- United States

- /

- Software

- /

- NYSE:RBRK

How Investors May Respond To Rubrik (RBRK) Launching Unified Okta Identity Recovery Solution

Reviewed by Sasha Jovanovic

- At Oktane 2025 in Las Vegas, Rubrik announced the launch of Rubrik Okta Recovery, a new solution designed to protect and restore Okta Identity Provider environments with automated, immutable backups and granular recovery directly in the live tenant.

- This extension of Rubrik’s identity recovery capabilities makes it the only provider to offer unified protection across Okta, Active Directory, and Entra ID, addressing critical operational risks for enterprises managing modern IT infrastructure.

- We'll explore how Rubrik's unified identity protection platform enhances its investment narrative and addresses key enterprise security challenges.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Rubrik Investment Narrative Recap

To own Rubrik shares, you need confidence in the growing importance of unified cyber resilience, particularly solutions that secure digital identity systems across the enterprise. The recent launch of Rubrik Okta Recovery directly targets a persistent pain point for IT teams but likely does not change the most significant short-term catalysts, which remain Rubrik’s ability to drive new subscription business and maintain rapid revenue growth. The biggest risk continues to be fierce competition, where delays in adoption or missteps against established rivals could impact long-term momentum.

Among Rubrik’s recent news, the expanded integration with CrowdStrike Falcon Next-Gen Identity Security most closely complements the Okta Recovery launch. This further positions Rubrik as a key player in unified identity protection, a focus that aligns strongly with current catalysts like enterprise demand for all-in-one cyber resilience solutions and could support customer retention and new business conversion over time.

Yet, despite this momentum, investors should be aware that even the most advanced identity recovery solutions may not fully address...

Read the full narrative on Rubrik (it's free!)

Rubrik's narrative projects $2.0 billion revenue and $257.3 million earnings by 2028. This requires 26.2% yearly revenue growth and a $782 million earnings increase from -$524.8 million.

Uncover how Rubrik's forecasts yield a $115.20 fair value, a 39% upside to its current price.

Exploring Other Perspectives

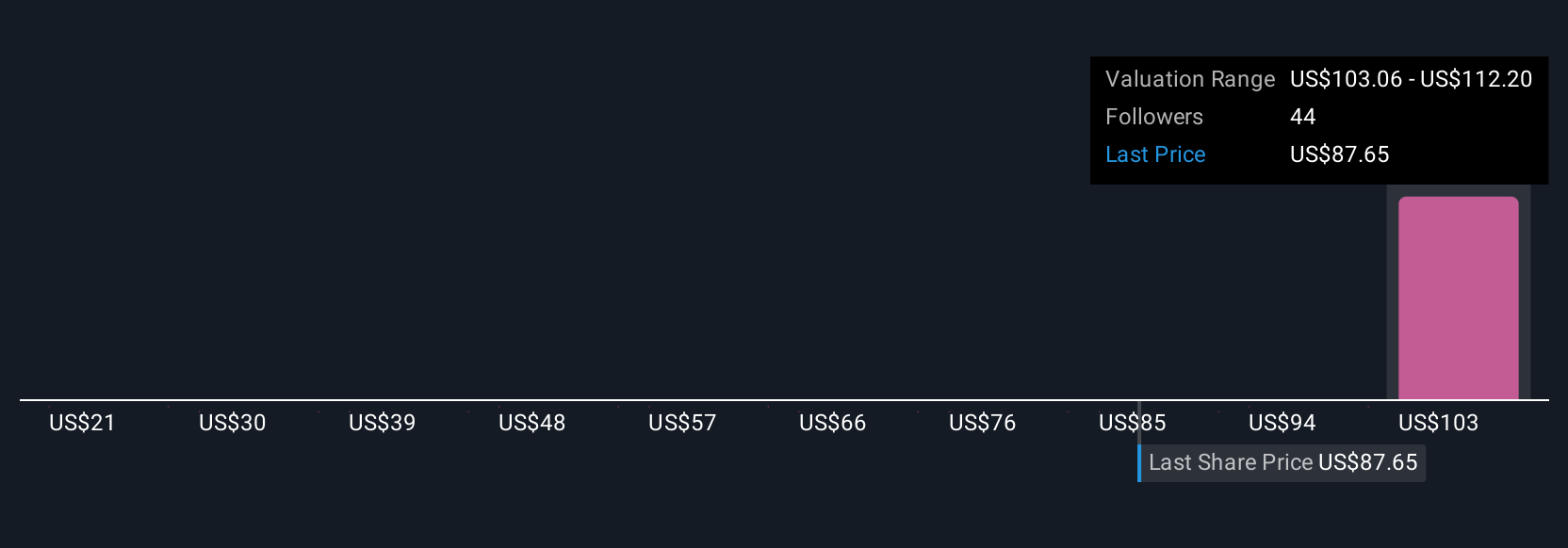

Eleven community fair value estimates for Rubrik range widely from US$20.21 to US$115.85 per share according to Simply Wall St Community members. Many see opportunity in Rubrik’s push for unified security, but continued delays in AI or cloud adoption could dramatically affect outcomes.

Explore 11 other fair value estimates on Rubrik - why the stock might be worth less than half the current price!

Build Your Own Rubrik Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rubrik research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Rubrik research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rubrik's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBRK

Rubrik

Provides data security solutions to individuals and businesses worldwide.

Imperfect balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives