- United States

- /

- Software

- /

- NYSE:RNG

RingCentral (RNG): Exploring Valuation as Analyst Upgrades Spark Fresh Earnings Optimism

Reviewed by Kshitija Bhandaru

RingCentral (RNG) is catching the eye of investors after analysts raised their earnings estimates for the company, suggesting a shift in market expectations. As a business at the center of cloud communications and contact center solutions, this fresh optimism has started to build a new narrative around its growth potential. Analyst revisions often hint at stronger operating results ahead. It is no surprise investors are wondering if RingCentral is hitting an inflection point or if these updates signal a longer-term turnaround.

Looking at the past year, RingCentral’s stock has traded sideways, landing about 3% lower over the twelve-month period despite gaining nearly 8% in the past 3 months. Short-term swings aside, long-term investors are still wrestling with the stock’s disappointing multi-year performance, even as the company posts rapid earnings growth and maintains steady revenue expansion. Momentum appears to have picked up more recently, but it comes after several years when enthusiasm for cloud names has been uneven.

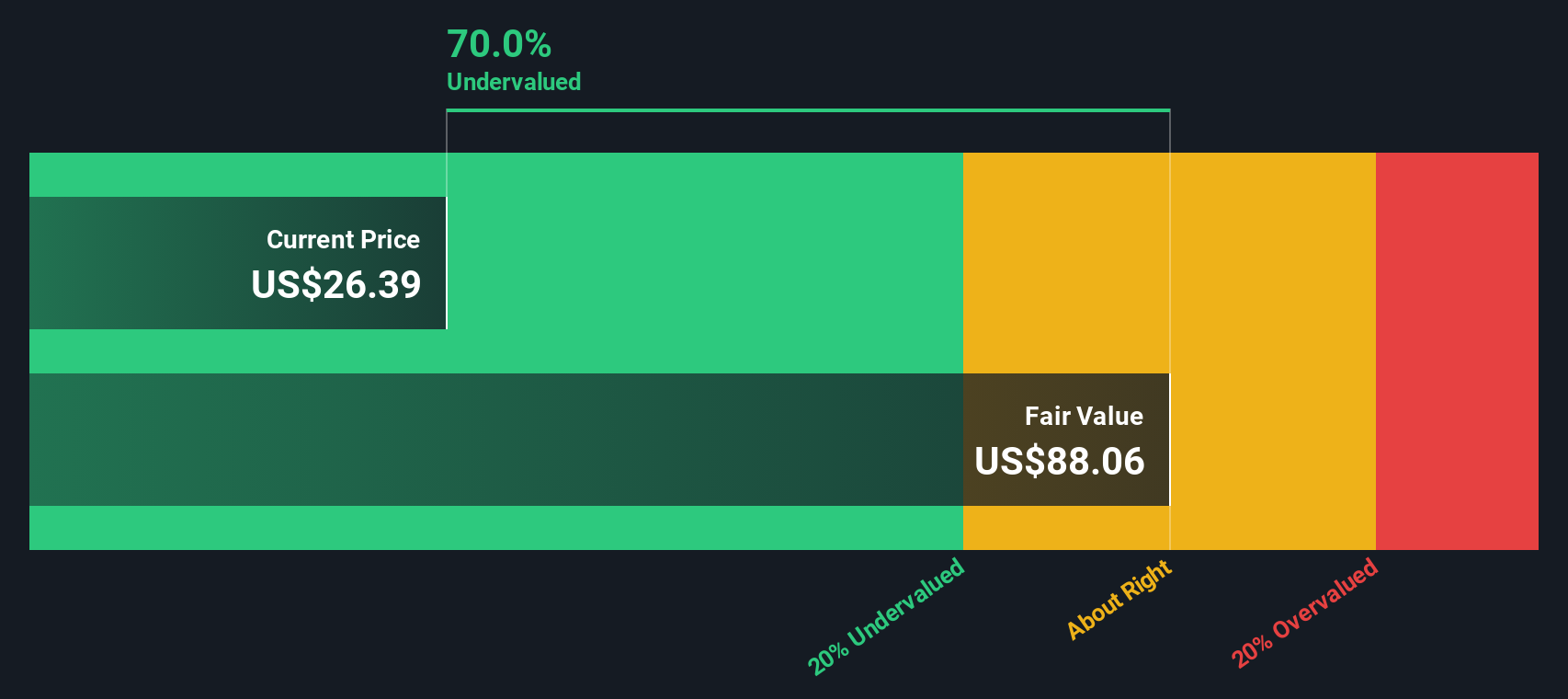

After this recent uptick in optimism and share price momentum, some investors may be asking whether RingCentral is undervalued or if the market is already pricing in its next phase of growth.

Most Popular Narrative: 7.6% Undervalued

The most popular narrative suggests RingCentral is currently undervalued, with the latest analyst consensus indicating the stock trades below its estimated fair value.

Deepening strategic partnerships with industry leaders like AT&T and the renewal of the NiCE partnership provide improved distribution and cross-sell opportunities. This expands RingCentral's addressable market and customer base across both SMB and enterprise segments, thus bolstering top-line revenue and lowering customer acquisition costs over time.

What could justify this narrative of undervaluation? Behind the scenes are bold analyst assumptions and a turnaround story that hints at rising profits and margin expansion. Want to understand which financial leaps, competitive partnerships, and long-range targets are fueling this outlook? The underlying logic here might surprise you, especially the ambitious projections for revenue and profitability that set this target apart from market consensus. Stay tuned for a closer look at the drivers shaping this valuation.

Result: Fair Value of $33.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, competition from larger bundled platforms and ongoing reliance on key partnerships could limit how much upside RingCentral actually realizes from its new growth story.

Find out about the key risks to this RingCentral narrative.Another View: SWS DCF Model Offers a Second Opinion

Looking at RingCentral through the lens of our DCF model, the results reinforce the idea that the company may be trading at a significant discount to its long-term intrinsic value. Could the market be overlooking the company’s real future potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own RingCentral Narrative

If you have a different perspective, or want to dig into the numbers yourself, you can easily craft your own take in just a few minutes. Do it your way

A great starting point for your RingCentral research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors stay ahead of the curve by scouting fresh stock ideas beyond the obvious picks. Let Simply Wall St’s tools point you toward your next big opportunity. These strategies are built for strong results, not missed chances.

- Spot hidden growth gems and uncover promising up-and-comers making waves in the market with penny stocks with strong financials.

- Maximize yield potential and find companies consistently delivering impressive returns with dividend stocks with yields > 3%.

- Tap into innovation and track pioneers fueling advancements in medical technology with healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RNG

RingCentral

Provides cloud business communications, contact center, video, and hybrid event solutions in North America and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives