- United States

- /

- Software

- /

- NYSE:QTWO

Q2 Holdings (QTWO): Exploring Valuation as S&P MidCap 400 Index Addition Draws Investor Attention

Reviewed by Simply Wall St

Most Popular Narrative: 21% Undervalued

According to the most popular narrative, Q2 Holdings is undervalued by a significant margin, with its fair value estimated well above current share prices.

The increasing focus by financial institutions on digital transformation, evidenced by strong engagement and expanded investments in mission-critical digital banking, fraud prevention, and AI solutions, is likely to drive robust subscription revenue growth and improve retention for Q2 over the longer term. Heightened demand for integrated, omni-channel, and mobile-first banking experiences is accelerating adoption of Q2's unified platform across both new and existing customers. This is expanding the addressable market and supporting higher average revenue per user (ARPU) and overall revenue growth.

Want to know the secret behind this bullish valuation? The narrative hinges on huge digital adoption, ambitious financial projections, and a profit leap that is rarely seen in the sector. Curious which numbers set this price target apart? Discover the surprising financial pillars behind this fair value. The story is just getting interesting.

Result: Fair Value of $104.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent customer losses and growing competition from specialized vendors could undermine Q2's positive outlook and slow the anticipated growth story.

Find out about the key risks to this Q2 Holdings narrative.Another View: Market Comparisons Tell a Different Story

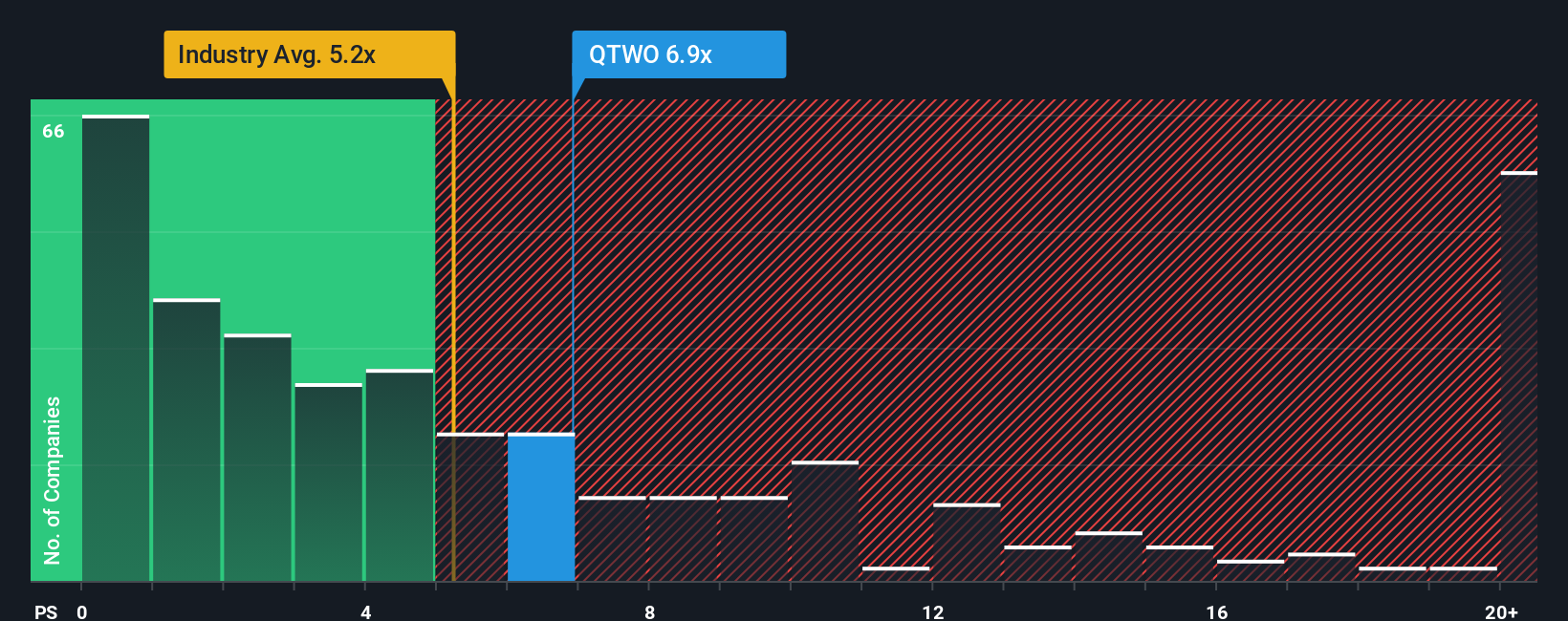

While analyst forecasts and bullish narratives paint Q2 Holdings as undervalued, comparing its pricing to peers in the software industry reveals the shares trade at a premium. Does this challenge the fair value story, or does it reinforce long-term growth expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Q2 Holdings Narrative

Prefer to draw your own conclusions or dive deeper into the numbers? You can craft your own narrative in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Q2 Holdings.

Looking for more investment ideas?

Don't let standout opportunities sit on the sidelines. The Simply Wall Street Screener can help you target winning stocks you may not have considered. Take action now and unlock hidden potential in different corners of the market.

- Start building a high-yield portfolio and tap into financial freedom with dividend stocks with yields > 3%.

- Catch early-stage disruptors shaking up the digital landscape with the help of AI penny stocks.

- Target stocks trading below their true value and seek to maximize your upside using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Q2 Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QTWO

Q2 Holdings

Provides digital solutions to financial institutions, financial technology companies, FinTechs, and alternative finance companies (Alt-FIs) in the United States.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives