- United States

- /

- Software

- /

- NYSE:PATH

UiPath (PATH) Is Up 5.0% After Deepening AI Partnerships With NVIDIA and OpenAI – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In late September 2025, UiPath announced a series of collaborations with leading technology companies, including NVIDIA, OpenAI, Snowflake, Google, and Microsoft, to integrate advanced generative AI capabilities into its automation platform and expand its suite of enterprise automation tools.

- These initiatives introduce AI-powered conversational agents, seamless workflow orchestration, and enhanced automation for high-trust industries like healthcare and financial services, highlighting UiPath's push to position itself as a key bridge for enterprise AI adoption and scale.

- We'll examine how the integration of advanced AI partnerships, especially with Nvidia and OpenAI, impacts UiPath's longer-term investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

UiPath Investment Narrative Recap

To own shares of UiPath, an investor needs conviction in the company's ability to be the backbone for enterprise AI adoption by integrating leading-edge automation with top-tier partners. The recent wave of high-profile collaborations, including the partnerships with NVIDIA, OpenAI, and Google, may create optimism in the near term but does not immediately mitigate the biggest short-term risks of deal delays and macroeconomic caution affecting customer budgets and revenue predictability.

The announcement of UiPath’s Conversational Agent, powered by Google’s Gemini models, is particularly relevant to this theme; it deepens voice-enabled automation, helping address customer demand for efficient, user-friendly AI while reinforcing the platform’s industry positioning. This aligns with UiPath’s broader goal of expanding its suite of automation tools and illustrates how specific innovations could contribute to future catalysts, though not all new offerings will necessarily translate to near-term revenue uplift.

Yet, it’s important for investors to keep in mind that against growing excitement around new AI partnerships, there remains uncertainty about how quickly these innovations will drive measurable revenue,

Read the full narrative on UiPath (it's free!)

UiPath's narrative projects $1.9 billion in revenue and $243.6 million in earnings by 2028. This requires 8.6% yearly revenue growth and a $311.1 million increase in earnings from current earnings of -$67.5 million.

Uncover how UiPath's forecasts yield a $13.30 fair value, a 4% upside to its current price.

Exploring Other Perspectives

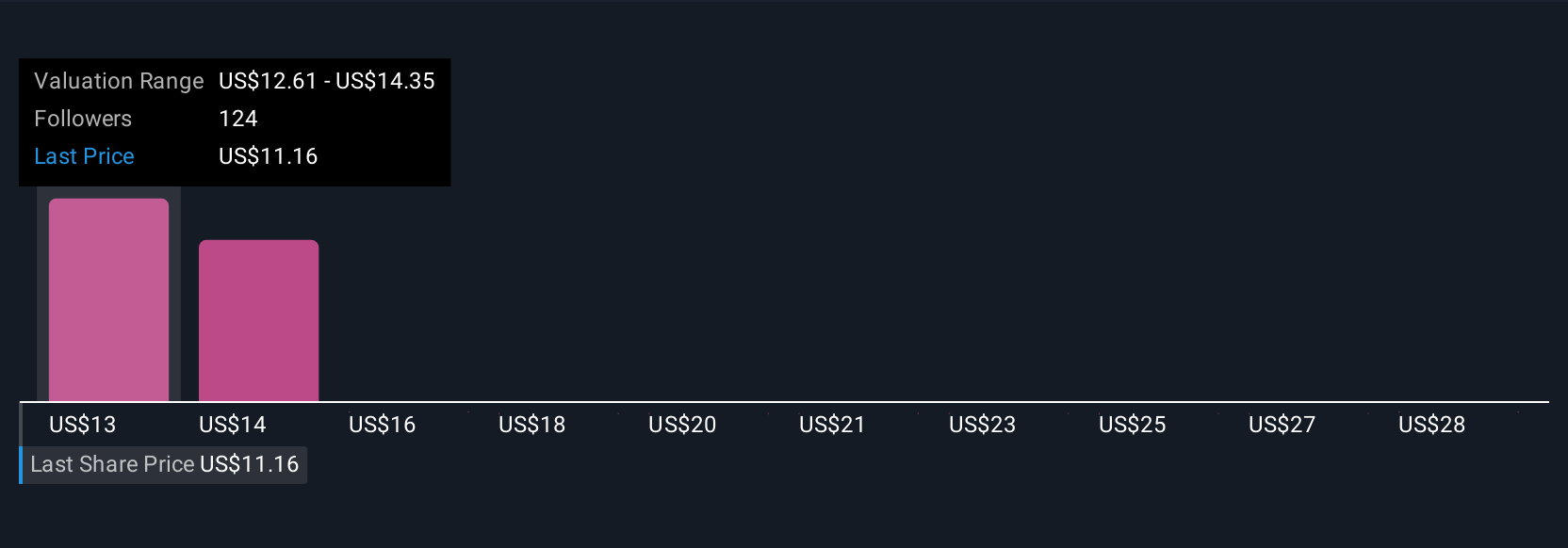

Retail investors in the Simply Wall St Community provided 10 fair value estimates for UiPath stock, ranging from US$12.61 to US$17.70. While short-term optimism follows recent product launches, delays in closing enterprise deals remain a central risk for financial outcomes.

Explore 10 other fair value estimates on UiPath - why the stock might be worth as much as 39% more than the current price!

Build Your Own UiPath Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UiPath research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free UiPath research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UiPath's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PATH

UiPath

Provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives