- United States

- /

- Software

- /

- NYSE:RAMP

Assessing LiveRamp (RAMP) Valuation Following Launch of Advanced AI Data Collaboration Tools

Reviewed by Kshitija Bhandaru

LiveRamp Holdings (RAMP) recently rolled out a suite of new AI capabilities, introducing agentic tools, segmentation, and search. The company also became the first platform to let autonomous AI agents access its data collaboration network under controlled conditions.

See our latest analysis for LiveRamp Holdings.

Momentum around LiveRamp’s new AI offerings comes as the company’s share price has seen a bit of a rollercoaster. After a fast start to the year, recent months brought a 90-day share price drop of 17.4%, but investors holding on for twelve months still enjoyed a total shareholder return of 10.3%. Big picture, the three-year total return sits at an impressive 54%, though long-term holders are still feeling the sting of heavy losses five years ago.

If you’re eyeing tech moves like LiveRamp’s, it could be the perfect moment to see the full list of leading innovators in our See the full list for free.

With shares still trading at a notable discount to analyst targets, the question for investors now is whether LiveRamp’s growth potential is underappreciated or if the recent moves are already fully reflected in the price.

Most Popular Narrative: 31% Undervalued

LiveRamp's current narrative-implied fair value of $39.62 stands well above its last closing price of $27.34, creating an important valuation gap for investors who are following analyst forecasts and projections in a rapidly evolving data landscape.

Heightened data privacy requirements and global regulatory changes (such as GDPR and CCPA) are creating greater demand for trusted data collaboration platforms and privacy-conscious identity solutions. LiveRamp's investments in privacy-preserving technologies (like clean rooms and fine-grained policy enforcement) are expected to differentiate its offerings, resulting in higher client retention, customer expansion, and recurring revenue.

Curious why analysts believe LiveRamp could unlock outsized value through shifting privacy rules and tech innovations? Hints: redefining margins, bold growth forecasts, and a projected leap in earnings transformation. See the logic and wild card assumptions behind this valuation to understand what numbers are driving analyst optimism.

Result: Fair Value of $39.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued dependence on a handful of major customers and tightening data privacy laws could limit LiveRamp’s ability to sustain its projected growth.

Find out about the key risks to this LiveRamp Holdings narrative.

Another View: Looking Through the Lens of Price-to-Earnings

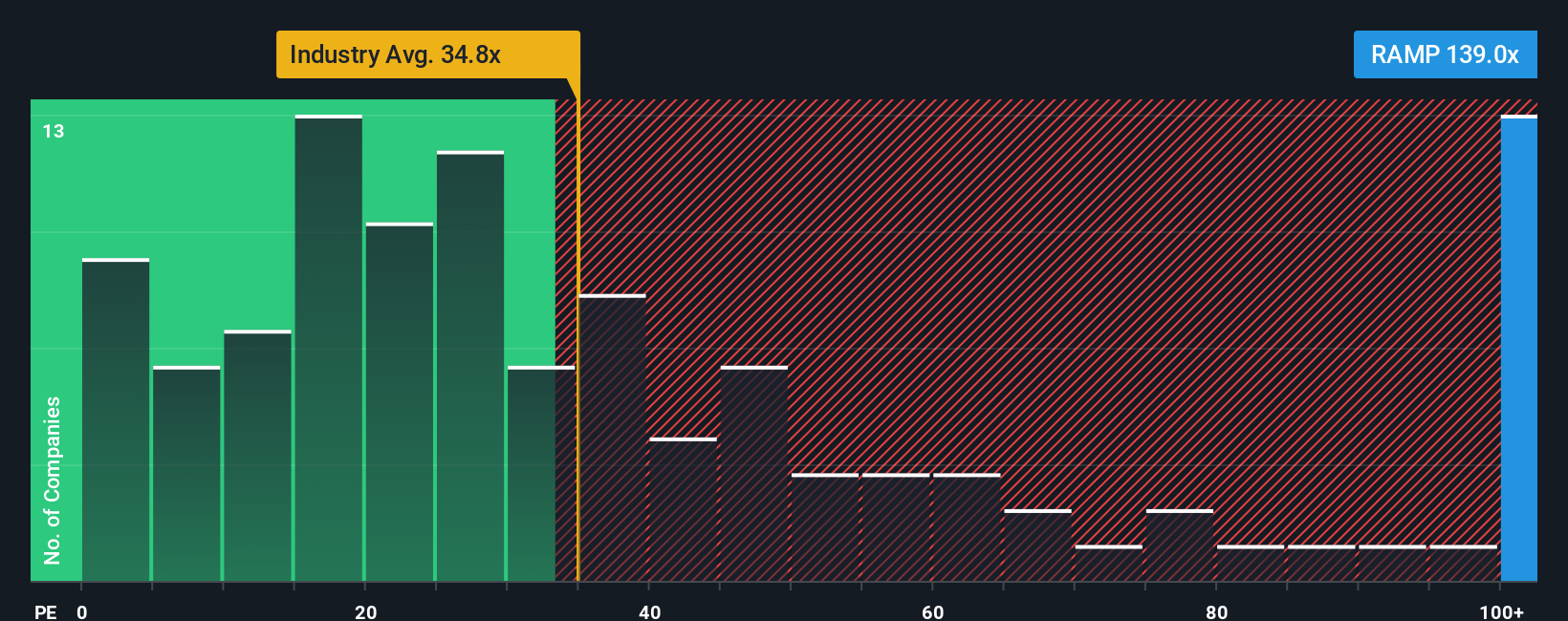

While analyst forecasts suggest LiveRamp is undervalued, its current price-to-earnings ratio stands at 140.9x, which is far higher than the US Software industry average of 34.9x, the peer average of 70.5x, and even the market’s fair ratio of 62.1x. This signals heightened expectations, and possibly more risk, if those earnings forecasts do not materialize as hoped. Is the market assigning too much future value, or do investors just believe in much faster transformation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LiveRamp Holdings Narrative

If you want to see things differently or like to dig into the numbers yourself, you can craft your own story in just a few minutes. Do it your way

A great starting point for your LiveRamp Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why settle for just one opportunity? Jump ahead of the curve and find high-potential stocks that align with your strategy using these curated investment angles from Simply Wall Street.

- Unlock potential growth by checking out these 870 undervalued stocks based on cash flows to see which companies could deliver value that may be overlooked by the market.

- Boost your portfolio’s income with these 18 dividend stocks with yields > 3%, which offers attractive yields above 3% from resilient businesses.

- Fuel your watchlist with future breakthroughs by scanning these 24 AI penny stocks, focusing on companies making real moves in artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RAMP

LiveRamp Holdings

A technology company, operates a data collaboration platform in the United States, Europe, the Asia-Pacific, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives