- United States

- /

- Software

- /

- NYSE:QBTS

D-Wave Quantum (NYSE:QBTS) Expands Quantum Optimization Solutions By 13% Despite US$500 Price Dip

Reviewed by Simply Wall St

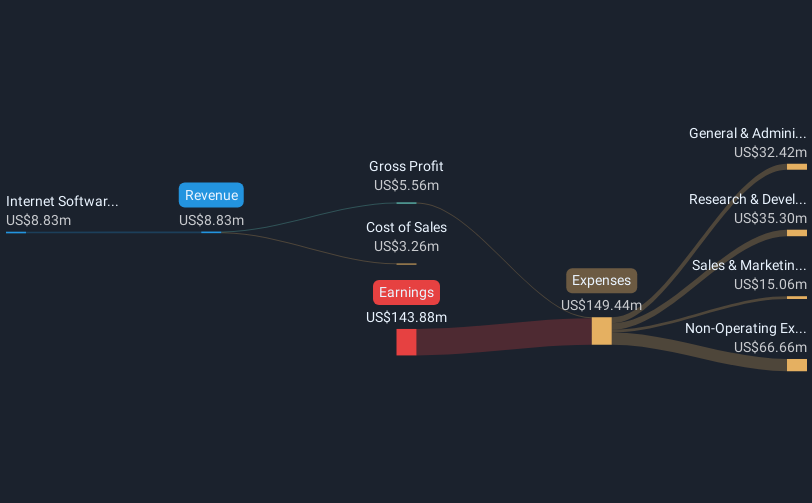

D-Wave Quantum (NYSE:QBTS) experienced a notable 38% price increase over the past month, coinciding with significant advancements in its quantum computing applications. The partnership with Ford Otosan aimed to revolutionize vehicle production sequencing while commercial expansion was enhanced with hybrid quantum solver updates. Amid a broader market downturn, where the S&P 500 and Nasdaq faced declines of 6% and 8%, D-Wave's progress stood out. The introduction of quantum optimization solutions, improving various industry applications, may have caught investor attention despite the company's financial challenges reported earlier in March, where it posted a $86 million net loss for Q4 2025.

In the past year, D-Wave Quantum's total shareholder return reached a substantial 280.90%, far surpassing the US Market and US Software industry returns of 5.8% and -3% respectively. This impressive performance coincided with several significant milestones, including the collaboration launched on August 20, 2024, with NTT DOCOMO to enhance network management through quantum optimization. Furthermore, D-Wave's inclusion in major indices like the Russell Microcap on July 1, 2024, likely increased investor awareness and demand. The company's focus on practical applications was underscored by a partnership with Japan Tobacco's pharmaceutical division, announced on October 1, 2024, aiming for advancements in AI-driven drug discovery.

Despite financial challenges reported earlier on March 13, 2025, with a US$86.08 million net loss, investor enthusiasm was buoyed by positive future guidance and ongoing developments. The January 23, 2025, successful follow-on equity offering of US$150 million further underscored the market's confidence in D-Wave's long-term growth potential. These efforts, combined with leadership enhancements on October 30, 2024, reflect D-Wave's commitment to expanding its footprint in the quantum technology sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade D-Wave Quantum, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QBTS

D-Wave Quantum

Develops and delivers quantum computing systems, software, and services worldwide.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives