- United States

- /

- Software

- /

- NYSE:RAMP

A Fresh Look at LiveRamp (RAMP) Valuation as New Measurement Tools Strengthen Its Retail Media Role

Reviewed by Simply Wall St

LiveRamp Holdings (RAMP) just introduced new measurement features that let retail media networks get a closer look at how their Meta campaigns impact sales by tying ad results directly to first-party transaction data. This move reinforces LiveRamp’s role as a key data partner and sets the stage for more advanced benchmarking tools soon.

See our latest analysis for LiveRamp Holdings.

Shares of LiveRamp Holdings have been volatile lately, with the stock up 4.4% over the past seven days but still down 15% from three months ago. While this reflects some cooling momentum in the share price, long-term investors have seen a total one-year return of 15%, which points to underlying growth despite recent swings and anticipation for next quarter’s earnings update.

If LiveRamp’s renewed push into data-driven media measurement caught your interest, it might be time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading nearly 40% below the average analyst price target and at a significant discount to intrinsic value, does LiveRamp represent an underappreciated opportunity for investors, or is the market already factoring in future growth?

Most Popular Narrative: 28% Undervalued

With LiveRamp last closing at $28.51, the most widely followed narrative sees fair value at $39.63, suggesting considerable upside compared to where the stock trades today. The stage is set for a transformative business model if the company delivers on several ambitious catalysts over the next cycle.

"Heightened data privacy requirements and global regulatory changes (such as GDPR and CCPA) are creating greater demand for trusted data collaboration platforms and privacy-conscious identity solutions. LiveRamp's investments in privacy-preserving technologies (like clean rooms and fine-grained policy enforcement) are expected to differentiate its offerings, resulting in higher client retention, customer expansion, and recurring revenue."

Want to know what’s driving LiveRamp’s high-flying valuation? The narrative is fueled by blockbuster growth assumptions and a fast track to higher margins. The real surprise is that its ambitious earnings transformation relies on unlocking a rare profit profile. Curious about the bullish numbers behind this target? Dive in to see the bold projections that could rewrite this stock’s story.

Result: Fair Value of $39.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if key enterprise clients leave or if privacy rules tighten further, LiveRamp’s growth and earnings outlook could face unexpected challenges despite current optimism.

Find out about the key risks to this LiveRamp Holdings narrative.

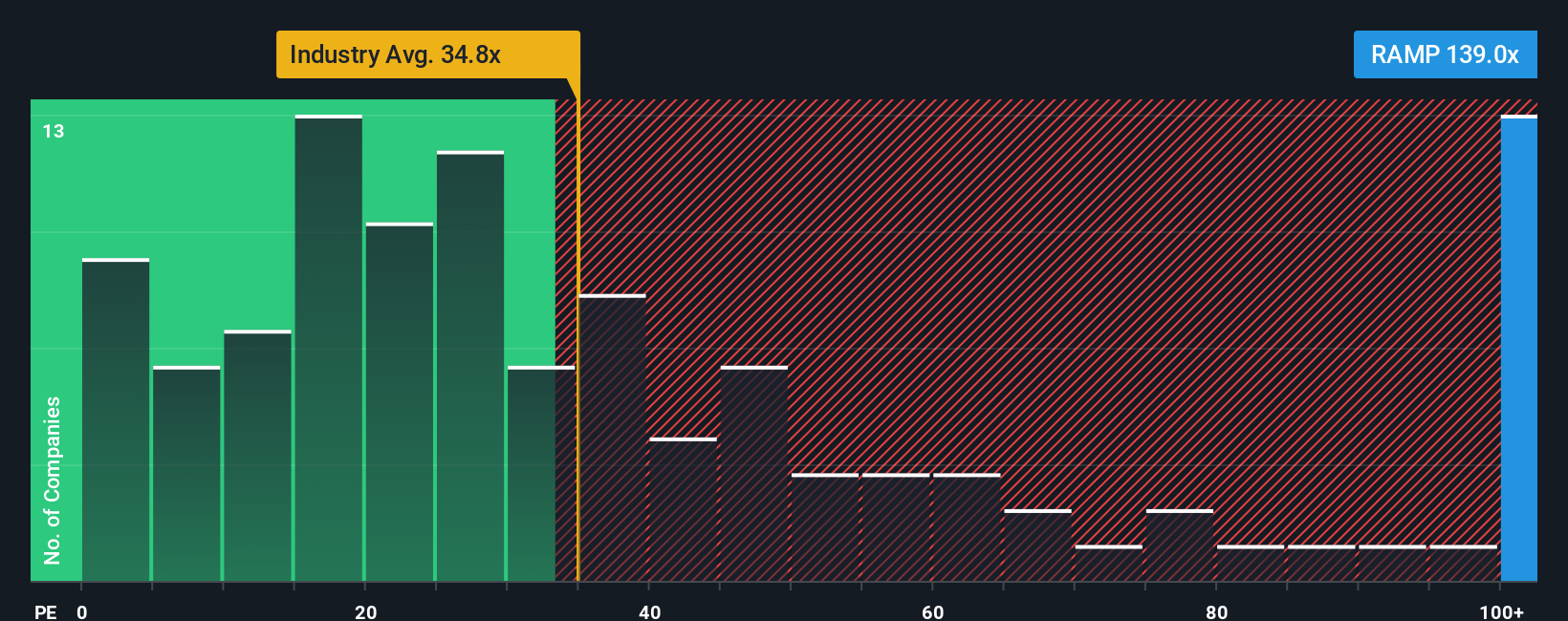

Another View: Looking Through the Lens of Price Multiples

While the narrative points to significant upside, traditional market multiples paint a less optimistic picture. LiveRamp trades at a price-to-earnings ratio of 146.9x, which is much higher than both the US Software industry average of 33.3x and the peer group average of 30x. Even when compared to its own fair ratio of 62.3x, the stock looks richly valued. This suggests that investors may be pricing in a lot of future growth already. Is the premium justified, or could it set the stage for disappointment if expectations fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LiveRamp Holdings Narrative

Keep in mind, if you'd rather dig into the data yourself or want to chart your own perspective, you can build a narrative from scratch in just a few minutes with Do it your way.

A great starting point for your LiveRamp Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors are always one step ahead. Make sure you are too by using the power of targeted screeners to pinpoint unique opportunities you might otherwise miss.

- Unlock potential with income-focused picks by checking out these 17 dividend stocks with yields > 3% for high-yield opportunities that can grow your portfolio steadily over time.

- Find growth at the intersection of innovation when you uncover early-stage players in artificial intelligence through these 27 AI penny stocks.

- Capitalize on overlooked gems by scanning these 877 undervalued stocks based on cash flows for stocks trading below their intrinsic value, giving you a shot at superior returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RAMP

LiveRamp Holdings

A technology company, operates a data collaboration platform in the United States, Europe, the Asia-Pacific, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives