- United States

- /

- Software

- /

- NYSE:PATH

UiPath (PATH): Assessing Valuation After Major AI Partnerships and Industry Recognition

Reviewed by Kshitija Bhandaru

UiPath has been making waves with a series of new partnerships and product milestones, cementing its position as a leader in enterprise automation. The recent collaborations with OpenAI, NVIDIA, Google Gemini, and Snowflake highlight a strategic move toward deeper AI integration.

See our latest analysis for UiPath.

Riding a wave of high-profile AI partnerships and glowing industry recognition, UiPath’s share price has put on a show lately. The stock posted a standout 49.56% surge in the past month and a 31.86% year-to-date return. While the latest trading session saw a sharp one-day drop of 7.89%, momentum has been building overall. The company’s one-year total shareholder return of 34.25% and 53.33% across three years underscore how much excitement is priced into UiPath’s long-term automation ambitions.

If these AI collaborations caught your attention, you might want to see which other tech innovators are making moves—See the full list for free.

The question now is whether UiPath’s recent momentum means investors are getting in early on a long-term AI automation winner, or if the market has already priced in all the future growth ahead.

Most Popular Narrative: 26.9% Overvalued

The current narrative’s fair value estimate stands at $13.44, considerably below UiPath’s latest close of $17.05. As excitement builds around the company’s future in automation, it’s worth looking at what drives this valuation and the key assumptions in play.

New product launches such as Agent Builder and Agentic Orchestration, along with strategic partnerships like with Microsoft and Deloitte, are positioned to expand market opportunities, potentially increasing earnings through higher-value deals. UiPath’s commitment to cloud offerings, with over $975 million in cloud ARR, positions the company to capitalize on AI-driven products and services, which could contribute to revenue growth and improved gross margins.

Want to know what’s fueling this premium price tag? The most ambitious projections focus on an aggressive shift in profit margins and sustained revenue growth from newly launched products and partnerships. The narrative sets a high bar. Are you curious which future milestones and bold financial outcomes must actually happen for UiPath to hit that target? Click through and see what the consensus is truly betting on.

Result: Fair Value of $13.44 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing geopolitical challenges and industry competition could slow revenue momentum. This introduces uncertainty to the upbeat long-term story for UiPath.

Find out about the key risks to this UiPath narrative.

Another View: What Do The Multiples Say?

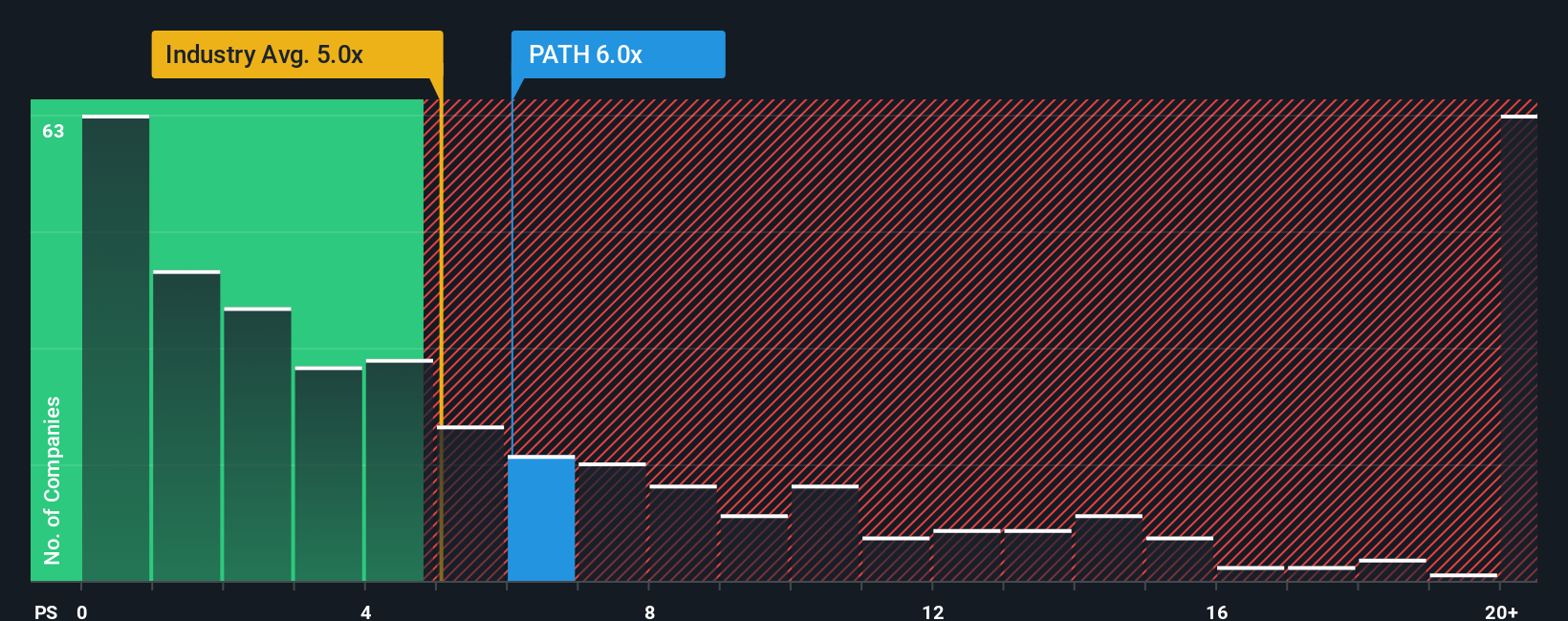

While the narrative suggests UiPath is 26.9% overvalued, a quick look at its usual price-to-sales ratio tells a slightly different story. UiPath trades at 6x sales, which is higher than the software industry average of 5x but still below peer averages at 10.2x. Interestingly, this is cheaper than the fair ratio of 7.1x that the market could eventually lean towards. Does this gap indicate hidden value or just more risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UiPath Narrative

If you see things differently or want to explore your own perspectives, try digging into UiPath’s numbers and narrative for yourself in just a few minutes. Do it your way

A great starting point for your UiPath research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Standout Investment Ideas?

Hundreds of possible opportunities are waiting beyond just UiPath. See which fast-moving companies could fit your strategy with these handpicked lists from Simply Wall St’s powerful Screener tool. If you want to make smarter moves, don’t miss your chance to act on them first.

- Tap into value by uncovering stocks undervalued by future cash flows using these 893 undervalued stocks based on cash flows that fit strict financial criteria.

- Find dynamic companies at the forefront of healthcare transformation and see which innovators are gaining momentum within these 33 healthcare AI stocks.

- Position yourself for the next wave in digital assets and blockchain by following these 79 cryptocurrency and blockchain stocks now surging ahead of the curve.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PATH

UiPath

Provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026