question:

"Is Shopify's current price justified?"

There are a number of ways to answer this.

For example, a traditional approach would be to create a model and value the equity of the firm. These are known as Discounted Cash Flow valuations, and give an estimate of what the current and future cash flows are worth today.

At Simply Wall St, we have a rough model for this, and you can view the results of our valuation HERE.

But sometimes models can have a large margin of error. Alternatively, we could take a behavioral approach, which assumes that insiders (people who run and own the company) are more informed than the public for the future of their company, and act from a rational financial standpoint - which just means that they sell if they think their company is overvalued and buy if they think it has plenty of potential.

Our next analysis will do just that. We will see what insiders do (as opposed to what they say) with their stock. Now, to be clear, while management outlines a positive growth vision for their company, they never explicitly say that their stock is at fair price.

When mapping out a clear picture for a company, sometimes a combined signal from 2 or more sources is better than looking at just one source in isolation. For example, looking at our valuation and insider transactions is better, and better still, is if these two points are congruent with each other. Let's take a look.

Although we don't think shareholders should simply follow insider transactions, we would consider it foolish to ignore insider transactions altogether.

Shopify Insider Transactions Over The Last Year

In the last twelve months, the biggest single sale by an insider was when the Chief Technology Officer, Jean-Michel Lemieux, sold US$2.1m worth of shares at a price of US$1,294 per share. So it's clear an insider wanted to take some cash off the table, even below the current price of US$1,504. We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. However, while insider selling is sometimes discouraging, it's only a weak signal. We note that the biggest single sale was only 16% of Jean-Michel Lemieux's holding.

Insiders in Shopify didn't buy any shares in the last year.

You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below.

If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

For those who like to find winning investments, this free list of growing companies with recent insider purchasing, could be just the ticket.

Shopify Insiders Are Selling The Stock

The last quarter saw substantial insider selling of Shopify shares. In total, insiders dumped US$664k worth of shares in that time, and we didn't record any purchases whatsoever. This may suggest that some insiders think that the shares are not cheap.

Insider Ownership

Many investors also like to check how much of a company is owned by insiders. Shopify's insiders own about US$12b worth of shares (which is 6.2% of the company).

This level of insider ownership shows a good amount of "skin in the game" and increases the chances that management are thinking about the best interests of shareholders.

Key Takeaways

Shopify is a large ecommerce retailer that is continuing their high growth performance. Growth rates have been boosted in 2020 by shifting market trends, and although they are expected to peak in 2021, they should still retain their high levels.

Both our DCF valuation and the behavior of insiders regarding their own stocks indicate that the company is currently overvalued. This in no way means that Shopify will stop performing, just that investors that jump in at this price may bear the additional risk for paying for next year's growth a bit early.

Shopify's net income does not reflect their earnings capacity from operations, and investors are better served by looking at the free cash flow numbers as an indication of profits.

The company's insiders still own a substantial chunk of their stock, and we can assume that their motivations are mostly aligned with the interests of shareholders.

When we did our research, we found 4 warning signs for Shopify (2 are a bit concerning!) that we believe deserve your full attention.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you're looking to trade Shopify, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives