- United States

- /

- Software

- /

- NYSE:QTWO

Q2 Holdings (QTWO): Exploring Valuation After Fed Rate Cut Signals and New Instant Payment Partnerships

Reviewed by Simply Wall St

If you’re holding shares of Q2 Holdings (QTWO), you probably noticed the stock jumped by just over 5% after the latest comments from Federal Reserve Chair Jerome Powell about possible rate cuts. The timing aligns with Q2’s own fresh news: partnerships and integrations aimed at bringing instant payment technology to more banks and credit unions. Between a friendlier interest rate outlook and Q2’s push to expand its digital payments offerings, investors got a double dose of encouragement that’s hard to ignore.

This wave of optimism comes after a year where Q2 Holdings has seen a modest 6% gain, rebounding from a rough patch that had left shares down more than 20% year-to-date before the rally. Over the past month and past three months, the stock was slipping, but recent announcements, along with the broader market relief rally, seem to have put some wind back in its sails. Q2’s ongoing efforts to deepen integrations, such as recent partnerships with Open Payment Network and Finzly, keep it moving with trends in digital finance, even as volatility continues in the sector.

With the stock snapping its slump and new growth moves in play, the real question is whether Q2 Holdings offers genuine value at this price or if expectations for future growth are already baked in.

Most Popular Narrative: 23.6% Undervalued

According to community narrative, Q2 Holdings is considered significantly undervalued, with the current share price sitting well below the fair value estimate based on robust forecasts for earnings and revenue growth. Analyst consensus points to over 20% upside from current levels, supported by strong long-term trends and profitable expansion in digital banking.

The increasing focus by financial institutions on digital transformation, as shown by strong engagement and expanded investments in mission-critical digital banking, fraud prevention, and AI solutions, is likely to drive robust subscription revenue growth and improve retention for Q2 over the longer term. Heightened demand for integrated, omni-channel, and mobile-first banking experiences is accelerating adoption of Q2's unified platform across both new and existing customers. This trend is expanding the addressable market and supporting higher average revenue per user (ARPU) and overall revenue growth.

Wondering what ambitious growth plans are woven into this valuation? The narrative hints at bold financial assumptions, including major improvements in profit margins and a dramatic shift in how the company could be valued in just a few years. Is this the blueprint for a breakout performer, or a stretch too far? Find out which numbers and transformation strategies are fueling the case for a much higher stock price. Discover the full narrative to reveal the detailed projections behind this compelling valuation.

Result: Fair Value of $104.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent customer losses from bank mergers and rising competition in fraud prevention could quickly challenge the bullish case for Q2 Holdings’ long-term growth.

Find out about the key risks to this Q2 Holdings narrative.Another View: Sizing Up Fair Value via the SWS DCF Model

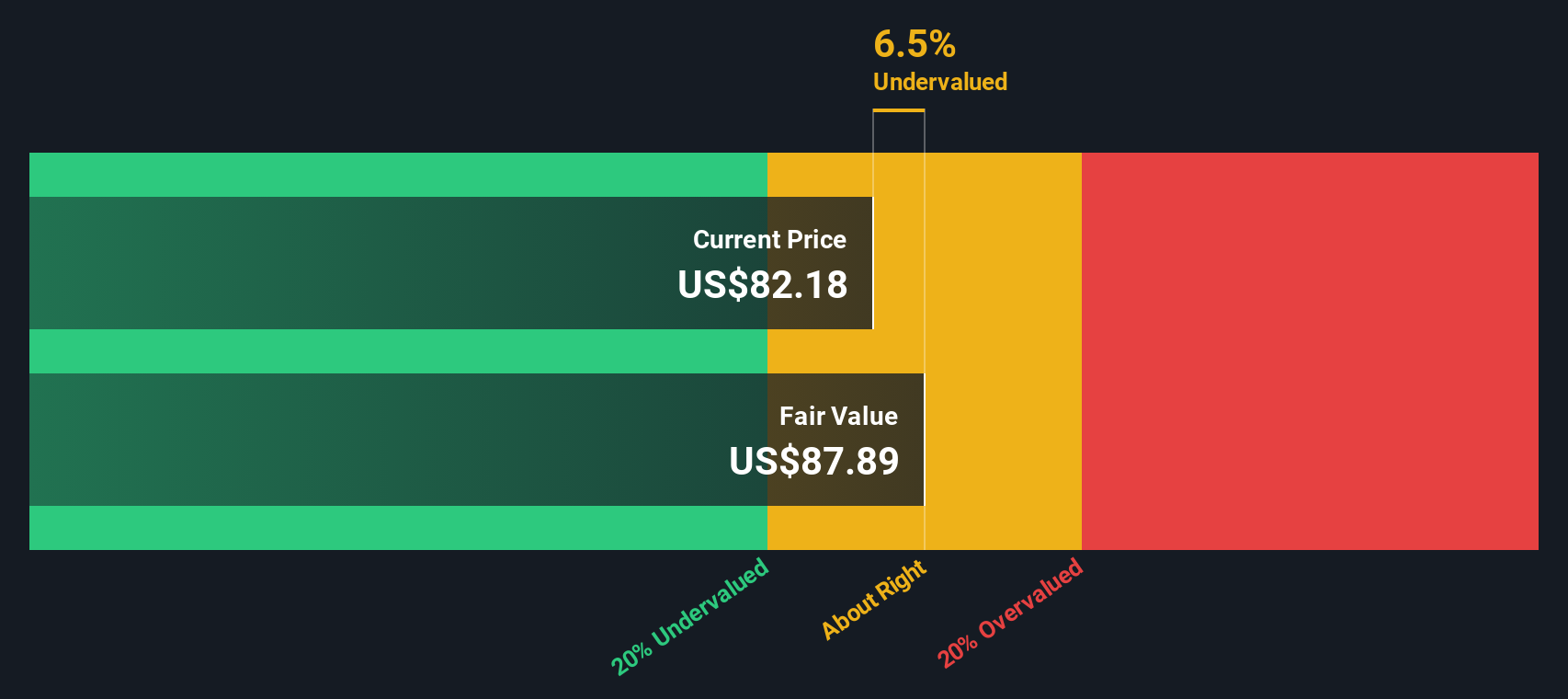

Looking from a different angle, the SWS DCF model takes into account Q2 Holdings’ expected future cash flows and overall business quality. This method also points to undervaluation. However, does it capture all the market risks ahead?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Q2 Holdings Narrative

Every investor sees the data differently, and your perspective matters. Why not dive in and craft your own take on Q2 Holdings in under three minutes and do it your way.

A great starting point for your Q2 Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Your next great opportunity might be closer than you think. Get ahead of the market and access investment angles most investors overlook. Stay curious and keep your edge. Don't let new trends or high-potential picks slip away.

- Uncover the potential of tech-driven innovation by checking out AI penny stocks that are riding the explosive wave of artificial intelligence across sectors.

- Capitalize on the reliability of regular income streams and see how dividend stocks with yields > 3% can strengthen your portfolio with stocks boasting yields above 3%.

- Spot tomorrow’s health breakthroughs by exploring healthcare AI stocks harnessing advanced technology to revolutionize patient care and medical research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Q2 Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QTWO

Q2 Holdings

Provides digital solutions to financial institutions, financial technology companies, FinTechs, and alternative finance companies (Alt-FIs) in the United States.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives