- United States

- /

- Software

- /

- NYSE:PCOR

Procore Technologies (PCOR): Valuation Spotlight as Leadership Transition to Ajei Gopal Signals Fresh Strategic Momentum

Reviewed by Kshitija Bhandaru

Procore Technologies (PCOR) just announced a CEO transition, with industry veteran Ajei Gopal set to succeed founder Tooey Courtemanche after the next earnings report. Gopal’s arrival signals stability and the potential for new momentum.

See our latest analysis for Procore Technologies.

With the CEO transition in the spotlight, Procore’s momentum appears to be building. Investors have seen a 21% total shareholder return over the past year, reflecting confidence in the company’s strategy and its ongoing execution in a competitive construction software market. Recent moves, including leadership changes and reaffirmed guidance, have prompted fresh interest in Procore’s long-term potential amid evolving industry trends.

If you’re curious about what other innovative tech firms might be gaining traction, now is the perfect opportunity to explore See the full list for free..

With shares up over 20% this year and the stock trading at only a modest discount to analyst price targets, the key question becomes whether Procore is priced for ongoing growth or if a fresh buying opportunity awaits.

Most Popular Narrative: 11.5% Undervalued

With Procore Technologies’ fair value pegged at $82.12 compared to its last close of $72.69, the narrative points to meaningful upside if expectations play out. The stage is set for a critical call on whether future performance can justify a premium to today’s price.

Accelerating adoption of AI-powered solutions in construction, particularly Procore Helix and Agent Builder, is driving increased customer automation, data unification, and workflow efficiency. This positions Procore as an indispensable platform and is likely to boost future revenue growth and support higher pricing, positively impacting both top-line and margins.

Want to know which bold tech bets and revenue lifts drive Procore’s valuation? The fine print includes margin boosts and next-level global growth forecasts. Curious what future financial leaps shape this number? Click to reveal the foundation behind this price target.

Result: Fair Value of $82.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic uncertainty or slower than expected international growth could quickly limit Procore’s addressable market and future revenue trajectory.

Find out about the key risks to this Procore Technologies narrative.

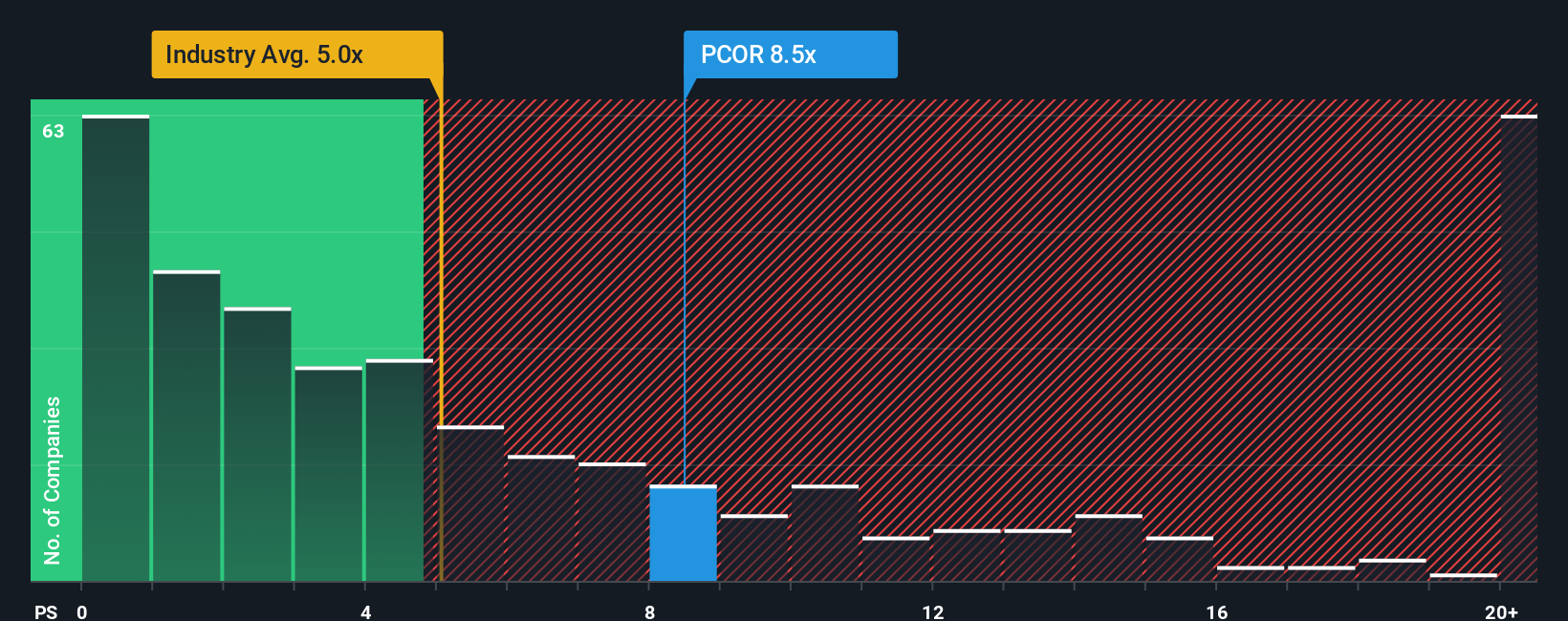

Another View: Market Ratios Raise Questions

While analysts see upside based on future growth, the price-to-sales ratio tells a different story. Procore is currently valued at 8.9 times sales, which is higher than the industry average of 5.3 and the fair ratio of 8. This premium suggests investors are paying up, which could amplify risks if growth slows. Does this leave the door open for disappointment, or is the optimism justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Procore Technologies Narrative

If you see the story differently or want to dive deeper into the data, you can piece together your own insights in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Procore Technologies.

Looking for More Investment Ideas?

Don’t rely on just one story. Maximize your opportunities by uncovering stocks with the qualities investors want most, right now, before others catch on.

- Turbocharge your portfolio by seizing these 896 undervalued stocks based on cash flows with prices that don’t match their earnings potential and could offer serious room to run.

- Secure consistent payouts and reliable growth by targeting these 19 dividend stocks with yields > 3% offering yields above 3 percent and strong financial footing.

- Capitalize on game-changing innovation by selecting these 24 AI penny stocks pushing boundaries in artificial intelligence and transforming entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PCOR

Procore Technologies

Provides a cloud-based construction management platform and related products and services in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives