- United States

- /

- Software

- /

- NYSE:RBRK

Rubrik (RBRK): Examining Valuation in Light of Revenue Surge and New Strategic Moves

Reviewed by Simply Wall St

Most Popular Narrative: 12.6% Undervalued

According to the most widely followed narrative, Rubrik is currently estimated to be undervalued, with its fair value projected above the latest market price.

"Rubrik's strategic focus on cyber resilience, particularly through innovations like their Rubrik Security Cloud and integration with DSPM, positions them strongly against competitors. This suggests potential future gains in market share and revenue growth. The company's pivotal role at the intersection of data security and AI, especially through products like Annapurna, can expand their total addressable market (TAM). This may potentially drive future revenue growth and enhance their market position in this expanding field."

Want to know the numbers fueling this bullish narrative? Find out which ambitious growth rate and margin leap are baked into the analysts’ fair value calculation. The consensus rests on a bold future scenario built on Rubrik’s evolving profits. Curious how high the expectations go, and just how aggressive these projections really are? The details may surprise you.

Result: Fair Value of $112.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, aggressive competition and unpredictable shifts in AI or cloud adoption could quickly challenge Rubrik’s growth story and future financial trajectory.

Find out about the key risks to this Rubrik narrative.Another View: Market-Based Comparison Raises Questions

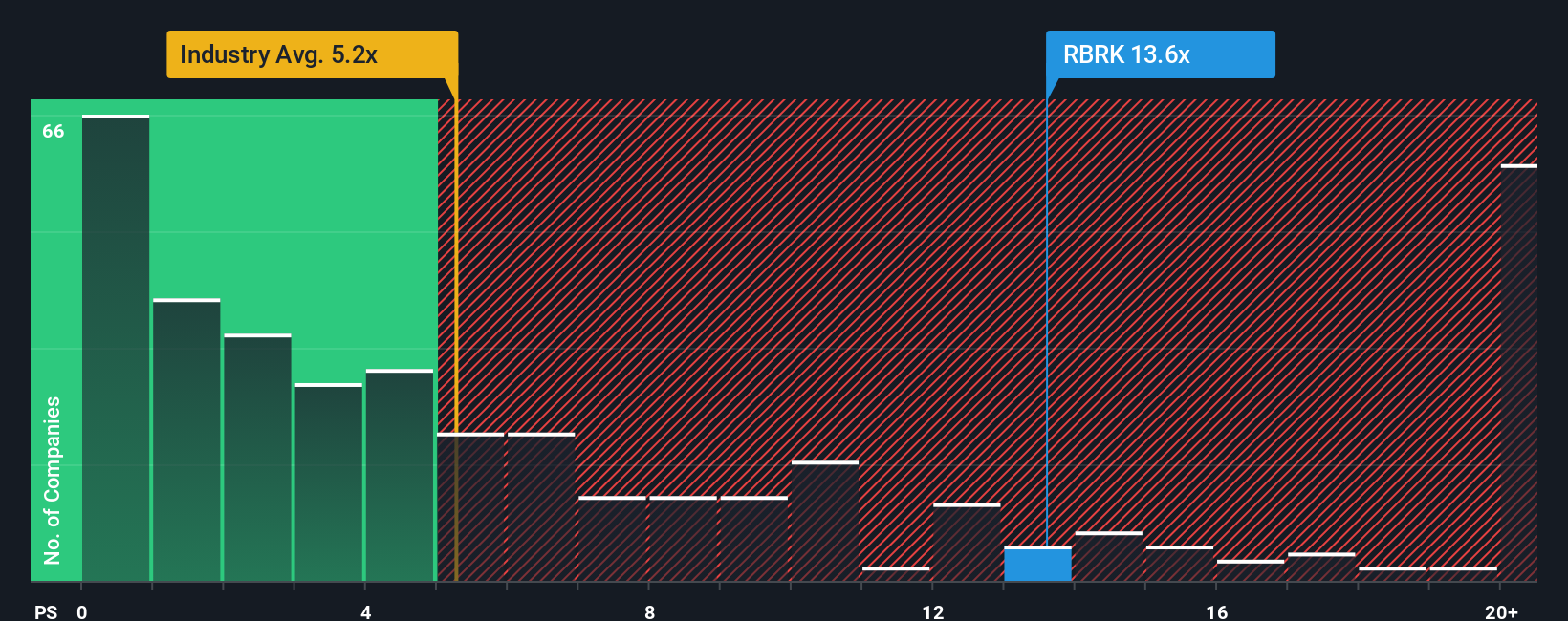

While the previous analysis points to Rubrik being undervalued, a look at how the company stacks up against the industry average on a key valuation ratio paints a much pricier picture. Could expectations be running too hot?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rubrik Narrative

If you are not convinced by these viewpoints or would rather dive into the analysis on your own, you can easily shape your own Rubrik story in just minutes. Do it your way.

A great starting point for your Rubrik research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for Your Next Move? Fresh Stock Picks Await

Unlock your full investing potential with insights chosen for your strategy. If you want more than just the usual names, these smart ideas could be your edge.

- Boost your portfolio with high-yield options that offer more than just stability. See which companies stand out among dividend stocks with yields > 3%.

- Be ahead of the curve in healthcare’s next revolution, where artificial intelligence is reshaping patient outcomes and diagnostics. Get inspired by leading healthcare AI stocks.

- Find hidden gems that the market might be overlooking, and spot value-packed opportunities by checking today’s most promising undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBRK

Rubrik

Provides data security solutions to individuals and businesses worldwide.

Imperfect balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives