- United States

- /

- Software

- /

- NYSE:QBTS

Can D-Wave Quantum's (QBTS) BASF Breakthrough Redefine Its Competitive Edge in Enterprise Computing?

- BASF and D-Wave Quantum announced the successful completion of a joint proof-of-concept project, where D-Wave’s hybrid-quantum application reduced production scheduling time at a BASF liquid-filling facility from 10 hours to seconds and improved key operational metrics.

- This collaboration showcases how quantum technology can address real-world manufacturing challenges beyond the capabilities of classical solutions, setting new benchmarks for workflow efficiency in complex industrial environments.

- We'll explore how the breakthrough with BASF strengthens D-Wave Quantum's investment narrative and highlights the growing enterprise appeal of hybrid-quantum computing.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

What Is D-Wave Quantum's Investment Narrative?

To own a piece of D-Wave Quantum, an investor needs to buy into the belief that quantum computing is capable of disrupting traditional technologies and will soon find real commercial uses across industries. The latest breakthrough with BASF gives this story a tangible, real-world success, narrowing the gap between years of bold promises and actual industry traction. On the one hand, this news could accelerate enterprise adoption and provide D-Wave with credibility that supports short-term catalysts, such as additional deal announcements or bigger contracts, especially as customers see operational savings and speed. On the other hand, the company’s financials have grown more challenging, with expanding net losses and continued shareholder dilution. While rapid revenue growth is expected, the runway remains dependent on financing, and volatility in the share price reflects investors’ thirst for proof that wins like BASF aren’t isolated. The BASF partnership helps offset questions about quantum readiness but doesn’t erase concerns about scaling, repeatability, and the path to profitability. Yet, while excitement is warranted, the company’s widening losses remain a key risk worth watching.

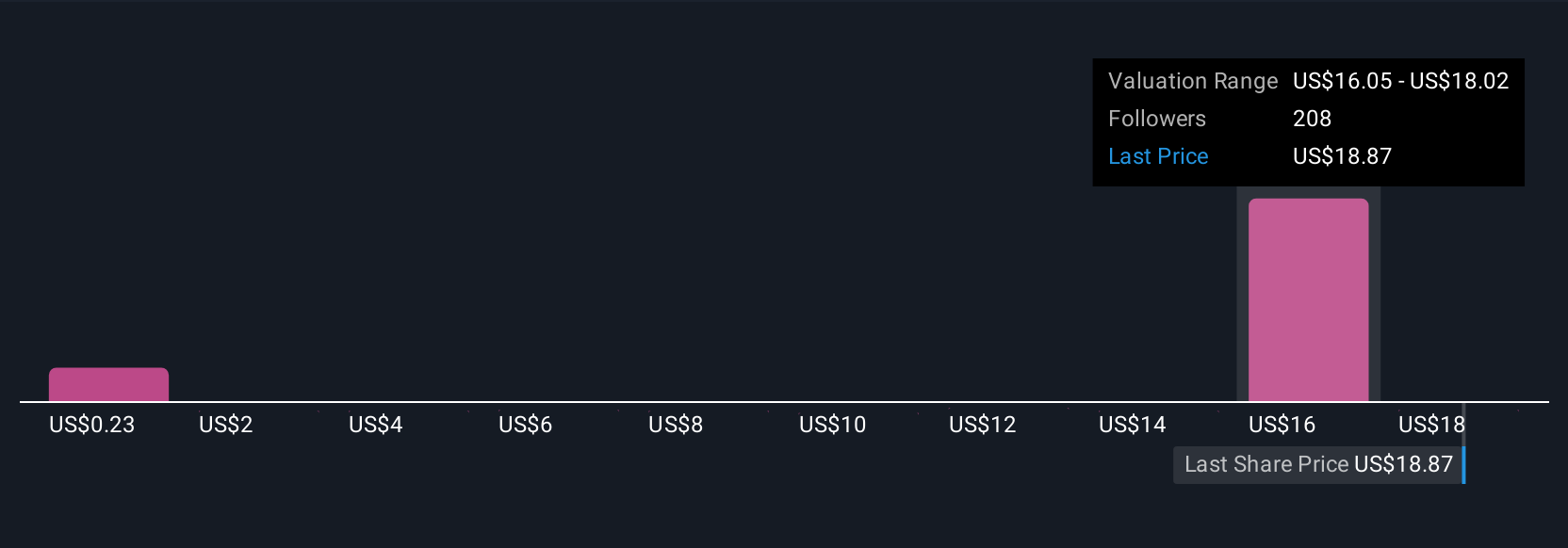

Insights from our recent valuation report point to the potential overvaluation of D-Wave Quantum shares in the market.Exploring Other Perspectives

Explore 85 other fair value estimates on D-Wave Quantum - why the stock might be worth as much as $29.89!

Build Your Own D-Wave Quantum Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your D-Wave Quantum research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free D-Wave Quantum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate D-Wave Quantum's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QBTS

D-Wave Quantum

Engages in the development and delivery of quantum computing systems, software, and services worldwide.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

What IREN's decision to buy over 50,000 NVIDIA GPUs could mean for its future

AI short positioning & India emerging market opportunties

Cheniere Energy (LNG) — The Toll Road That Geopolitics Just Made More Valuable

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026