- United States

- /

- Software

- /

- NYSE:RNG

What RingCentral (RNG)'s Strong Quarterly Revenue Growth Means For Shareholders

Reviewed by Sasha Jovanovic

- RingCentral recently reported strong quarterly revenue growth compared to the previous year, highlighting clear operational improvements in its business.

- This performance has drawn attention from industry analysts, who emphasize the company's evolving operational efficiency and strengthening financial foundation.

- We'll explore how RingCentral's latest revenue growth could affect its investment narrative and long-term business prospects.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

RingCentral Investment Narrative Recap

To be a RingCentral shareholder, you typically need confidence in its position as a leading provider of cloud-based business communications, especially as it expands its AI-powered solutions. While the latest revenue growth signals improved operational performance, it does not significantly alter the current short-term catalyst: broad adoption of new AI and customer engagement products. The critical risk remains the sustained shift of large enterprises toward bundled productivity suites that may reduce demand for standalone platforms like RingCentral.

Among recent developments, the launch of RingCentral's Customer Engagement (CE) Bundle closely aligns with ongoing catalysts, the growing demand for automated, data-driven communications and value-added features. This product launch highlights efforts to strengthen enterprise value, potentially supporting both customer retention and acquisition, but whether it can offset rising competitive pressures is still uncertain. For investors looking longer term, keep in mind that, despite operational momentum, growing enterprise adoption of bundled suites like Microsoft Teams could represent a structural headwind ...

Read the full narrative on RingCentral (it's free!)

RingCentral's outlook forecasts $2.8 billion in revenue and $219.0 million in earnings by 2028. This projection assumes 5.0% annual revenue growth and a $231.2 million increase in earnings from the current level of -$12.2 million.

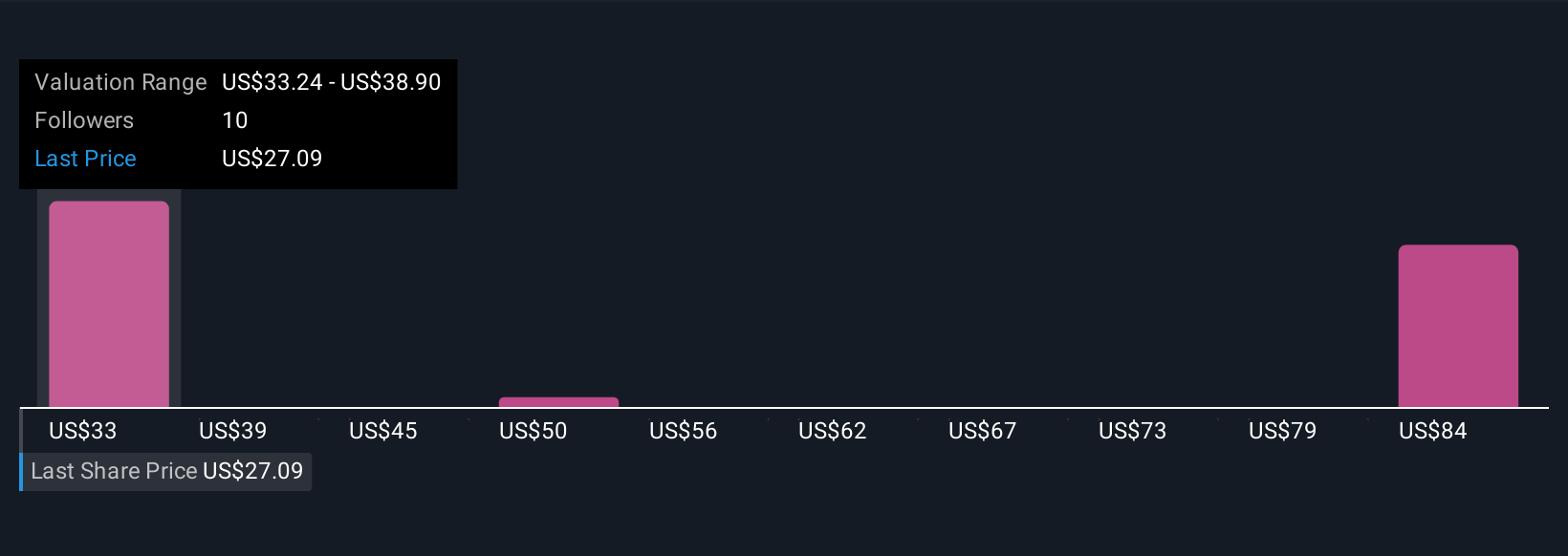

Uncover how RingCentral's forecasts yield a $33.24 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Four estimates from the Simply Wall St Community place RingCentral’s fair value between US$33 and US$97 per share. Many analysts see AI innovation and new product launches as a key growth driver, but evolving customer preferences may limit upside, explore these contrasting viewpoints to inform your own take.

Explore 4 other fair value estimates on RingCentral - why the stock might be worth just $33.24!

Build Your Own RingCentral Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RingCentral research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free RingCentral research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RingCentral's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RNG

RingCentral

Provides cloud business communications, contact center, video, and hybrid event solutions in North America and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.