Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So should Perfect (NYSE:PERF) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for Perfect

Does Perfect Have A Long Cash Runway?

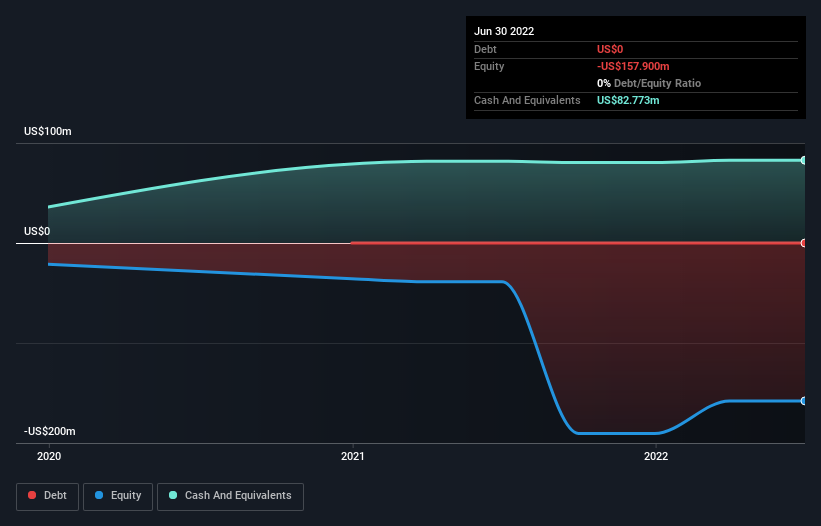

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In June 2022, Perfect had US$83m in cash, and was debt-free. Importantly, its cash burn was US$2.6m over the trailing twelve months. So it had a very long cash runway of many years from June 2022. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. Depicted below, you can see how its cash holdings have changed over time.

Is Perfect's Revenue Growing?

Given that Perfect actually had positive free cash flow last year, before burning cash this year, we'll focus on its operating revenue to get a measure of the business trajectory. We think that it's fairly positive to see that revenue grew 43% in the last twelve months. Of course, we've only taken a quick look at the stock's growth metrics, here. This graph of historic revenue growth shows how Perfect is building its business over time.

How Easily Can Perfect Raise Cash?

Notwithstanding Perfect's revenue growth, it is still important to consider how it could raise more money, if it needs to. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of US$1.2b, Perfect's US$2.6m in cash burn equates to about 0.2% of its market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

So, Should We Worry About Perfect's Cash Burn?

It may already be apparent to you that we're relatively comfortable with the way Perfect is burning through its cash. For example, we think its cash runway suggests that the company is on a good path. But it's fair to say that its revenue growth was also very reassuring. Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. Its important for readers to be cognizant of the risks that can affect the company's operations, and we've picked out 3 warning signs for Perfect that investors should know when investing in the stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PERF

Perfect

An artificial intelligence software as a service company, provides artificial intelligence (AI)- and augmented reality (AR)-powered solutions for beauty, fashion, and skincare industries worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026