- United States

- /

- Medical Equipment

- /

- NasdaqCM:BEAT

Spotlight On US Penny Stocks In October 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences a downturn, particularly impacting major tech companies, investors are reassessing their strategies amid fluctuating earnings reports and economic indicators. In this climate of uncertainty, penny stocks—though often overlooked—continue to present intriguing opportunities for growth, especially when they boast solid financial health. These smaller or newer companies can offer unique value and growth prospects that larger firms might miss, making them an appealing option for those looking to uncover potential in under-the-radar investments.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.799 | $5.75M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.19 | $534.34M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.63 | $2.12B | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.575 | $50.82M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| MIND C.T.I (NasdaqGM:MNDO) | $1.88 | $39.56M | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.41 | $147.91M | ★★★★★★ |

| Commercial Vehicle Group (NasdaqGS:CVGI) | $3.01 | $99.68M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.10 | $98.93M | ★★★★★☆ |

| So-Young International (NasdaqGM:SY) | $1.25 | $97.93M | ★★★★☆☆ |

Click here to see the full list of 756 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

HeartBeam (NasdaqCM:BEAT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: HeartBeam, Inc. is a medical technology company that develops and commercializes ambulatory electrocardiogram solutions for detecting and monitoring cardiac disease both inside and outside healthcare facilities, with a market cap of $64.01 million.

Operations: HeartBeam, Inc. does not currently report any revenue segments.

Market Cap: $64.01M

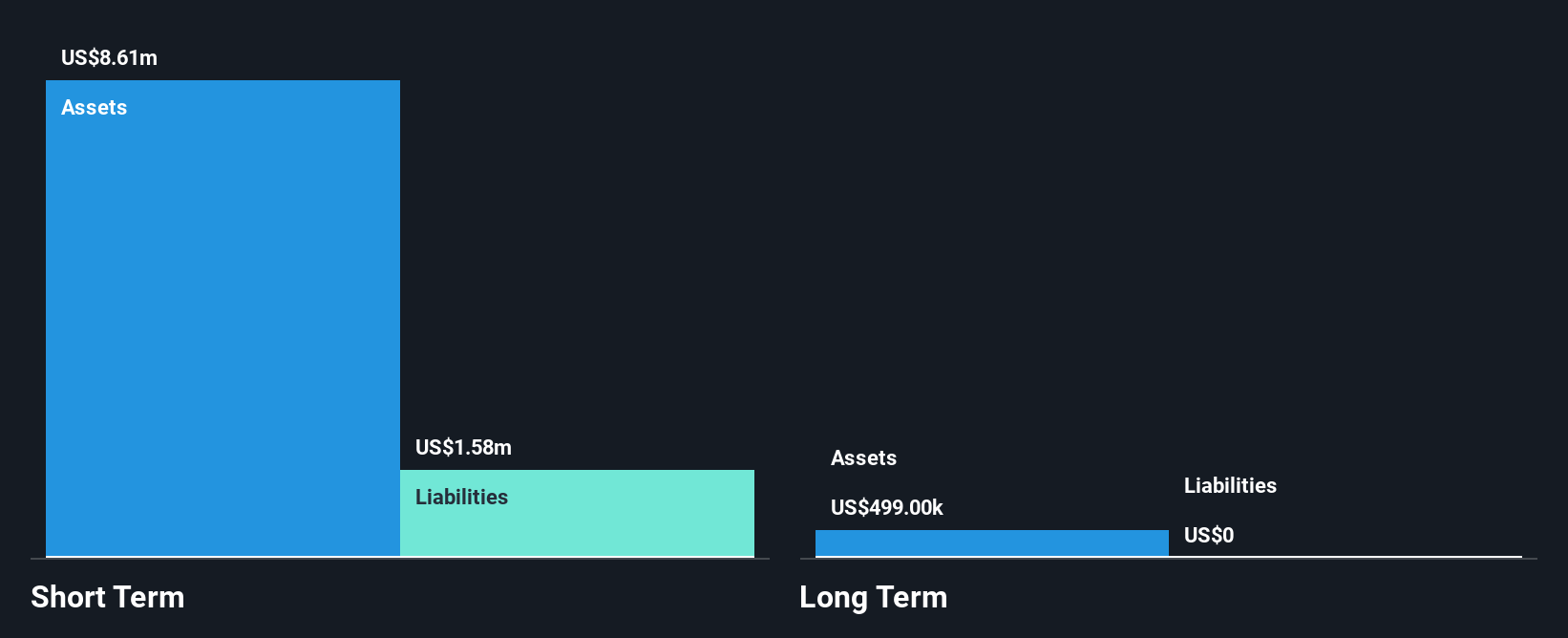

HeartBeam, Inc., a medical technology company with a market cap of US$64.01 million, remains pre-revenue and unprofitable. Despite having no debt or long-term liabilities and short-term assets exceeding liabilities, the company faces financial challenges with less than a year of cash runway. Recent executive changes include Robert Eno as CEO to lead efforts for FDA 510(k) clearance and commercialization of their vector-based ECG technology. HeartBeam's innovative approach is supported by 13 U.S. patents but requires significant progress towards revenue generation to improve its financial position in the penny stock market segment.

- Click to explore a detailed breakdown of our findings in HeartBeam's financial health report.

- Gain insights into HeartBeam's future direction by reviewing our growth report.

NeoVolta (NasdaqCM:NEOV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NeoVolta Inc. designs, manufactures, and sells energy storage systems in the United States with a market cap of $107.35 million.

Operations: The company's revenue is derived entirely from its Electric Equipment segment, amounting to $2.65 million.

Market Cap: $107.35M

NeoVolta Inc., with a market cap of US$107.35 million, focuses on energy storage solutions and reported revenues of US$2.65 million for the year ending June 2024, alongside a net loss of US$2.3 million. The company remains debt-free, enhancing its financial stability despite high share price volatility and an inexperienced management team. Recent strategic moves include securing a US$5 million line of credit to support growth without equity dilution concerns and partnerships expanding its reach in Puerto Rico's energy sector, potentially generating over $8 million in revenue from new installations aimed at bolstering local energy resilience.

- Navigate through the intricacies of NeoVolta with our comprehensive balance sheet health report here.

- Evaluate NeoVolta's prospects by accessing our earnings growth report.

Riskified (NYSE:RSKD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Riskified Ltd. develops and provides an e-commerce risk management platform that helps online merchants build trusted consumer relationships globally, with a market cap of approximately $767.43 million.

Operations: The company's revenue is derived from its Security Software & Services segment, totaling $311.08 million.

Market Cap: $767.43M

Riskified Ltd., with a market cap of US$767.43 million, operates in the e-commerce risk management sector and is currently unprofitable, though it has a positive cash flow and no debt. Its revenue for the first half of 2024 was US$155.14 million, showing growth from the previous year while net losses decreased to US$21.14 million from US$34.85 million. The company forecasts annual revenues between US$320-325 million for 2024 and has completed significant share buybacks totaling approximately 8.46% of shares for $75 million, indicating confidence in its valuation despite ongoing profitability challenges.

- Get an in-depth perspective on Riskified's performance by reading our balance sheet health report here.

- Examine Riskified's earnings growth report to understand how analysts expect it to perform.

Seize The Opportunity

- Unlock our comprehensive list of 756 US Penny Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HeartBeam might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BEAT

HeartBeam

Operates as a medical technology company that focuses on developing and commercializing ambulatory electrocardiogram solutions that enable the detection and monitoring of cardiac disease inside and outside a healthcare facility setting.

Moderate with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives